- Canada

- /

- Metals and Mining

- /

- TSXV:SVRS

We Think Golden Tag Resources (CVE:GOG) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Golden Tag Resources (CVE:GOG) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Golden Tag Resources

How Long Is Golden Tag Resources' Cash Runway?

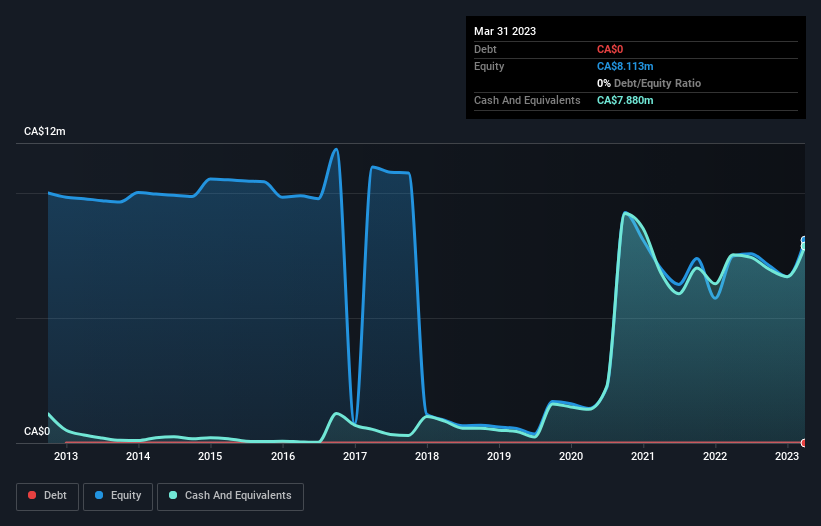

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In March 2023, Golden Tag Resources had CA$7.9m in cash, and was debt-free. In the last year, its cash burn was CA$2.3m. So it had a cash runway of about 3.4 years from March 2023. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Is Golden Tag Resources' Cash Burn Changing Over Time?

Because Golden Tag Resources isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Even though it doesn't get us excited, the 50% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Admittedly, we're a bit cautious of Golden Tag Resources due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Golden Tag Resources To Raise More Cash For Growth?

There's no doubt Golden Tag Resources' rapidly reducing cash burn brings comfort, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Golden Tag Resources has a market capitalisation of CA$38m and burnt through CA$2.3m last year, which is 6.2% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Golden Tag Resources' Cash Burn?

As you can probably tell by now, we're not too worried about Golden Tag Resources' cash burn. For example, we think its cash runway suggests that the company is on a good path. But it's fair to say that its cash burn reduction was also very reassuring. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking a deeper dive, we've spotted 4 warning signs for Golden Tag Resources you should be aware of, and 3 of them don't sit too well with us.

Of course Golden Tag Resources may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SVRS

Silver Storm Mining

Engages in the acquisition, exploration, and development of mineral properties in Mexico.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)