- Canada

- /

- Metals and Mining

- /

- TSXV:LUCA

Luca Mining Corp.'s (CVE:LUCA) Shares Climb 34% But Its Business Is Yet to Catch Up

Luca Mining Corp. (CVE:LUCA) shares have continued their recent momentum with a 34% gain in the last month alone. The last month tops off a massive increase of 259% in the last year.

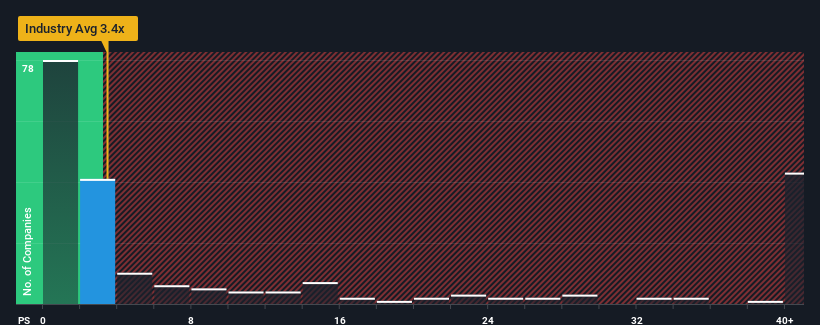

Even after such a large jump in price, there still wouldn't be many who think Luca Mining's price-to-sales (or "P/S") ratio of 3.5x is worth a mention when the median P/S in Canada's Metals and Mining industry is similar at about 3.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Luca Mining

How Luca Mining Has Been Performing

With revenue growth that's superior to most other companies of late, Luca Mining has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Luca Mining's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Luca Mining would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 56%. The latest three year period has also seen an excellent 46% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 48% per year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 57% growth each year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Luca Mining's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Its shares have lifted substantially and now Luca Mining's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Luca Mining's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Luca Mining that you need to be mindful of.

If you're unsure about the strength of Luca Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LUCA

Luca Mining

Engages in the acquisition, exploration, and development of mineral resource properties in North America.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026