- Canada

- /

- Capital Markets

- /

- TSX:WNDR

TSX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The Canadian stock market has shown resilience, with the TSX rising over 2% recently, even as global markets grapple with tariff uncertainties and economic growth concerns. Amidst this backdrop, investors often turn to penny stocks for their potential value and growth opportunities. While the term "penny stocks" may seem outdated, these smaller or emerging companies can offer significant potential when they possess strong financials and a clear path forward.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.56 | CA$58.67M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.58 | CA$65.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.60 | CA$389.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.20 | CA$627.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$503.32M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.52 | CA$121.91M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.39 | CA$72.8M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.16 | CA$42.46M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 925 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Hercules Metals (TSXV:BIG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hercules Metals Corp., a junior mining company with a market cap of CA$154.33 million, focuses on the exploration and development of mineral properties in the United States.

Operations: Hercules Metals Corp. has not reported any revenue segments.

Market Cap: CA$154.33M

Hercules Metals Corp., a junior mining company, remains pre-revenue with less than CA$1 million in revenue. Despite being debt-free and having short-term assets of CA$9.6 million exceeding liabilities, the company faces financial challenges with a net loss of CA$18.98 million for 2024 and auditor concerns about its ability to continue as a going concern. Recent developments include completing a 3D block model for its Leviathan discovery in Idaho, which guides an upcoming fully funded 12,000-meter drill campaign aimed at expanding resource potential. The management team is experienced, though the company's cash runway is limited to less than one year.

- Click here to discover the nuances of Hercules Metals with our detailed analytical financial health report.

- Examine Hercules Metals' past performance report to understand how it has performed in prior years.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zoomd Technologies Ltd. operates as a marketing technology user-acquisition and engagement platform worldwide, with a market cap of CA$42.96 million.

Operations: The company generates revenue of $54.50 million from its Internet Software & Services segment.

Market Cap: CA$42.96M

Zoomd Technologies Ltd. has shown significant financial improvement, reporting a net income of US$8.91 million for 2024, reversing a previous loss. The company's market cap stands at CA$42.96 million with revenues of US$54.5 million from its Internet Software & Services segment, highlighting strong operational performance and growth potential in the penny stock sector. Its financial health is underscored by having more cash than total debt and short-term assets exceeding both short and long-term liabilities, while maintaining high-quality earnings and an outstanding return on equity of 50.3%. Despite these strengths, the stock remains highly volatile with recent price fluctuations not uncommon for penny stocks.

- Get an in-depth perspective on Zoomd Technologies' performance by reading our balance sheet health report here.

- Gain insights into Zoomd Technologies' historical outcomes by reviewing our past performance report.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WonderFi Technologies Inc. focuses on developing and acquiring technology platforms for digital asset investments, with a market cap of CA$132.25 million.

Operations: The company's revenue is derived from two main segments: Trading, which accounts for CA$54.92 million, and Payments, contributing CA$2.82 million.

