- Canada

- /

- Metals and Mining

- /

- TSXV:CPI

TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape shaped by rising government bond yields and political changes, including Prime Minister Trudeau's announced resignation. Despite these uncertainties, investors are reminded that market fundamentals remain key drivers of financial performance. In this context, penny stocks—often smaller or newer companies—still present intriguing opportunities for investors when backed by strong financials and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.30 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$125.57M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.42 | CA$996.43M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$656.66M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$13.18M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$223.45M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.69 | CA$319.02M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$176.7M | ★★★★★☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Greenlane Renewables (TSX:GRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenlane Renewables Inc. is a company that provides biogas upgrading systems globally, with a market cap of CA$14.68 million.

Operations: The company generates revenue from its Machinery & Industrial Equipment segment, amounting to CA$63.03 million.

Market Cap: CA$14.68M

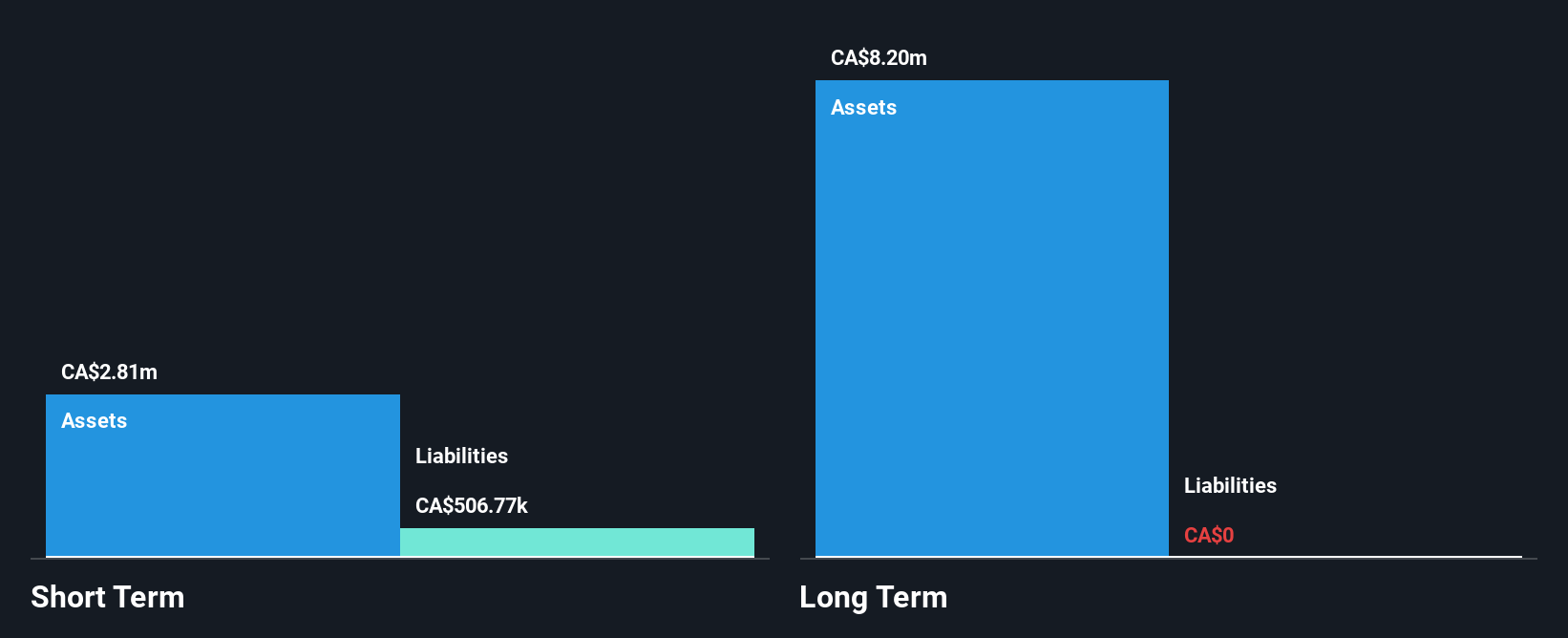

Greenlane Renewables, with a market cap of CA$14.68 million, is actively expanding its biogas upgrading technology portfolio, recently securing a CA$6.5 million contract for landfill gas-to-RNG conversion and filing patents for new technologies aimed at enhancing methane recovery while reducing costs. Despite being unprofitable with losses increasing over the past five years, the company maintains a strong cash position with no debt and has sufficient runway for over three years. Leadership changes include Stephanie Mason's appointment as CFO to drive strategic goals in the RNG sector amidst increased share price volatility and insider selling activity.

