Every investor in K92 Mining Inc. (CVE:KNT) should be aware of the most powerful shareholder groups. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Companies that used to be publicly owned tend to have lower insider ownership.

K92 Mining is a smaller company with a market capitalization of CA$599m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about K92 Mining.

View our latest analysis for K92 Mining

What Does The Institutional Ownership Tell Us About K92 Mining?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

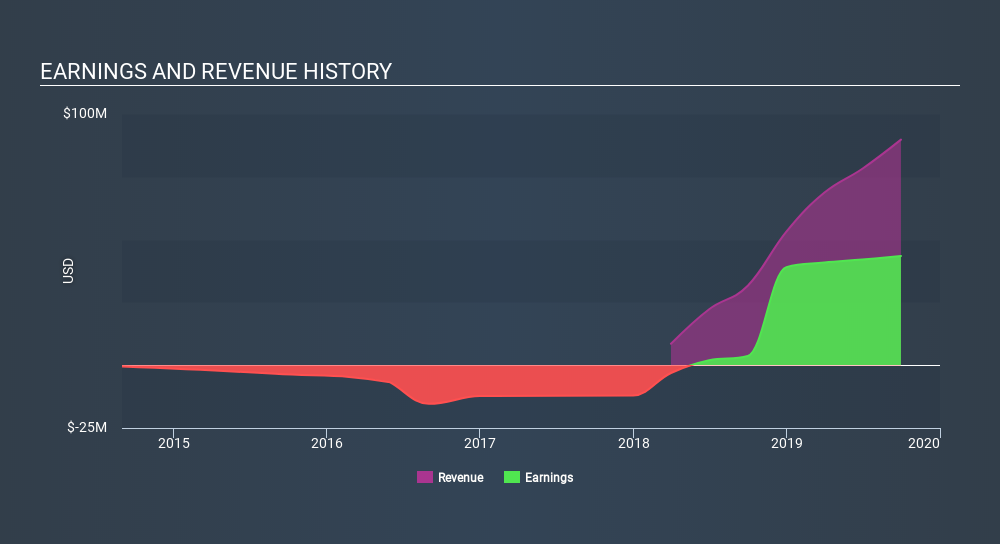

As you can see, institutional investors own 21% of K92 Mining. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of K92 Mining, (below). Of course, keep in mind that there are other factors to consider, too.

K92 Mining is not owned by hedge funds. 1832 Asset Management L.P. is currently the company's largest shareholder with 4.1% of shares outstanding. Next, we have Invesco Ltd. and RBC Global Asset Management Inc. as the second and third largest shareholders, holding 3.8% and 3.6%, of the shares outstanding, respectively.

Our studies suggest that the top 25 shareholders collectively control less than 50% of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of K92 Mining

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

We can see that insiders own shares in K92 Mining Inc.. In their own names, insiders own CA$10.0m worth of stock in the CA$599m company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 77% of K92 Mining shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for K92 Mining (of which 1 is concerning!) you should know about.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:KNT

K92 Mining

Engages in the exploration and development of mineral deposits in Papua New Guinea.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026