- Canada

- /

- Metals and Mining

- /

- TSXV:CVW

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by trade uncertainties, a U.S. government shutdown, and emerging credit concerns, there's optimism that any market pullbacks won't lead to a prolonged bear market. This backdrop provides an intriguing setting for investors exploring opportunities in penny stocks—an area often associated with smaller or newer companies that offer growth potential at lower price points. Despite being considered a throwback term, penny stocks remain relevant today; when backed by strong financials and solid fundamentals, they can present hidden gems with the potential for impressive returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.83 | CA$66.49M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.45 | CA$224.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.47M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.18 | CA$788.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.92 | CA$20.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.67 | CA$429.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.40 | CA$171.55M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.05 | CA$193.19M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 408 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

CVW Sustainable Royalties (TSXV:CVW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CVW Sustainable Royalties Inc. focuses on developing technology to recover bitumen, solvents, minerals, and water from oil sands froth treatment tailings, with a market cap of CA$147.31 million.

Operations: CVW Sustainable Royalties Inc. has not reported any revenue segments.

Market Cap: CA$147.31M

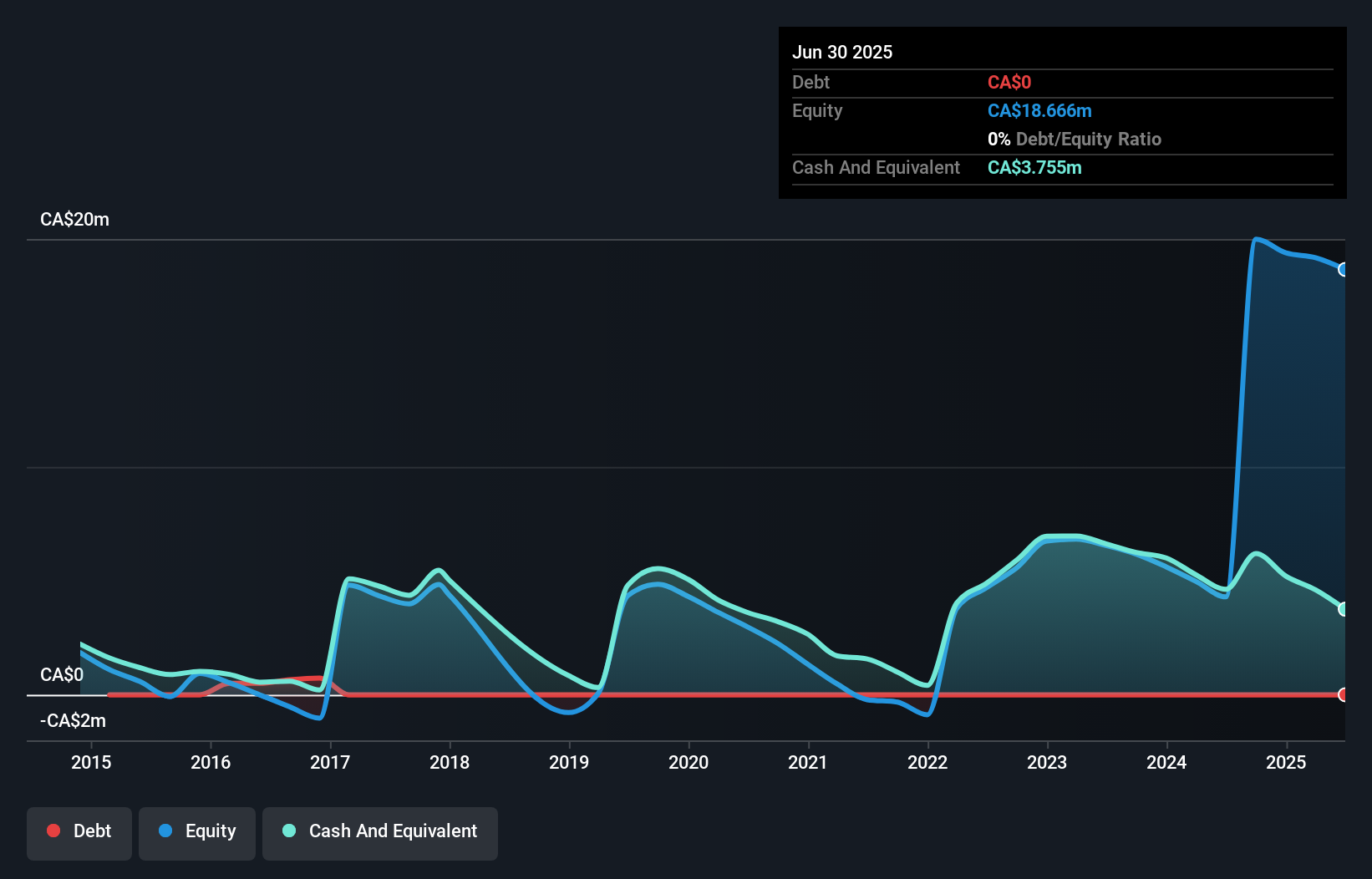

CVW Sustainable Royalties Inc., with a market cap of CA$147.31 million, operates as a pre-revenue entity focused on developing technology for oil sands tailings recovery. Despite being unprofitable and having a negative return on equity, the company maintains sufficient cash runway for more than a year without debt. Recent board changes include the retirement of Moss Kadey and the appointment of Roger Mortimer, an experienced investor in clean technology sectors. The company reported consistent net losses over recent quarters but remains supported by seasoned management and board members with expertise in relevant industries.

