- Canada

- /

- Metals and Mining

- /

- TSXV:HSTR

Undervalued Small Caps With Insider Action In Global Markets October 2025

Reviewed by Simply Wall St

In October 2025, global markets are navigating a complex landscape marked by renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, leading to volatility across major indices like the S&P 600 for small-cap stocks. Amid these uncertainties, investors are keenly observing the small-cap sector for opportunities that may arise from insider actions and strategic positioning in response to current economic challenges. Identifying promising stocks often involves assessing companies with strong fundamentals and potential resilience in turbulent market conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.4x | 4.0x | 27.30% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 27.58% | ★★★★★☆ |

| Bumitama Agri | 10.5x | 1.5x | 48.87% | ★★★★☆☆ |

| Senior | 25.5x | 0.8x | 23.97% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.92% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.6x | 1.8x | 21.25% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -70.33% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.9x | 0.4x | -448.94% | ★★★☆☆☆ |

| Chinasoft International | 24.7x | 0.8x | -1356.14% | ★★★☆☆☆ |

| GDI Integrated Facility Services | 19.1x | 0.3x | -1.30% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

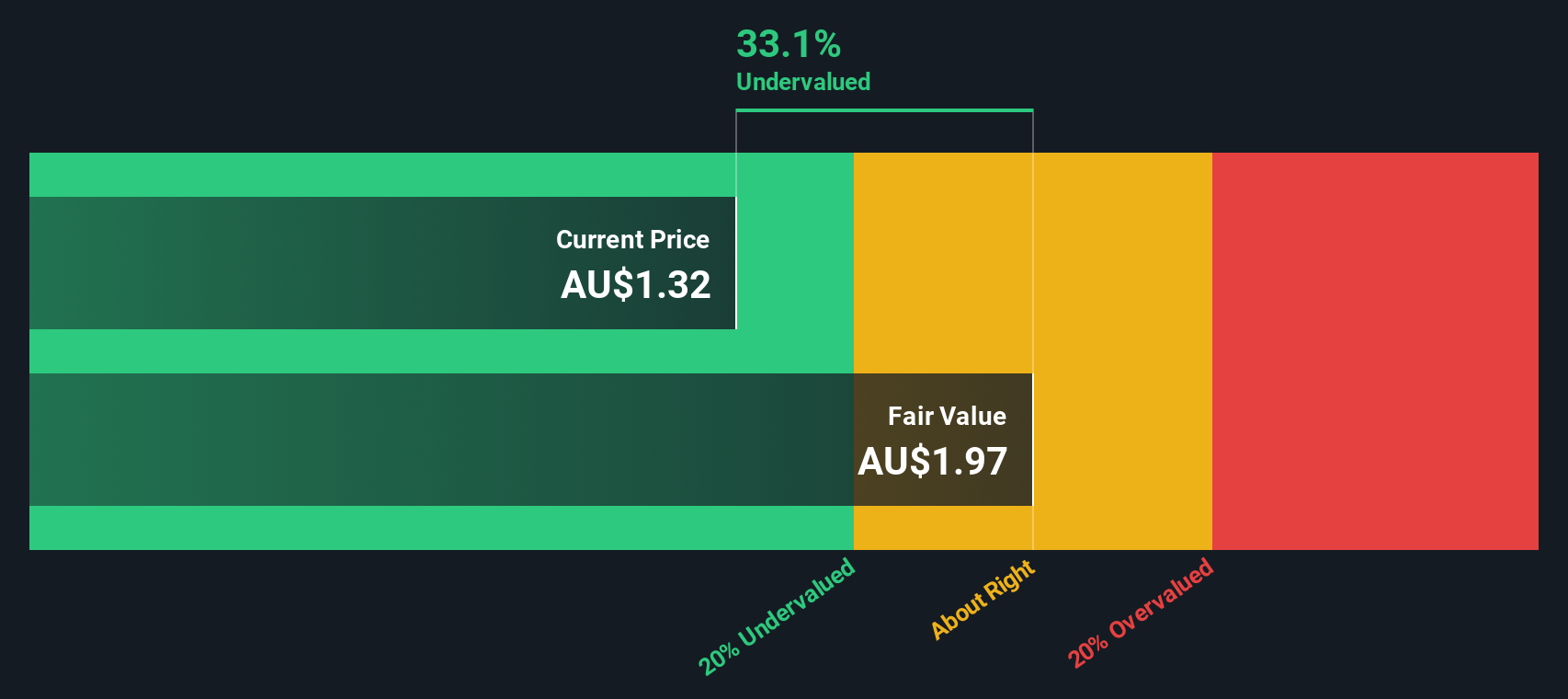

Alliance Aviation Services (ASX:AQZ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alliance Aviation Services provides aircraft charter and aviation services, with a market cap of A$0.91 billion.

Operations: Alliance Aviation Services generates revenue primarily from aircraft charter and aviation services, amounting to A$773.08 million. The company's cost of goods sold (COGS) is A$537.88 million, resulting in a gross profit margin of 30.42%. Operating expenses are recorded at A$116.50 million, with non-operating expenses at A$61.37 million, impacting the net income margin which stands at 7.41%.

PE: 6.9x

Alliance Aviation Services, a smaller player in its industry, recently announced a fully franked dividend of A$0.03 per share for 2025, reflecting steady shareholder returns. Despite facing high debt levels due to reliance on external borrowing, the company reported sales of A$760.87 million and revenue of A$769.66 million for the year ending June 30, 2025—an increase from the previous year. Insider confidence is evident with Craig Coleman's purchase of 75,000 shares valued at approximately A$180K in July 2025. Earnings are expected to grow annually by around 3.42%, indicating potential value growth amidst financial challenges.

