- Canada

- /

- Metals and Mining

- /

- TSXV:CRE

TSX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape influenced by shifting expectations around U.S. Federal Reserve policies and concerns over U.S. debt, which have implications for global economic conditions. Despite these challenges, the allure of penny stocks remains strong for investors seeking affordable entry points and potential growth opportunities in smaller or newer companies. While the term "penny stocks" might seem outdated, they continue to hold relevance as investment vehicles that can offer significant returns when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.59M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.145 | CA$4.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.33 | CA$313.02M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.75M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.24 | CA$137.16M | ★★★★☆☆ |

Click here to see the full list of 952 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Solaris Resources (TSX:SLS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Solaris Resources Inc. is involved in the exploration of mineral properties and has a market cap of approximately CA$522.42 million.

Operations: Currently, the company has not reported any revenue segments.

Market Cap: CA$522.42M

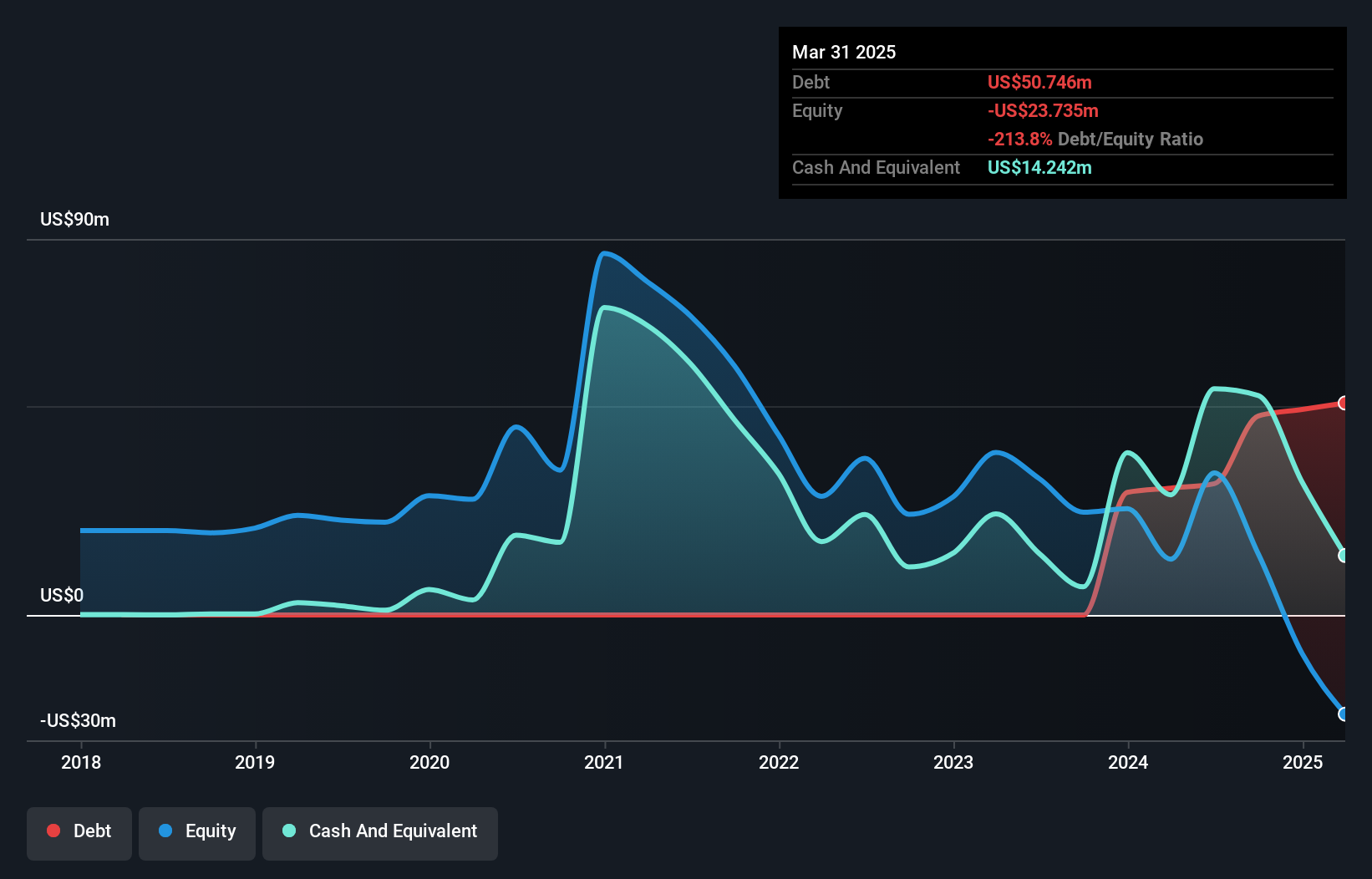

Solaris Resources, with a market cap of CA$522.42 million, is currently pre-revenue and focused on mineral exploration at its Warintza Project in Ecuador. Recent drilling results have shown promising high-grade mineralization beyond the existing Mineral Resource Estimate, suggesting potential for resource expansion. Despite having more cash than debt and sufficient short-term assets to cover liabilities, Solaris faces financial challenges with increased shareholder dilution and a rising debt-to-equity ratio over five years. The company remains unprofitable with no immediate forecast for profitability, highlighting the speculative nature typical of penny stocks in this sector.

- Click here to discover the nuances of Solaris Resources with our detailed analytical financial health report.

- Gain insights into Solaris Resources' outlook and expected performance with our report on the company's earnings estimates.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Critical Elements Lithium Corporation focuses on acquiring, exploring, and developing mining properties in Canada with a market cap of CA$124.17 million.

Operations: Currently, the company does not report any specific revenue segments.

