The Canadian market has been navigating the complexities of new U.S. policy changes, including potential tariffs, while maintaining a positive trajectory on the TSX index. For investors willing to explore beyond well-known names, penny stocks—often representing smaller or newer companies—remain an intriguing investment area despite their somewhat outdated label. These stocks can offer unique opportunities for value and growth, especially when backed by strong financials, making them worthy of consideration for those seeking under-the-radar investments with potential long-term benefits.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.34 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.50 | CA$432.92M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$124.04M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$231.32M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.495 | CA$13.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$632.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.61M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.11 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Chibougamau Independent Mines (TSXV:CBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chibougamau Independent Mines Inc. focuses on the exploration and development of natural resource properties in the Chibougamau mining district of Québec, Canada, with a market cap of CA$9.16 million.

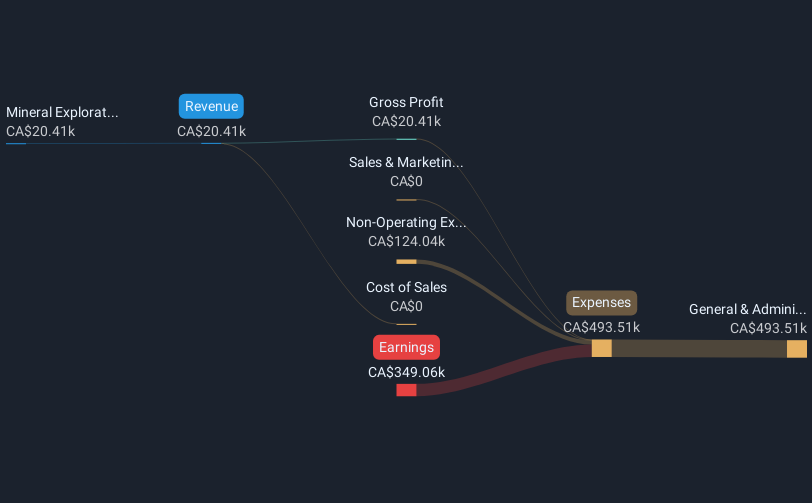

Operations: The company generates revenue primarily from mineral exploration activities amounting to CA$0.02 million.

Market Cap: CA$9.16M

Chibougamau Independent Mines Inc., with a market cap of CA$9.16 million, remains pre-revenue, generating minimal income from mineral exploration activities. Despite its unprofitability, the company has reduced losses by 16.7% annually over five years and maintains more cash than debt, indicating financial prudence. It holds a significant 2% Gross Metal Royalty on the Mont Sorcier Iron Project, which is undergoing feasibility studies for future development. The board's average tenure of 15 years suggests experienced oversight, while short-term assets comfortably cover liabilities. Recent earnings showed decreased sales and income compared to last year but highlight ongoing operational adjustments.

- Click here and access our complete financial health analysis report to understand the dynamics of Chibougamau Independent Mines.

- Evaluate Chibougamau Independent Mines' historical performance by accessing our past performance report.

Fresh Factory B.C (TSXV:FRSH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Fresh Factory B.C. Ltd. formulates, develops, manufactures, distributes, and sells fresh and plant-based food and beverages in the United States with a market cap of CA$45.38 million.

Operations: The company generates revenue of $30.42 million from its food processing segment.