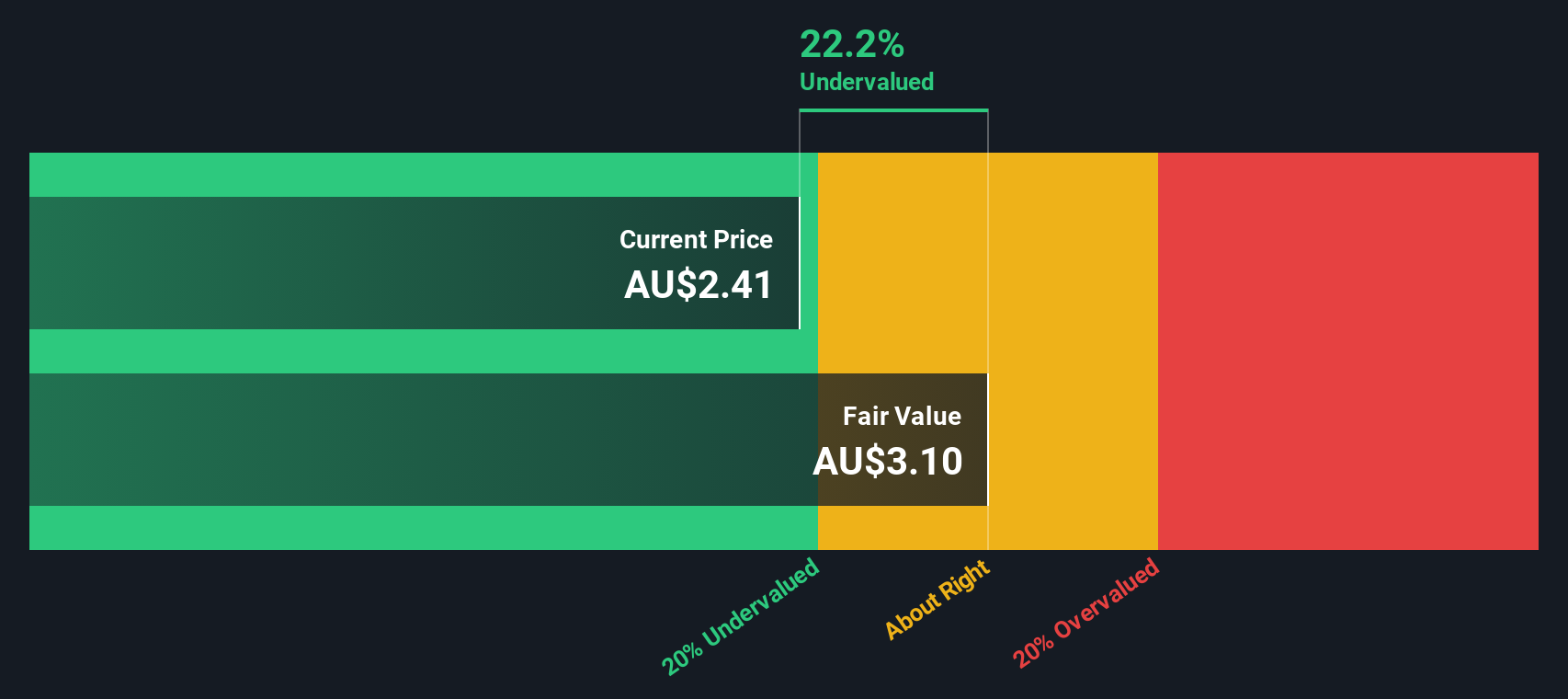

Growthpoint Properties Australia (ASX:GOZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Growthpoint Properties Australia is a real estate investment trust that focuses on owning and managing a diversified portfolio of office and industrial properties, with a market capitalization of approximately A$3.43 billion.

Operations: Growthpoint Properties Australia's revenue primarily comes from its office and industrial segments, generating A$210 million and A$101 million respectively. The company has experienced fluctuations in its net income margin over time, with recent periods showing negative margins, such as -0.3849% for the quarter ending June 2025. Operating expenses have been increasing steadily alongside depreciation and amortization costs. Gross profit margin has shown a declining trend from earlier years, reaching 78.47% by mid-2025.

PE: -15.6x

Growthpoint Properties Australia, with its small cap nature, shows potential despite challenges. The company reported a net loss of A$124.6 million for the year ending June 2025, an improvement from the previous year's A$298.2 million loss. While earnings are forecast to grow at 39% annually, interest payments currently exceed earnings coverage due to reliance on external borrowing. Insider confidence is evident as insiders have increased their holdings recently, suggesting belief in future growth prospects amidst ongoing executive transitions and strategic adjustments.

- Dive into the specifics of Growthpoint Properties Australia here with our thorough valuation report.

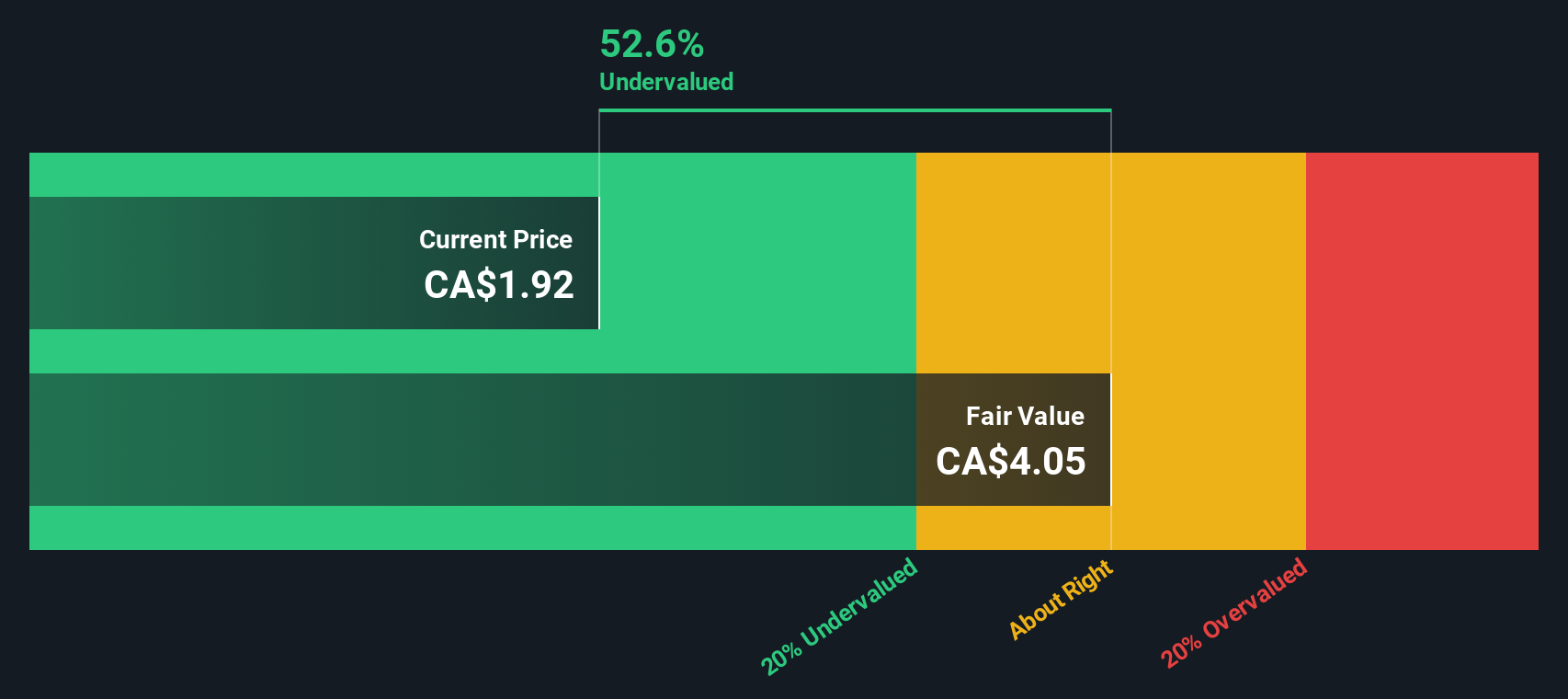

Heliostar Metals (TSXV:HSTR)

Simply Wall St Value Rating: ★★★★★★

Overview: Heliostar Metals is a mineral exploration and development company focused on advancing its gold projects in North America, with a market capitalization of approximately CAD $23.45 million.

Operations: Heliostar Metals has reported no revenue from 2014 to September 2024, with a significant shift in December 2024 when it recorded $13.60 million in revenue. The company experienced a net income of $49.47 million for the same period, with a gross profit margin of 48.90%. By March and June 2025, revenues increased to $36.57 million and $64.50 million respectively, while maintaining net incomes of $21.04 million and $25.22 million with gross profit margins around the mid-40% range during these periods.

PE: 14.9x

Heliostar Metals, a company with a focus on gold exploration and production, is making strides at its Ana Paula project in Guerrero, Mexico. Recent drilling results highlight promising high-grade gold mineralization within the High Grade Panel. The addition of a third drill underscores their commitment to enhancing resource classification and supporting feasibility studies. Financially, Heliostar reported US$27.93 million in sales for Q1 2025 and returned to profitability with net income of US$1.89 million compared to the previous year's loss. Despite past shareholder dilution and reliance on external borrowing for funding, insider confidence is evident through recent share purchases by company insiders during this period, suggesting optimism about future growth prospects as they continue expanding their resource base and production capabilities.

Summing It All Up

- Unlock more gems! Our Undervalued Global Small Caps With Insider Buying screener has unearthed 116 more companies for you to explore.Click here to unveil our expertly curated list of 119 Undervalued Global Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Heliostar Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HSTR

Heliostar Metals

Engages in the identification, acquisition, evaluation, and exploration of mineral properties in North America.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)