- Canada

- /

- Metals and Mining

- /

- TSXV:EPL

Is Now The Time To Put Eagle Plains Resources (CVE:EPL) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Eagle Plains Resources (CVE:EPL), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Eagle Plains Resources

How Fast Is Eagle Plains Resources Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Eagle Plains Resources has grown EPS by 38% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

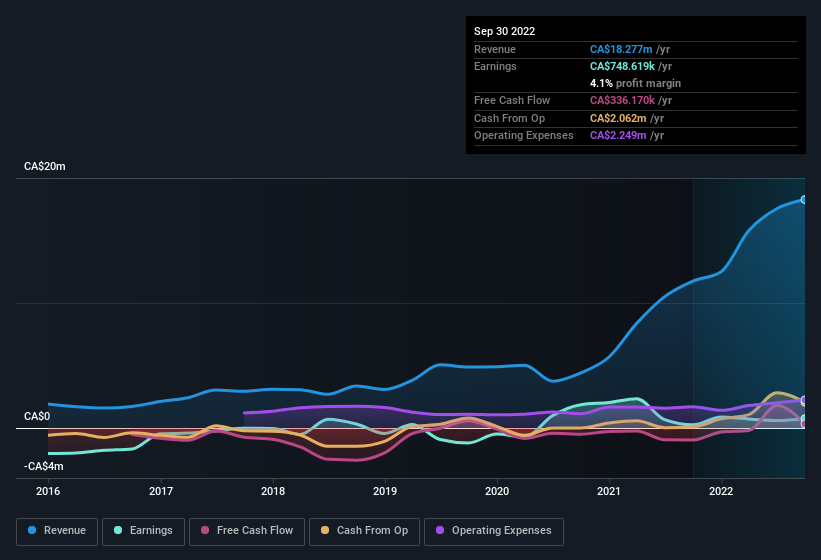

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, Eagle Plains Resources has done well over the past year, growing revenue by 55% to CA$18m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Eagle Plains Resources isn't a huge company, given its market capitalisation of CA$24m. That makes it extra important to check on its balance sheet strength.

Are Eagle Plains Resources Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Eagle Plains Resources shareholders can gain quiet confidence from the fact that insiders shelled out CA$388k to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was President Timothy Termuende who made the biggest single purchase, worth CA$102k, paying CA$0.17 per share.

Recent insider purchases of Eagle Plains Resources stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations under CA$273m, like Eagle Plains Resources, the median CEO pay is around CA$240k.

The Eagle Plains Resources CEO received total compensation of just CA$109k in the year to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Eagle Plains Resources Deserve A Spot On Your Watchlist?

Eagle Plains Resources' earnings per share growth have been climbing higher at an appreciable rate. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. The strong EPS growth suggests Eagle Plains Resources may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. What about risks? Every company has them, and we've spotted 3 warning signs for Eagle Plains Resources you should know about.

The good news is that Eagle Plains Resources is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Plains Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EPL

Eagle Plains Resources

A junior resource company, engages in acquiring, exploring, and developing mineral resource properties in Western Canada.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.