Market Cap: CA$45.38M

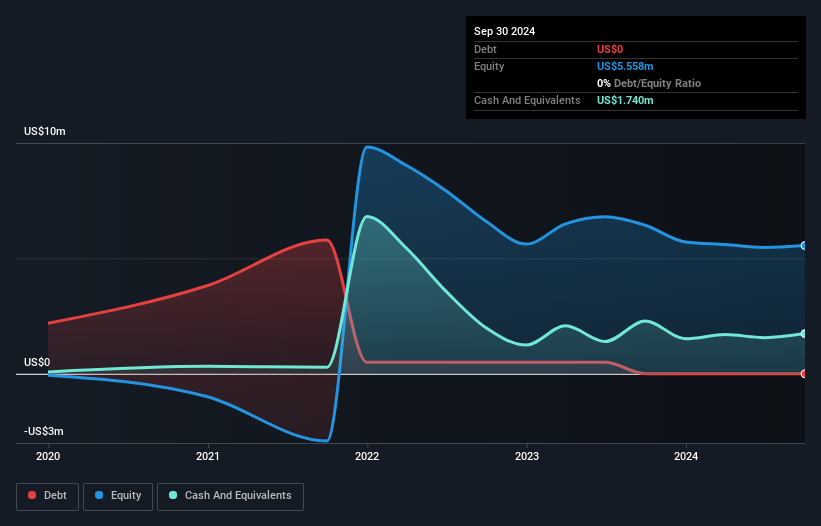

Fresh Factory B.C. Ltd., with a market cap of CA$45.38 million, operates in the plant-based food and beverage sector, generating US$30.42 million in revenue from its food processing segment. Despite being unprofitable, the company has reduced losses by 5.1% annually over five years and maintains a positive cash flow with no debt, ensuring a cash runway exceeding three years. Recent earnings show improved sales and reduced net loss compared to last year, reflecting operational progress. The company's strategic share buyback program further indicates confidence in its valuation as it trades below estimated fair value by 62.8%.

- Get an in-depth perspective on Fresh Factory B.C's performance by reading our balance sheet health report here.

- Gain insights into Fresh Factory B.C's historical outcomes by reviewing our past performance report.

Tombill Mines (TSXV:TBLL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tombill Mines Limited is a Canadian company focused on exploring mineral properties, with a market cap of CA$4.43 million.

Operations: Tombill Mines Limited does not report any revenue segments.

Market Cap: CA$4.43M

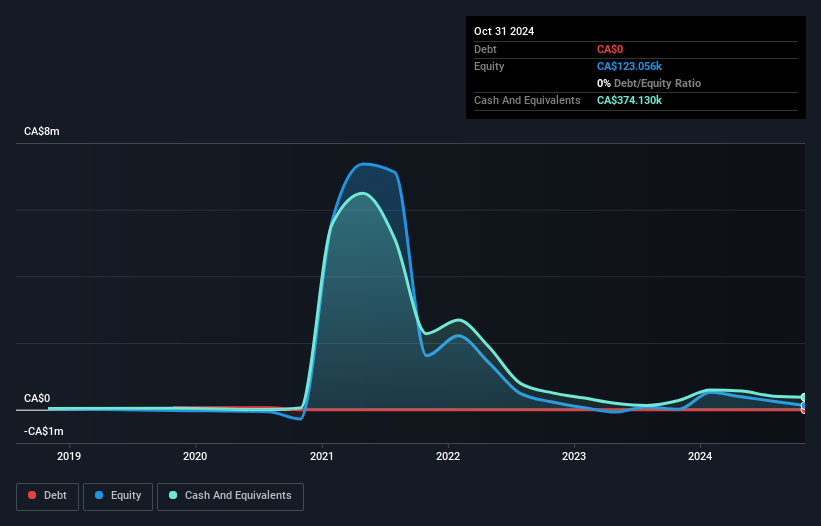

Tombill Mines Limited, a pre-revenue company with a market cap of CA$4.43 million, is focused on mineral exploration but faces financial challenges. The company has no long-term liabilities and is debt-free, yet its short-term assets barely cover its short-term liabilities. Recent exploration updates highlight ongoing work to assess potential gold resources at its Tombill Old Mine and Talmora Mine sites. However, the company's auditor has expressed doubts about its ability to continue as a going concern following an increased net loss for the year ending October 31, 2024, suggesting significant operational risks ahead.

- Jump into the full analysis health report here for a deeper understanding of Tombill Mines.

- Understand Tombill Mines' track record by examining our performance history report.

Seize The Opportunity

- Jump into our full catalog of 936 TSX Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FRSH

Fresh Factory B.C

The Fresh Factory B.C. Ltd. formulates, develops, manufactures, distributes, and sells fresh and plant-based food and beverage products in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)