Market Cap: CA$124.17M

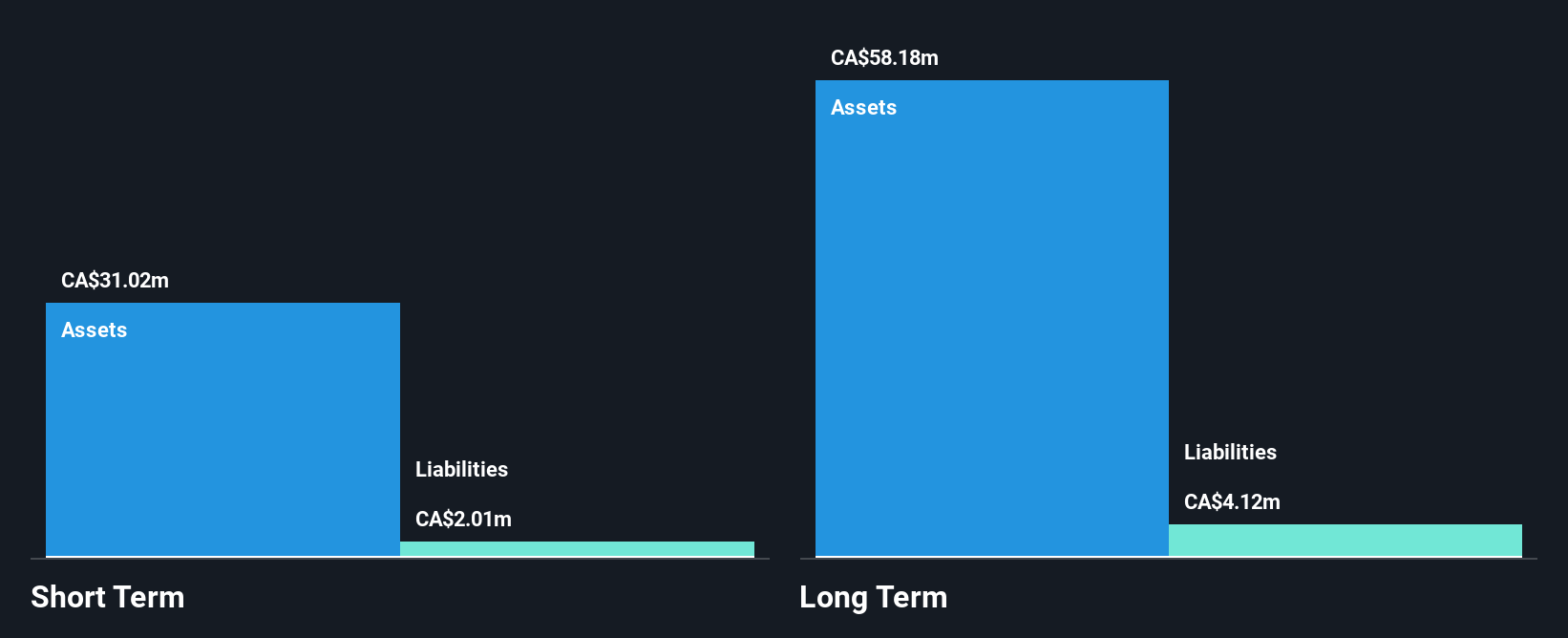

Critical Elements Lithium Corporation, with a market cap of CA$124.17 million, is pre-revenue and advancing its Rose Lithium-Tantalum project in Quebec. The company recently secured essential occupancy leases for the project's development, marking significant progress towards potential mining operations. Despite the challenging lithium market sentiment impacting share valuation, Critical Elements maintains a debt-free balance sheet with sufficient short-term assets exceeding liabilities. The management team has extensive experience and is actively working on securing project financing while minimizing shareholder dilution. Although profitable this year, revenue remains minimal under US$1 million, reflecting typical penny stock risks.

- Jump into the full analysis health report here for a deeper understanding of Critical Elements Lithium.

- Understand Critical Elements Lithium's earnings outlook by examining our growth report.

Goldquest Mining (TSXV:GQC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goldquest Mining Corp. is involved in the identification, acquisition, and exploration of mineral properties in the Dominican Republic, with a market cap of CA$50.59 million.

