- Canada

- /

- Oil and Gas

- /

- TSX:MGA

TSX Penny Stocks With Market Caps Over CA$20M To Consider

Reviewed by Simply Wall St

The Canadian market has recently experienced a pullback, with the TSX index losing about 6.5% since its peak in December, reflecting uncertainties in political leadership and policy shifts. Despite these challenges, the underlying economic growth and easing inflation present opportunities for investors willing to navigate this volatility. For those interested in smaller or newer companies, penny stocks—though an older term—remain a relevant investment area; when backed by strong financials, they can offer significant potential returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$115M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.33 | CA$942.04M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.15 | CA$389.72M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.82 | CA$112.03M | ★★★★☆☆ |

Click here to see the full list of 961 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Base Carbon (NEOE:BCBN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Base Carbon Inc. provides capital, development expertise, and management resources to projects in voluntary carbon and environmental markets, with a market cap of CA$48.05 million.

Operations: Base Carbon's revenue segment is focused on the development and deployment of its projects, which reported a revenue of -$6.05 million.

Market Cap: CA$48.05M

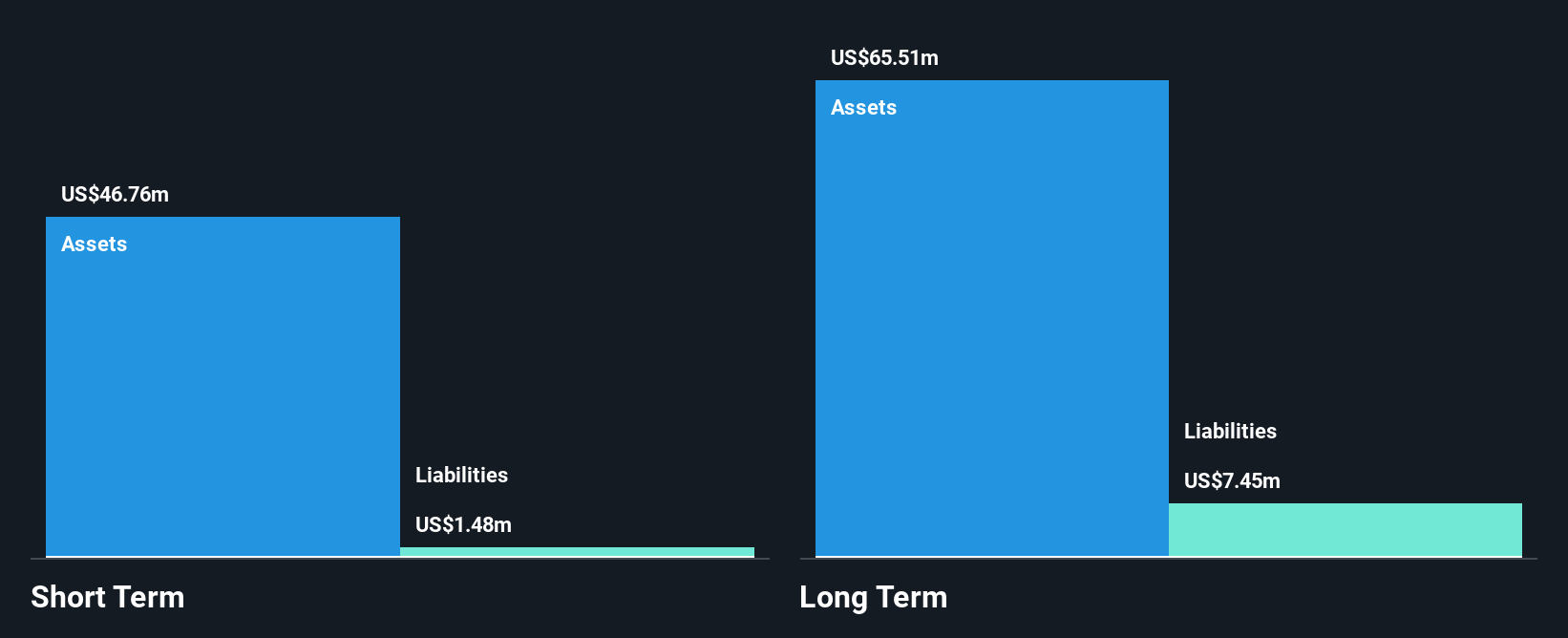

Base Carbon Inc., with a market cap of CA$48.05 million, is navigating the penny stock landscape by focusing on voluntary carbon and environmental markets. Despite recent earnings showing US$2.16 million in revenue for Q3 2024, the company remains pre-revenue due to its negative revenue over nine months and ongoing unprofitability. The absence of debt is a positive aspect, supported by short-term assets covering liabilities comfortably. However, challenges include a lack of seasoned board experience and declining annual revenue growth. Future prospects hinge on expected significant revenue growth amidst stable volatility and no shareholder dilution in the past year.

