- Canada

- /

- Metals and Mining

- /

- TSXV:LITH

Prime Mining And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Canadian market navigates a period of sideways consolidation, investors are considering strategies to fortify their portfolios against potential volatility. Even in such conditions, penny stocks—often representing smaller or newer companies—remain a compelling area for exploration due to their affordability and growth potential. By focusing on those with strong financials and clear growth prospects, investors can uncover promising opportunities among these lesser-known equities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.63 | CA$172.92M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.94 | CA$71.66M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.49 | CA$15.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.92 | CA$452.64M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.07 | CA$36.92M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$604.82M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$3.89 | CA$3.08B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.09M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$383.82M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.78 | CA$298.08M | ★★★★★☆ |

Click here to see the full list of 932 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Prime Mining (TSX:PRYM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prime Mining Corp. focuses on acquiring, exploring, and developing mineral resource properties in Mexico, with a market cap of CA$203.07 million.

Operations: Prime Mining Corp. does not report any revenue segments.

Market Cap: CA$203.07M

Prime Mining Corp., a pre-revenue entity with a CA$203.07 million market cap, is actively exploring its Los Reyes Project in Mexico. Recent drilling results from Fresnillo and Mariposa indicate promising mineralization, potentially increasing future resource estimates. Despite being unprofitable and having less than a year of cash runway based on current free cash flow, Prime remains debt-free and has not diluted shareholders recently. The company continues to focus on high-grade gold-silver exploration while managing risks associated with local security challenges. Analysts expect significant stock price appreciation despite the company's current financial constraints.

- Click to explore a detailed breakdown of our findings in Prime Mining's financial health report.

- Assess Prime Mining's previous results with our detailed historical performance reports.

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$134.24 million.

Operations: No revenue segments have been reported.

Market Cap: CA$134.24M

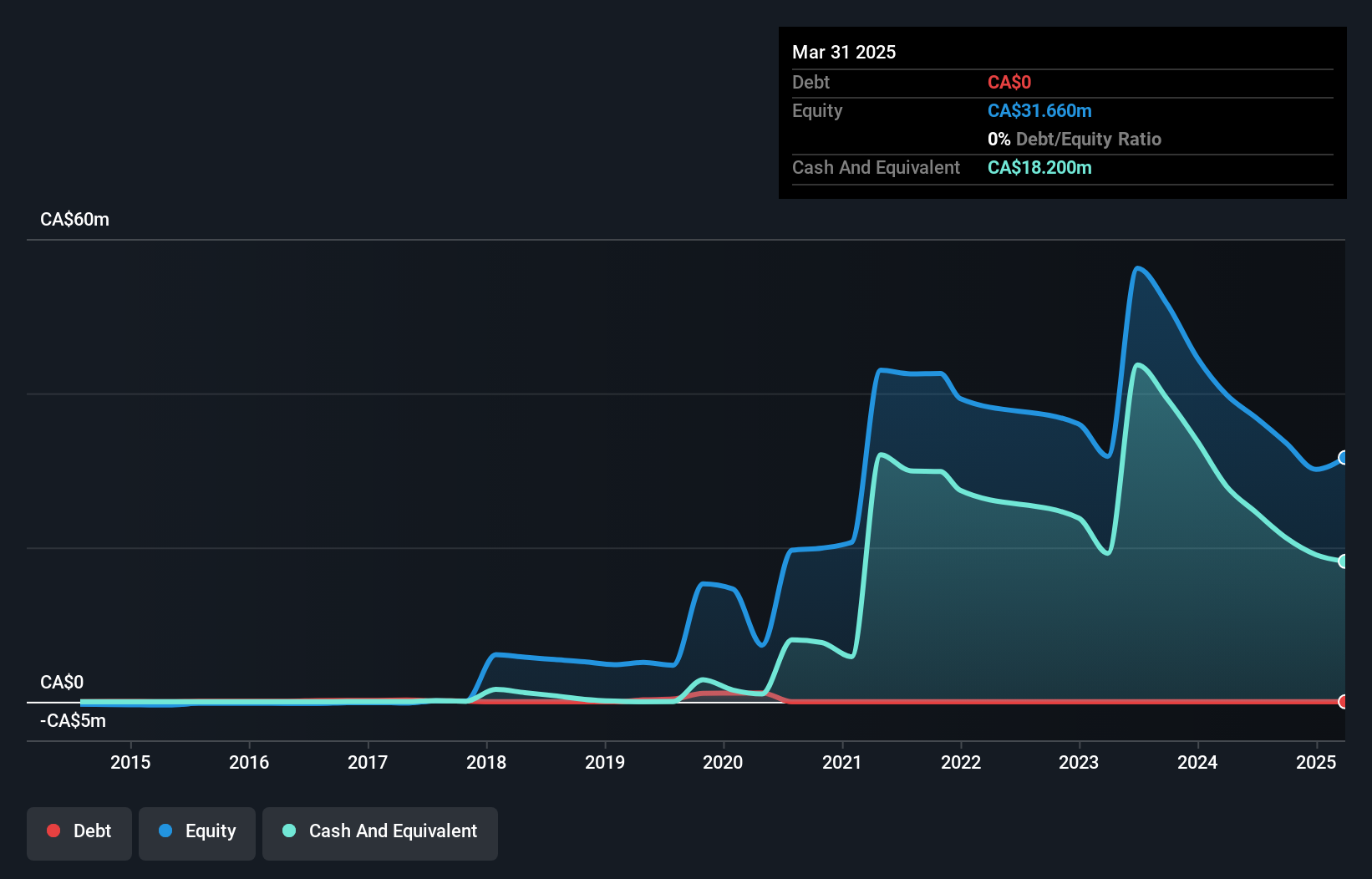

Lithium Chile Inc., with a market cap of CA$134.24 million, is pre-revenue and focuses on lithium properties in Chile and Argentina. The company is debt-free, with short-term assets exceeding liabilities, indicating solid financial management. Recent strategic moves include a joint venture with Eramet to develop the Llamara area, potentially enhancing resource delineation through phased exploration. Additionally, Lithium Chile increased its stake in the Salar de Arizaro project to 80%, which boasts a pre-tax NPV of US$3.8 billion. These developments may position the company for future growth despite current revenue limitations.

- Click here and access our complete financial health analysis report to understand the dynamics of Lithium Chile.

- Evaluate Lithium Chile's historical performance by accessing our past performance report.

Mayfair Gold (TSXV:MFG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mayfair Gold Corp. is an exploration-stage company focused on acquiring, exploring, evaluating, and developing mineral properties with a market cap of CA$190.15 million.

Operations: Currently, there are no reported revenue segments for this exploration-stage company.

Market Cap: CA$190.15M

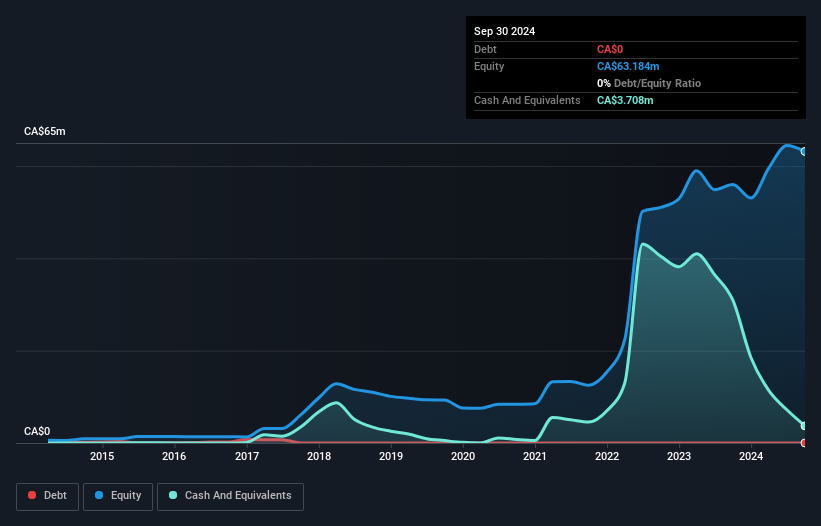

Mayfair Gold Corp., with a market cap of CA$190.15 million, is pre-revenue and debt-free, with short-term assets significantly exceeding liabilities. Despite its current unprofitability and increasing losses over the past five years, the company has managed to maintain financial stability without shareholder dilution. Recent leadership changes include the appointment of Nicholas Campbell as CEO and Drew Anwyll as COO, both bringing extensive industry experience that could enhance operational capabilities. Although Mayfair faces challenges typical of exploration-stage firms, these strategic appointments may strengthen its position in advancing mineral projects.

- Navigate through the intricacies of Mayfair Gold with our comprehensive balance sheet health report here.

- Explore historical data to track Mayfair Gold's performance over time in our past results report.

Seize The Opportunity

- Get an in-depth perspective on all 932 TSX Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lithium Chile, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LITH

Lithium Chile

Engages in the acquisition and development of lithium properties in Chile and Argentina.

Flawless balance sheet with acceptable track record.