Operations: Currently, there are no reported revenue segments for Goldquest Mining Corp., which focuses on mineral property exploration in the Dominican Republic.

Market Cap: CA$50.59M

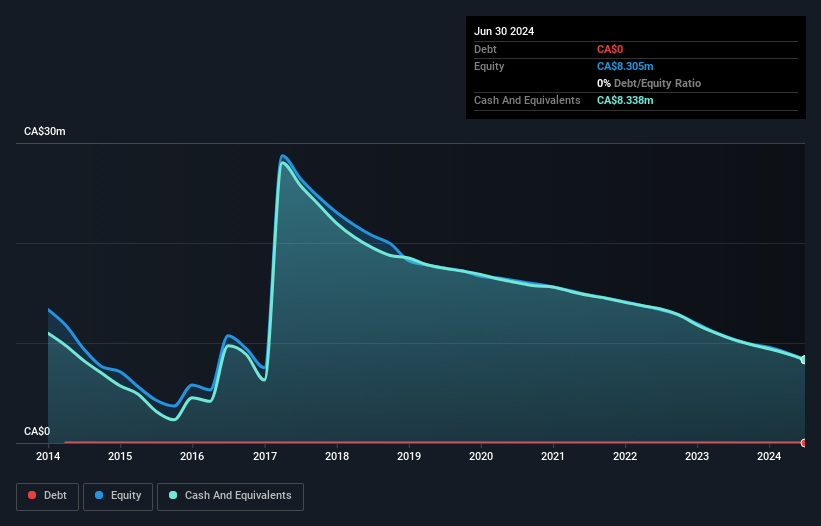

Goldquest Mining Corp., with a market cap of CA$50.59 million, is pre-revenue and focused on mineral exploration in the Dominican Republic. Despite being unprofitable, the company maintains a debt-free status and has sufficient cash runway for over three years based on current free cash flow levels. Its short-term assets significantly exceed its liabilities, providing financial stability in the near term. The board of directors is experienced with an average tenure of 13.3 years, although management tenure data is insufficient to assess experience fully. Shareholders have not faced meaningful dilution recently despite ongoing losses.

- Click here and access our complete financial health analysis report to understand the dynamics of Goldquest Mining.

- Evaluate Goldquest Mining's historical performance by accessing our past performance report.

Summing It All Up

- Jump into our full catalog of 952 TSX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CRE

Critical Elements Lithium

Engages in the acquisition, exploration, and development of mining properties in Canada.

Excellent balance sheet and fair value.