- Get an in-depth perspective on Base Carbon's performance by reading our balance sheet health report here.

- Understand Base Carbon's earnings outlook by examining our growth report.

MediPharm Labs (TSX:LABS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MediPharm Labs Corp. is a pharmaceutical company that produces and sells purified, pharmaceutical-quality cannabis extracts and advanced derivative products in Canada, Australia, Germany, and internationally with a market cap of CA$26.72 million.

Operations: The company's revenue primarily comes from the production and sale of cannabis extracts and derivative products, totaling CA$39.05 million.

Market Cap: CA$26.72M

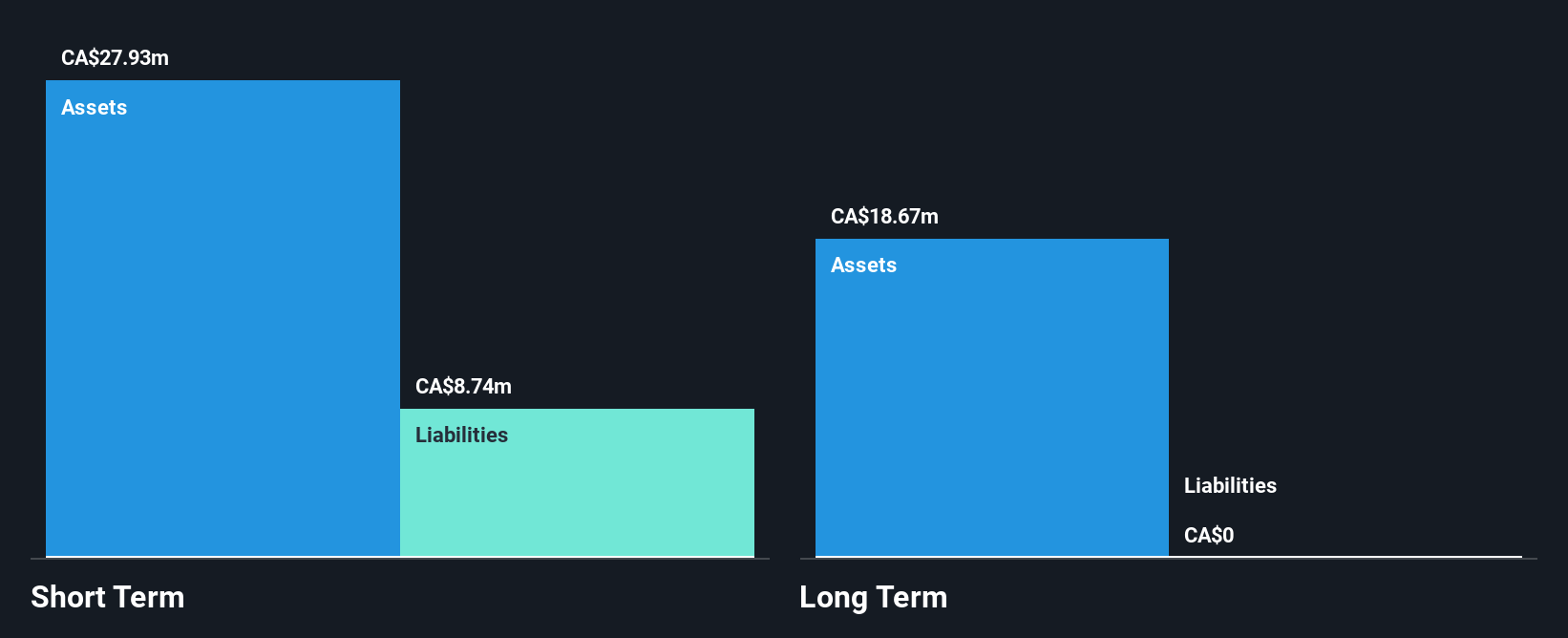

MediPharm Labs Corp., with a market cap of CA$26.72 million, is navigating the penny stock landscape by focusing on cannabis extracts and derivative products. Recent earnings show revenue growth to CA$9.8 million in Q3 2024 from CA$8.51 million a year ago, alongside reduced net losses. Despite being unprofitable, the company has decreased its debt-to-equity ratio significantly over five years and maintains more cash than total debt, ensuring short-term liabilities are covered by assets. However, shareholder dilution occurred recently, and volatility remains high despite a stable cash runway exceeding three years based on current free cash flow trends.

