- Canada

- /

- Metals and Mining

- /

- TSXV:CBR

3 TSX Penny Stocks With Over CA$30M Market Cap

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of economic uncertainty, highlighted by the Bank of Canada's recent rate cut amid concerns over potential U.S. tariffs and a contraction in GDP for November. Despite these broader economic challenges, there remains an intriguing segment of the market that continues to capture investor interest: penny stocks. Although the term may seem outdated, these smaller or newer companies can still offer significant opportunities when they possess solid financial foundations, making them worth exploring for those looking to uncover hidden value.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$989.91M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.77 | CA$447.95M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$230.34M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.49 | CA$126.59M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.87M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$28.21M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$138.93M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.15 | CA$222.42M | ★★★★☆☆ |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Microbix Biosystems (TSX:MBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Microbix Biosystems Inc. is a life science company that develops and commercializes proprietary biological and technological solutions for human health and wellbeing across North America, Europe, and internationally, with a market cap of CA$66.44 million.

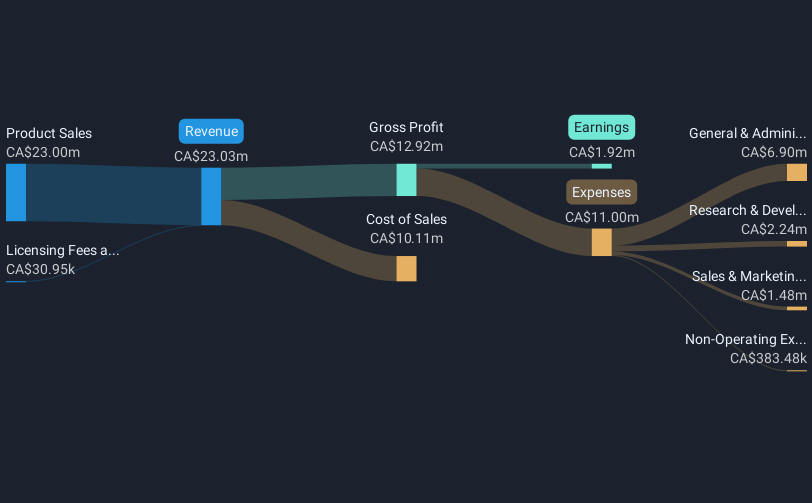

Operations: The company's revenue is primarily derived from its Antigens, QAPs, and DxTM segment, which generated CA$21.31 million.