- Dive into the specifics of CVW Sustainable Royalties here with our thorough balance sheet health report.

- Gain insights into CVW Sustainable Royalties' historical outcomes by reviewing our past performance report.

Legend Power Systems (TSXV:LPS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Legend Power Systems Inc. provides onsite energy management technology in Canada and the United States, with a market cap of CA$21.29 million.

Operations: The company's revenue segment is derived from the sale or installation of The Smartgate, amounting to CA$1.70 million.

Market Cap: CA$21.29M

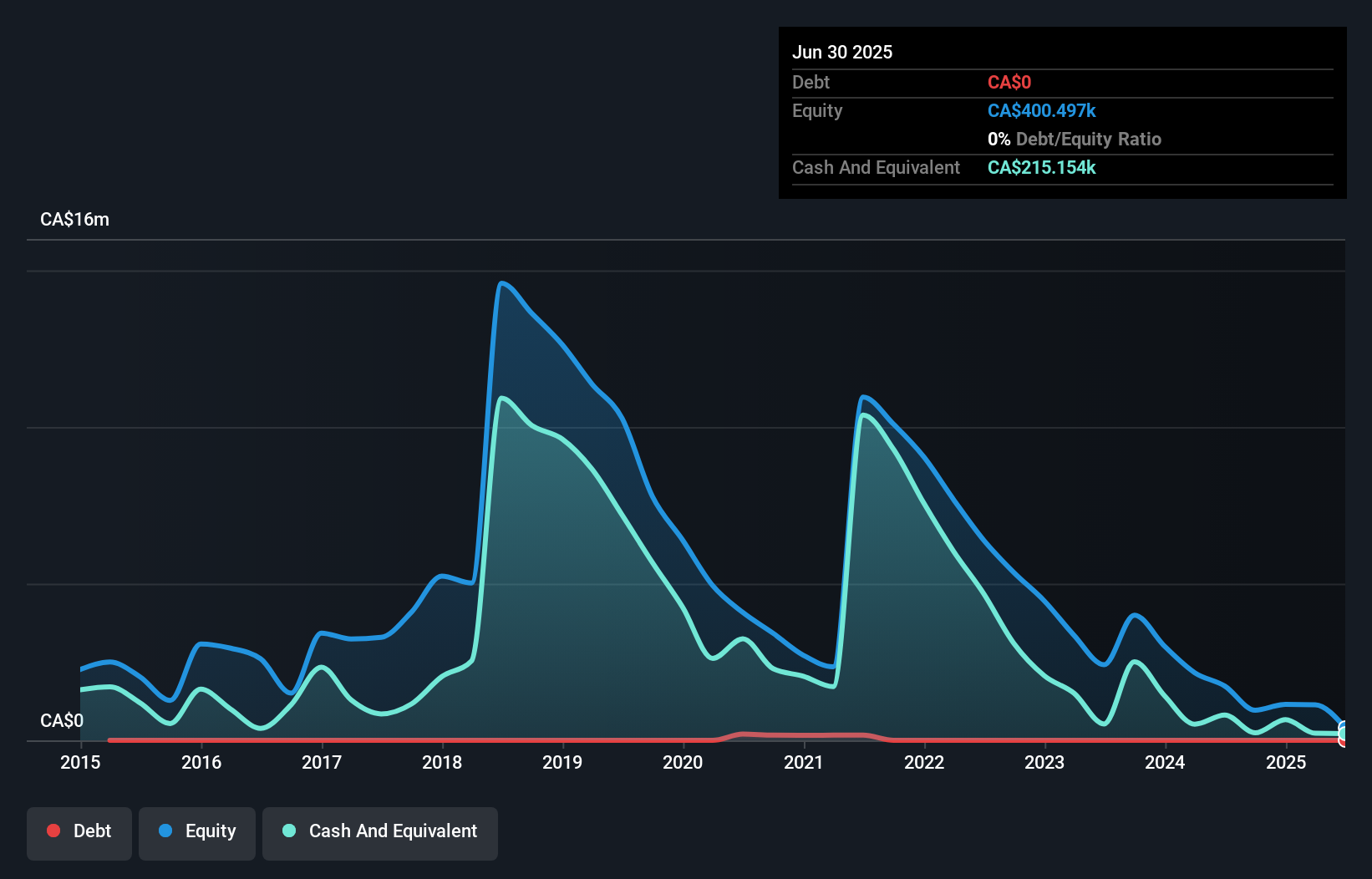

Legend Power Systems Inc., with a market cap of CA$21.29 million, is currently pre-revenue, generating under CA$1 million from its SmartGATE sales. The company recently partnered with a major facility management franchise, enhancing market access and installation capabilities across North America. Despite being unprofitable with a negative return on equity and high share price volatility, Legend Power has reduced its debt to zero over five years and maintains short-term asset coverage over liabilities. However, it faces challenges with less than a year of cash runway if current free cash flow trends persist. Management changes include an interim CFO appointment following the previous CFO's transition to an advisory role.