- Take a closer look at MediPharm Labs' potential here in our financial health report.

- Explore MediPharm Labs' analyst forecasts in our growth report.

Mega Uranium (TSX:MGA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Uranium Ltd. is a uranium mining and investment company focused on exploring uranium properties mainly in Canada and Australia, with a market cap of CA$124.61 million.

Operations: Mega Uranium Ltd. does not report any specific revenue segments.

Market Cap: CA$124.61M

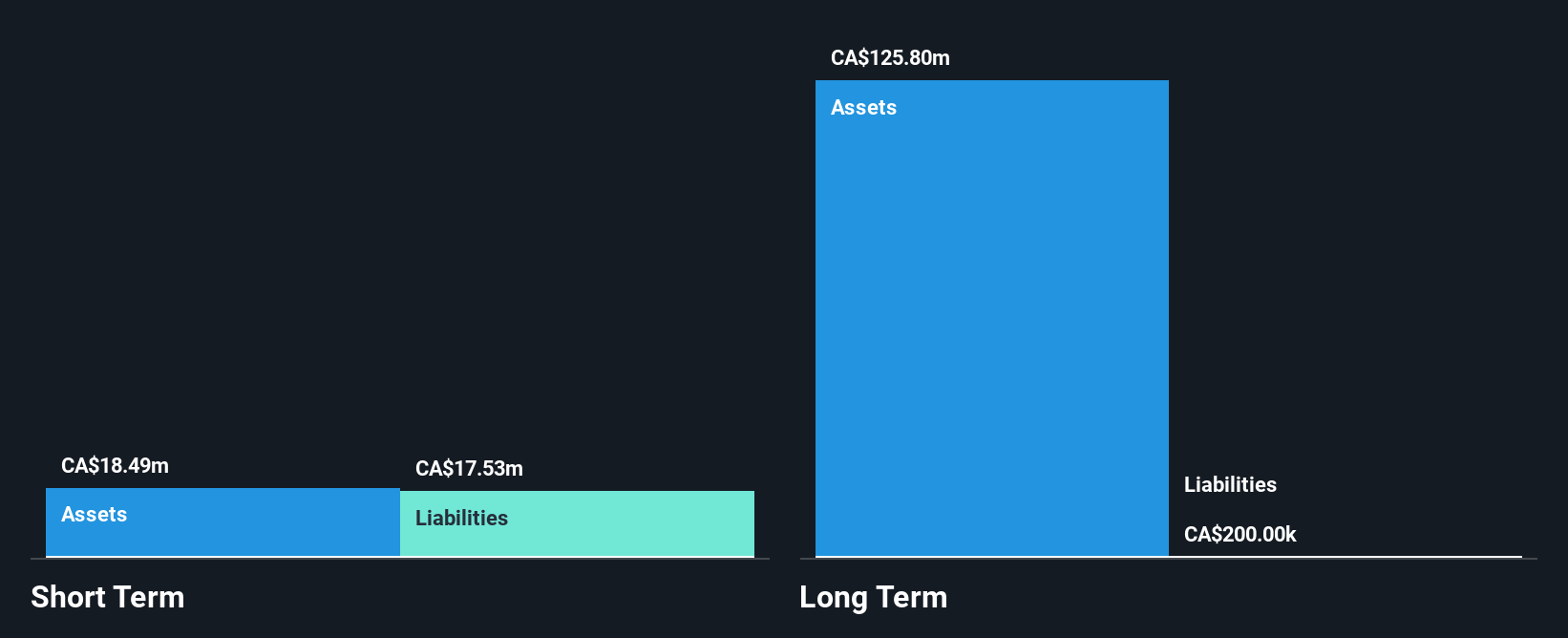

Mega Uranium Ltd., with a market cap of CA$124.61 million, remains pre-revenue, focusing on uranium exploration in Canada and Australia. Despite reporting a net loss of CA$6.12 million for the fiscal year ending September 2024, the company has not diluted shareholders recently and maintains a stable cash runway exceeding three years, supported by sufficient short-term assets to cover liabilities. While its debt-to-equity ratio has risen to 8.3% over five years, Mega Uranium holds more cash than total debt and benefits from an experienced management team with an average tenure of nearly ten years.

- Dive into the specifics of Mega Uranium here with our thorough balance sheet health report.

- Gain insights into Mega Uranium's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Access the full spectrum of 961 TSX Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MGA

Mega Uranium

A uranium mining and investment company, explores for uranium properties primarily in Canada and Australia.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives