- Canada

- /

- Metals and Mining

- /

- TSXV:ROCK

Can We See Significant Insider Ownership On The Eros Resources Corp. (CVE:ERC) Share Register?

A look at the shareholders of Eros Resources Corp. (CVE:ERC) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Eros Resources is not a large company by global standards. It has a market capitalization of CA$4.1m, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own many shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Eros Resources.

View our latest analysis for Eros Resources

What Does The Institutional Ownership Tell Us About Eros Resources?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

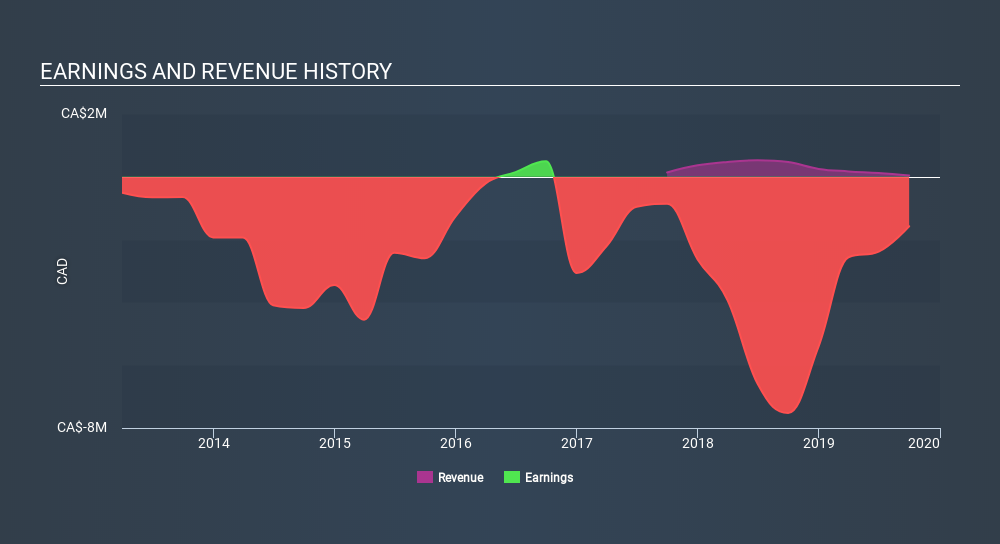

Since institutions own under 5% of Eros Resources, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

Eros Resources is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is the CEO Ronald Netolitzky with 11% of shares outstanding. Next, we have 49 North Resources Inc. and Thomas MacNeill as the second and third largest shareholders, holding 4.2% and 0.08%, of the shares outstanding, respectively. Interestingly, Thomas MacNeill is also a Chairman of the Board, again, indicating strong insider ownership amongst the company's top shareholders.

Our studies suggest that the top 3 shareholders collectively control less than 50% of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Eros Resources

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of Eros Resources Corp.. Insiders have a CA$447k stake in this CA$4.1m business. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 85% stake in ERC, suggesting it is a fairly popular stock. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Eros Resources better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Eros Resources (at least 4 which are concerning) , and understanding them should be part of your investment process.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:ROCK

Trident Resources

Engages in the identification, acquisition, exploration, and development of mineral, and oil and gas resource properties in North America.

Moderate and good value.

Market Insights

Community Narratives