Market Cap: CA$66.44M

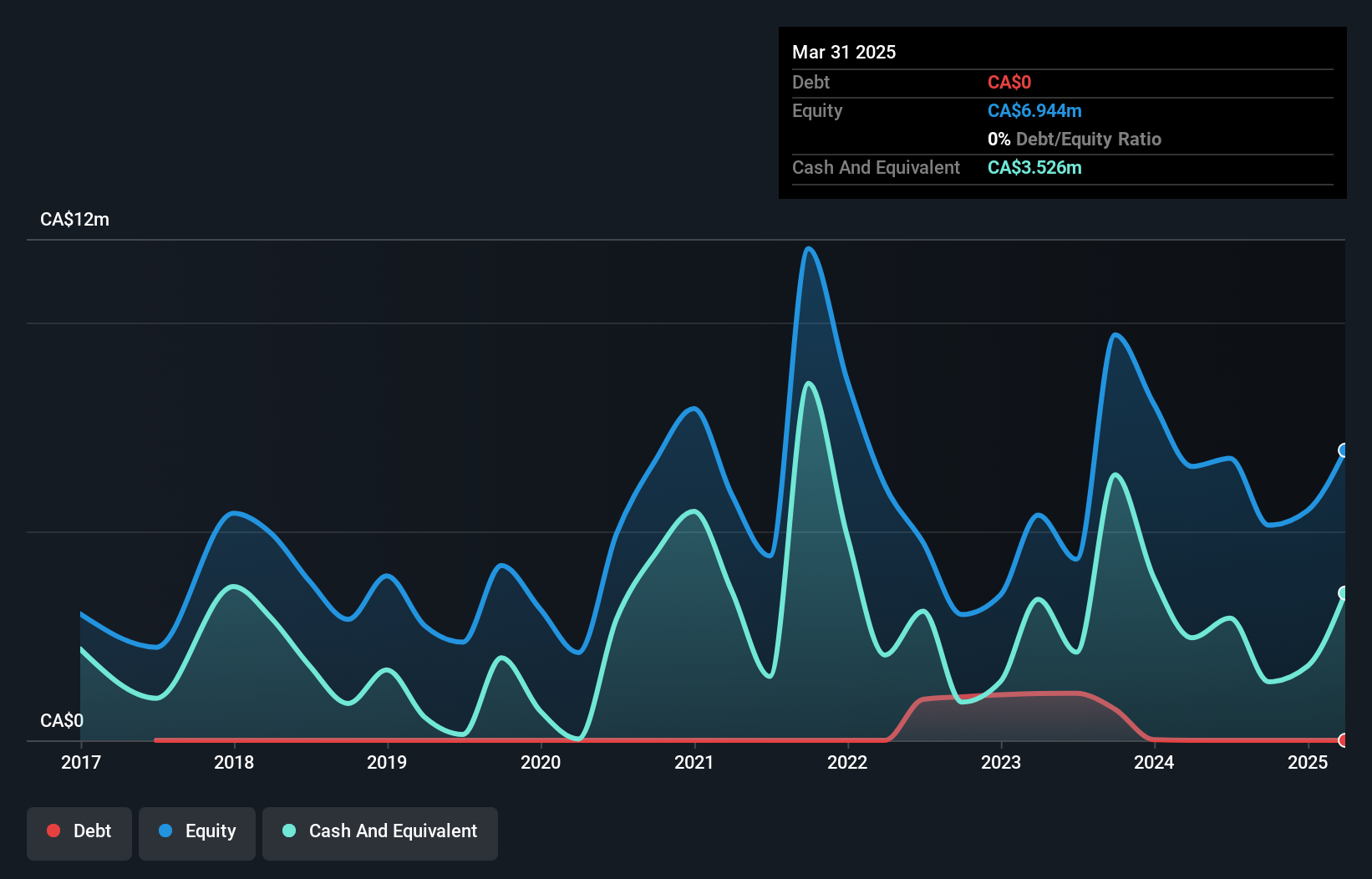

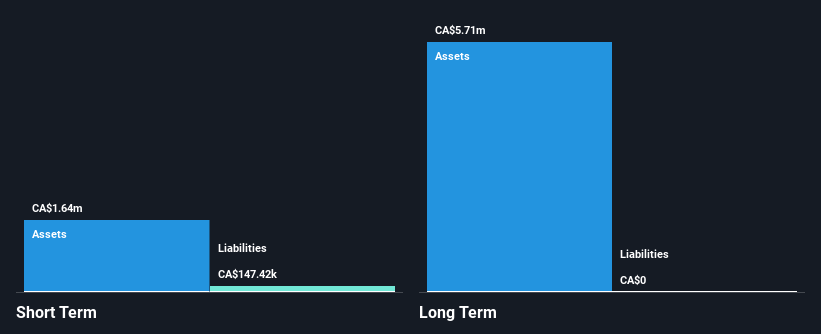

Microbix Biosystems Inc., with a market cap of CA$66.44 million, has transitioned to profitability, reporting net income of CA$3.52 million for fiscal 2024. The company is actively expanding its capabilities in recombinant Antigens production, which could enhance its market share in immunoassays. Recent collaborations, such as the pilot PT program with the American Proficiency Institute for H5N1 detection, highlight its innovative approach in virology and synthetic biology. Despite insider selling over the past quarter, Microbix maintains a strong financial position with more cash than debt and well-covered interest payments by EBIT (16.7x coverage).

- Navigate through the intricacies of Microbix Biosystems with our comprehensive balance sheet health report here.

- Evaluate Microbix Biosystems' prospects by accessing our earnings growth report.

Cabral Gold (TSXV:CBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cabral Gold Inc. is a mineral exploration and development company focused on gold properties in Brazil, with a market cap of CA$56.24 million.

Operations: There are no reported revenue segments for this mineral exploration and development company focused on gold properties in Brazil.

Market Cap: CA$56.24M

Cabral Gold Inc., with a market cap of CA$56.24 million, is currently pre-revenue and focuses on gold exploration in Brazil. Recent developments include a two-stage strategy for the Cuiu Cuiu district, featuring near-term production to fund further drilling. The company has completed a PFS for an initial mining operation and plans to upgrade resources at Central and Machichie Main. Despite being debt-free, Cabral faces challenges with limited cash runway but recently raised capital through private placements. Exploration results at Jerimum Cima suggest potential resource growth, which could enhance future operations if successfully developed.

- Jump into the full analysis health report here for a deeper understanding of Cabral Gold.

- Evaluate Cabral Gold's historical performance by accessing our past performance report.

Metallic Minerals (TSXV:MMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metallic Minerals Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and the United States, with a market cap of CA$37.05 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$37.05M

Metallic Minerals Corp., with a market cap of CA$37.05 million, is pre-revenue and focuses on mineral exploration in North America. The company remains debt-free and has experienced management, but faces financial challenges with less than a year of cash runway and ongoing losses, including a net loss of CA$6.01 million for the full year ending July 31, 2024. Despite stable weekly volatility over the past year, its auditor has expressed doubts about its ability to continue as a going concern. Recent earnings reports indicate reduced losses compared to previous periods but still highlight financial instability.

- Click here and access our complete financial health analysis report to understand the dynamics of Metallic Minerals.

- Review our historical performance report to gain insights into Metallic Minerals' track record.

Key Takeaways

- Jump into our full catalog of 928 TSX Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CBR

Cabral Gold

Engages in the exploration and development of gold properties in Brazil.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)