- Jump into the full analysis health report here for a deeper understanding of Legend Power Systems.

- Examine Legend Power Systems' past performance report to understand how it has performed in prior years.

NeuPath Health (TSXV:NPTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NeuPath Health Inc. offers chronic pain management services in Canada and has a market cap of CA$19.24 million.

Operations: The company's revenue primarily comes from its medical services segment, which generated CA$79.41 million.

Market Cap: CA$19.24M

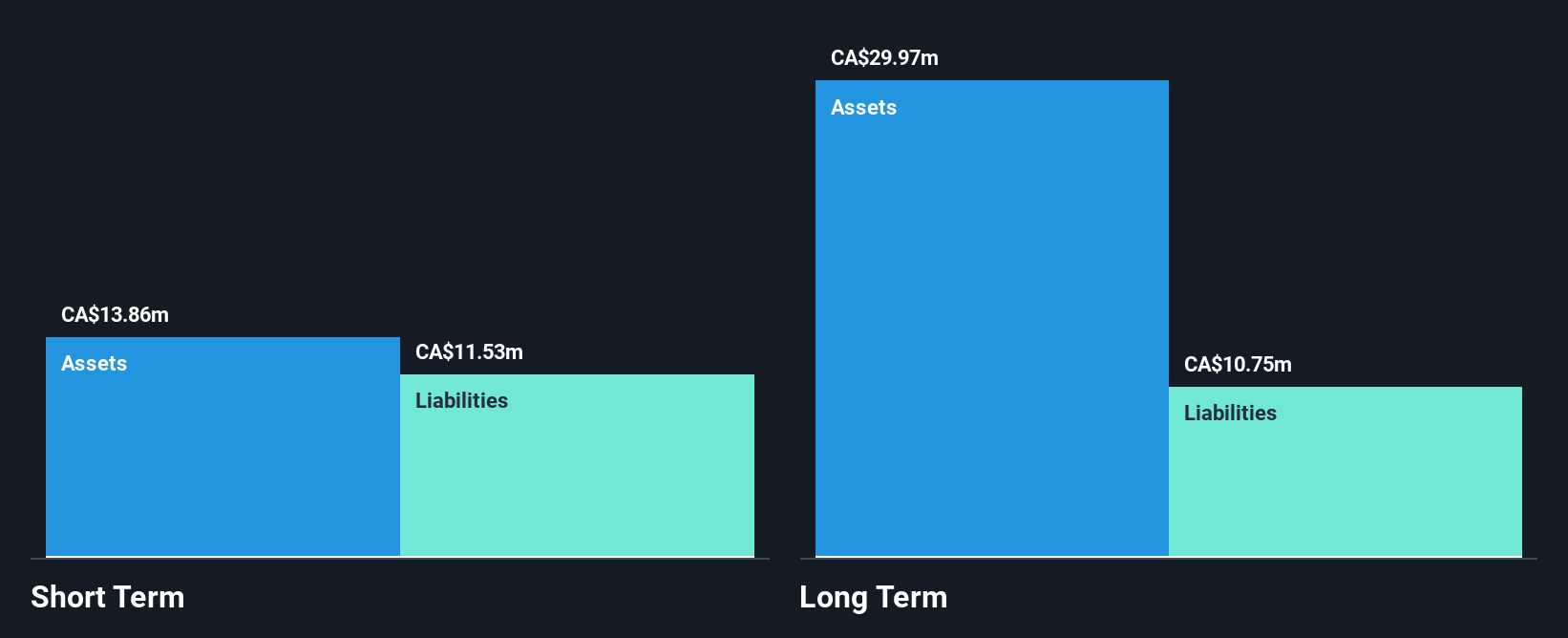

NeuPath Health Inc., with a market cap of CA$19.24 million, has shown revenue growth, reporting CA$23.63 million in the second quarter of 2025, up from CA$18.88 million a year prior. Despite being unprofitable with a negative return on equity and reduced net income compared to last year, NeuPath has improved its financial stability by reducing its debt to equity ratio over five years and maintaining sufficient cash runway for over three years due to positive free cash flow growth. The company has also completed a share buyback program and continues to engage investors through presentations at key conferences.

- Navigate through the intricacies of NeuPath Health with our comprehensive balance sheet health report here.

- Explore historical data to track NeuPath Health's performance over time in our past results report.

Make It Happen

- Gain an insight into the universe of 408 TSX Penny Stocks by clicking here.

- Curious About Other Options? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CVW

CVW Sustainable Royalties

Develops technology for the recovery of bitumen, solvents, minerals, and water from oil sands froth treatment tailings.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)