- Get an in-depth perspective on Greenlane Renewables' performance by reading our balance sheet health report here.

- Gain insights into Greenlane Renewables' historical outcomes by reviewing our past performance report.

Carlton Precious (TSXV:CPI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Carlton Precious Inc. is involved in the exploration and evaluation of mineral properties across Canada, Australia, Peru, and the United States with a market cap of CA$4.40 million.

Operations: No revenue segments are reported for the company.

Market Cap: CA$4.4M

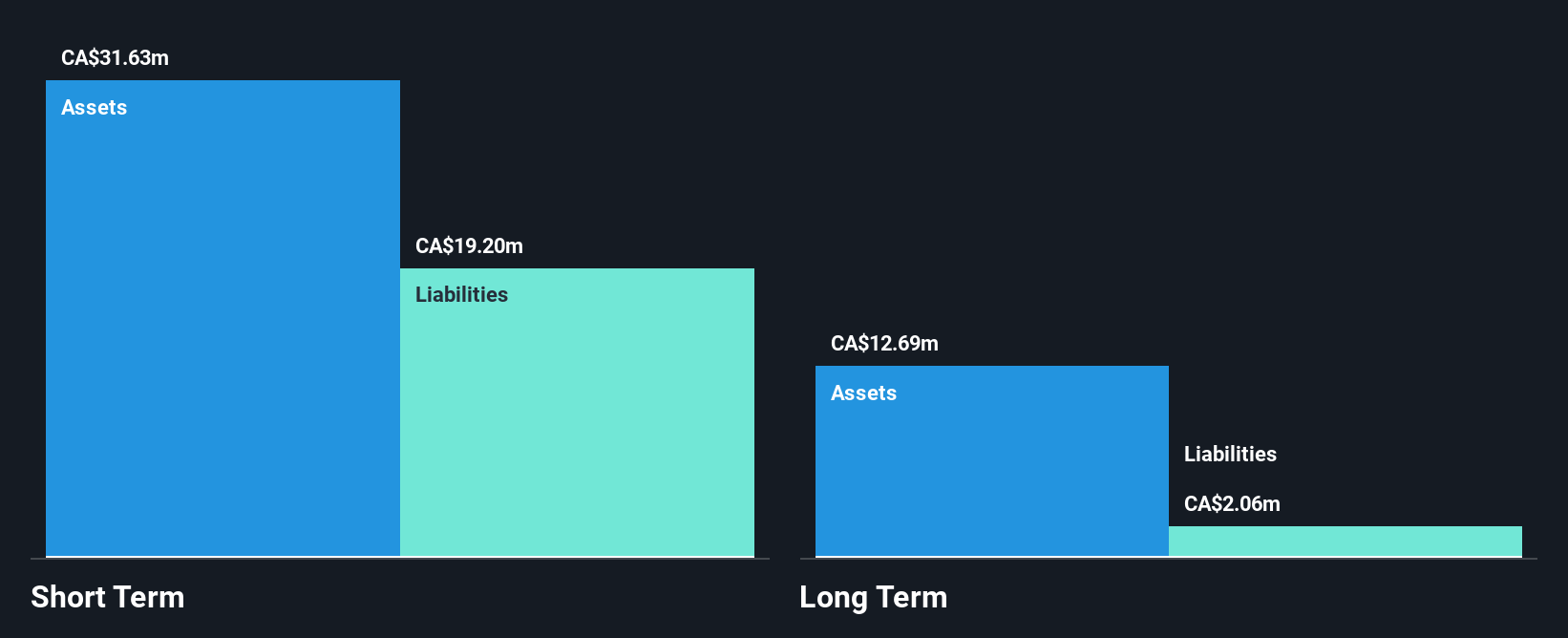

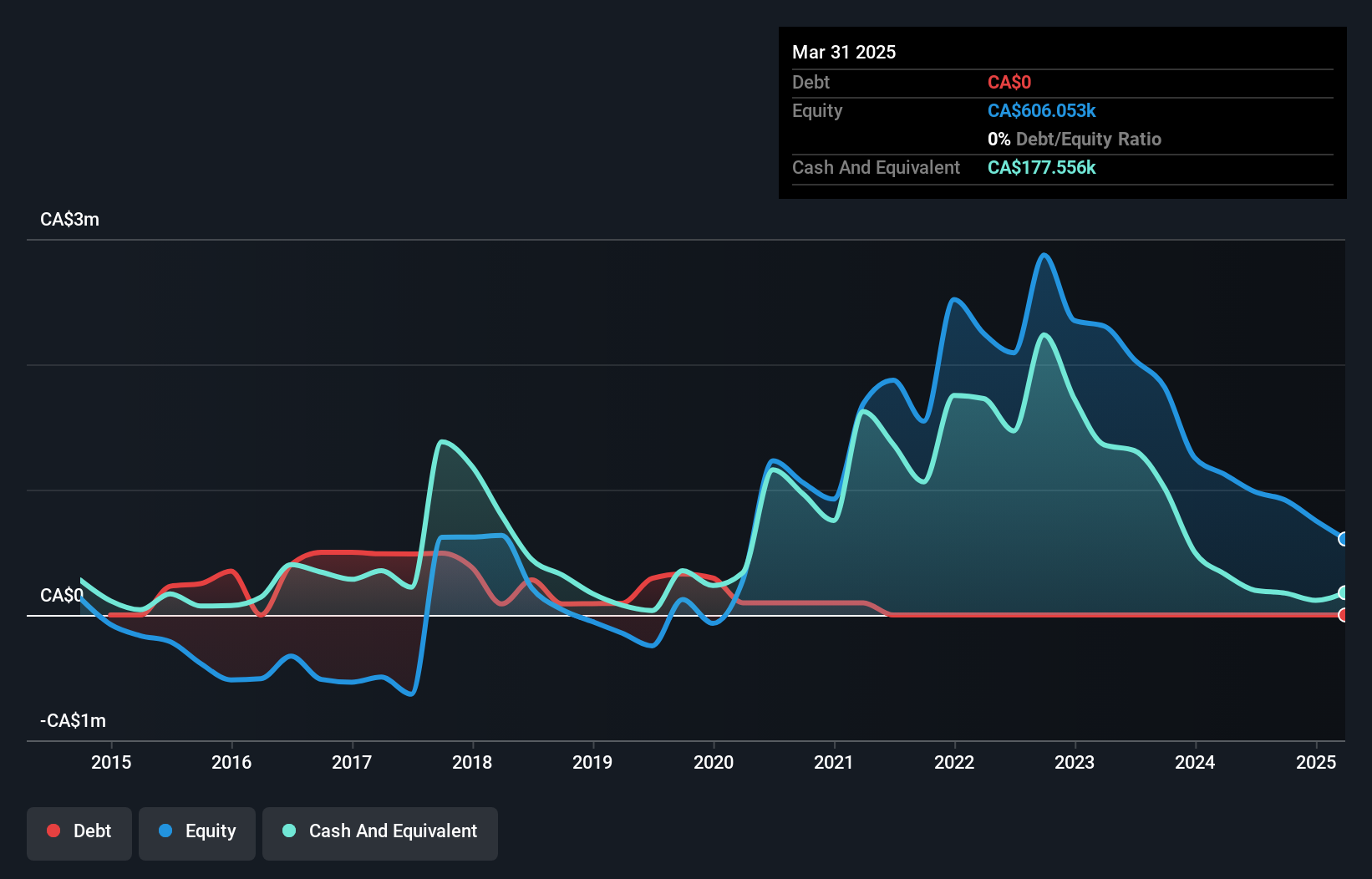

Carlton Precious Inc., with a market cap of CA$4.40 million, is pre-revenue and focused on mineral exploration across multiple countries. Despite being unprofitable, the company has managed to reduce its losses over the past five years by 14.1% annually and maintains a strong financial position with short-term assets exceeding liabilities and no long-term debt. The management team is experienced, averaging 7.7 years in tenure, which provides stability amidst high share price volatility observed recently. Carlton's cash reserves are sufficient for more than three years if current free cash flow trends continue, despite recent auditor concerns about its ability to continue as a going concern.

- Click to explore a detailed breakdown of our findings in Carlton Precious' financial health report.

- Understand Carlton Precious' track record by examining our performance history report.

Searchlight Resources (TSXV:SCLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Searchlight Resources Inc. is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$1.47 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$1.47M

Searchlight Resources Inc., with a market cap of CA$1.47 million, is focused on mineral exploration and remains pre-revenue. The company has no long-term liabilities and is debt-free, although it faces challenges with less than a year of cash runway based on current free cash flow trends. Recent airborne radiometric surveys at Daly Lake have identified significant thorium and uranium targets, expanding historical rare earth element showings. Despite these promising exploration results, the company reported a net loss for the past fiscal year and its auditor expressed doubts about its ability to continue as a going concern due to financial constraints.

- Take a closer look at Searchlight Resources' potential here in our financial health report.

- Explore historical data to track Searchlight Resources' performance over time in our past results report.

Next Steps

- Click this link to deep-dive into the 930 companies within our TSX Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CPI

Carlton Precious

Engages in the exploration and evaluation of mineral properties in Peru, Australia, Peru, and the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)