Market Cap: CA$132.25M

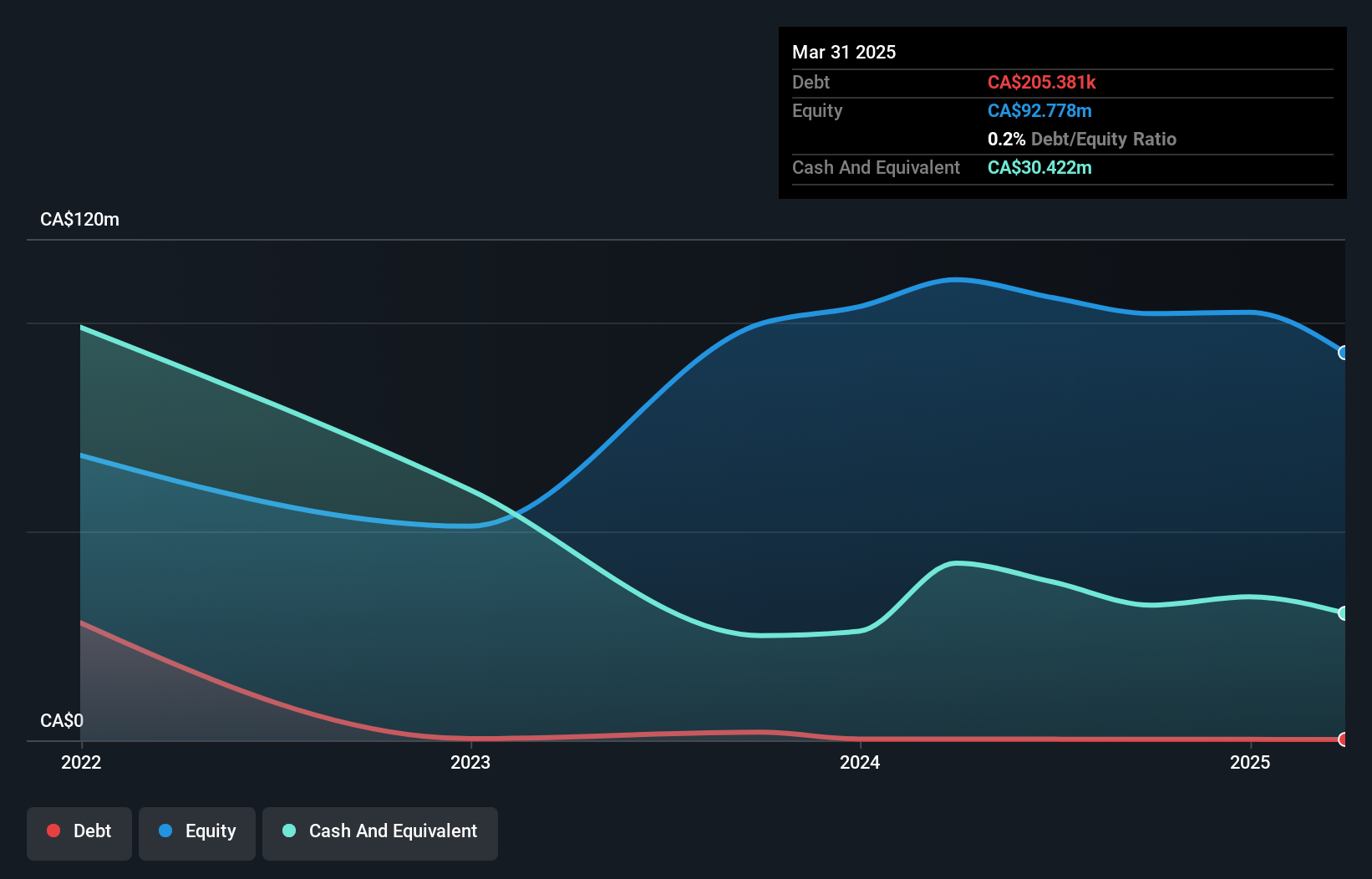

WonderFi Technologies Inc. has demonstrated robust revenue growth, with sales reaching CA$57.74 million in 2024, doubling from the previous year. Despite being unprofitable with a net loss of CA$1.24 million, the company maintains a strong financial position by holding more cash than debt and having short-term assets that exceed liabilities. Recent strategic moves include a partnership to expand trading services and launching Bitcoin.ca to capture educational traffic in Canada. While its board lacks experience, WonderFi's sufficient cash runway and stable volatility suggest potential resilience within the volatile penny stock market environment.

- Click here and access our complete financial health analysis report to understand the dynamics of WonderFi Technologies.

- Understand WonderFi Technologies' earnings outlook by examining our growth report.

Taking Advantage

- Click through to start exploring the rest of the 922 TSX Penny Stocks now.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WonderFi Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WNDR

WonderFi Technologies

Engages in the development and acquisition of technology platforms to facilitate investments in the emerging industry of digital assets.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives