- Canada

- /

- Metals and Mining

- /

- TSXV:VLC

3 TSX Penny Stocks With Market Caps Under CA$40M

Reviewed by Simply Wall St

The Canadian stock market is showing strong momentum as we head into 2025, driven by resilient consumer spending and rising corporate profits, although investors remain cautious about potential curveballs. Amidst this backdrop, penny stocks—smaller or newer companies that often fly under the radar—continue to offer intriguing opportunities for those willing to explore beyond the dominant mega-cap names. While the term "penny stock" might seem outdated, these investments can still uncover hidden value and financial strength in overlooked sectors of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$158.19M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$121.61M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.45 | CA$13.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.66 | CA$324.12M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$574.88M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.76 | CA$188.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$208.8M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$4.71M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$181.41M | ★★★★★☆ |

Click here to see the full list of 953 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

BCM Resources (TSXV:B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BCM Resources Corporation is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$9.52 million.

Operations: BCM Resources Corporation does not have reported revenue segments.

Market Cap: CA$9.52M

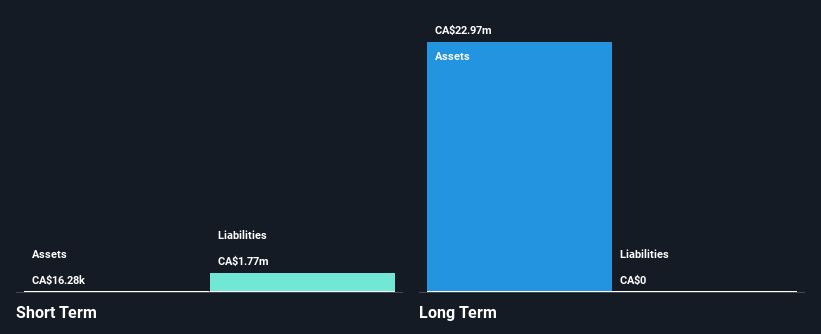

BCM Resources, with a market cap of CA$9.52 million, is pre-revenue and focused on mineral exploration in Canada. Despite being debt-free and having no long-term liabilities, the company faces financial challenges with short-term assets of CA$16.3K unable to cover its short-term liabilities of CA$1.8M. Shareholders have experienced dilution over the past year, with shares outstanding increasing by 5%. The stock has shown high volatility recently, though weekly volatility has stabilized somewhat over the past year. BCM Resources maintains a cash runway exceeding three years despite declining free cash flow trends at 38.9% annually.

- Jump into the full analysis health report here for a deeper understanding of BCM Resources.

- Assess BCM Resources' previous results with our detailed historical performance reports.

Omni-Lite Industries Canada (TSXV:OML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Omni-Lite Industries Canada Inc. manufactures metal alloy, composite components, and fastener systems in the United States and Canada, with a market cap of CA$20.04 million.

Operations: The company generates revenue from its operations in Canada and the United States, with $4.03 million coming from Canada and $11.67 million from the United States.

Market Cap: CA$20.04M

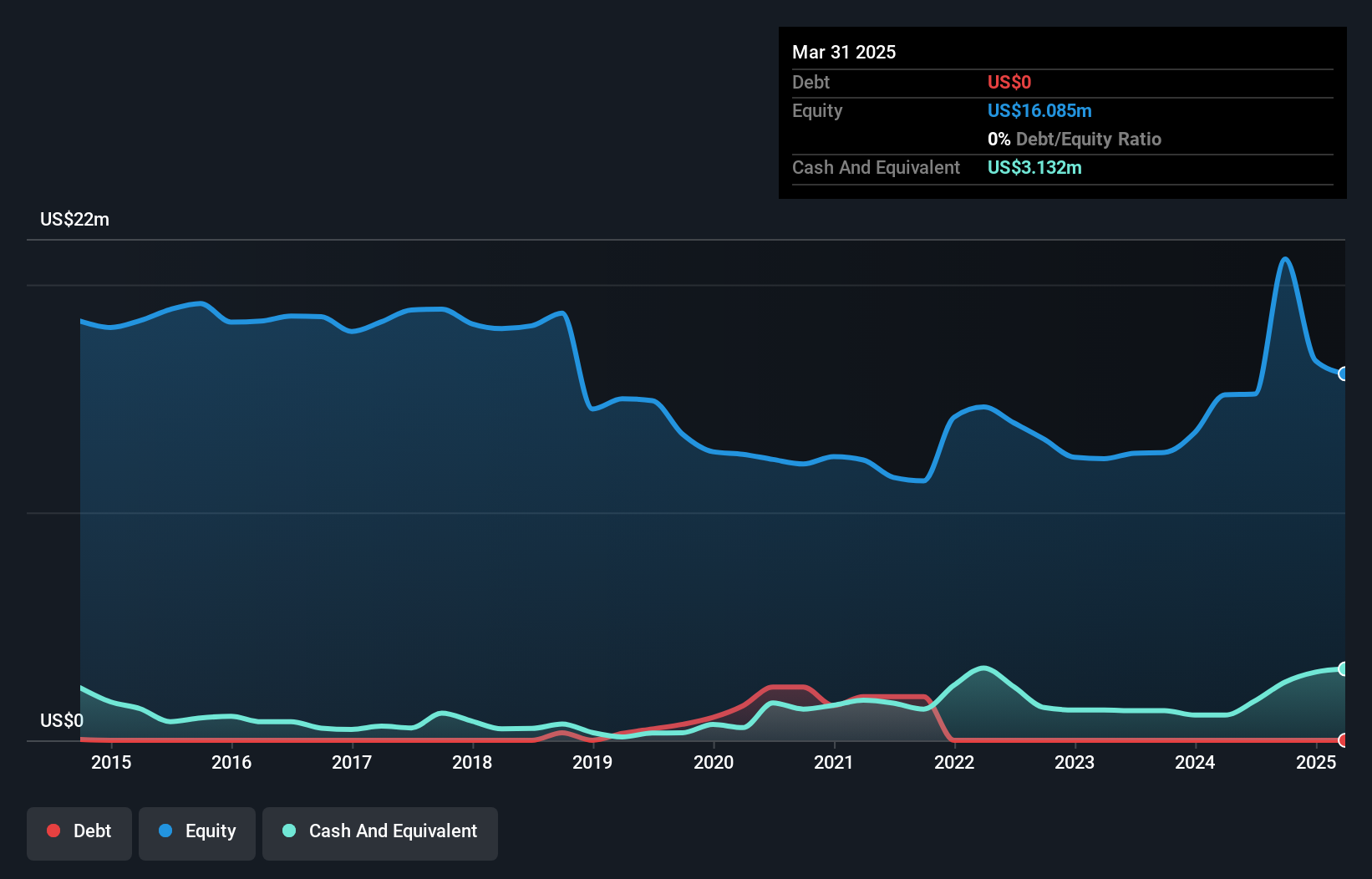

Omni-Lite Industries Canada Inc., with a market cap of CA$20.04 million, has shown financial improvement by becoming profitable over the past year, reporting nine-month sales of US$12.39 million compared to US$9.1 million a year ago. The company is debt-free, which alleviates concerns about interest payments and enhances its financial stability. Despite this progress, Omni-Lite experienced a significant one-off loss impacting recent results and maintains a low return on equity at 5.1%. Its short-term assets of $9.8M comfortably cover both short-term ($1.9M) and long-term liabilities ($5.4M).

- Dive into the specifics of Omni-Lite Industries Canada here with our thorough balance sheet health report.

- Evaluate Omni-Lite Industries Canada's historical performance by accessing our past performance report.

Velocity Minerals (TSXV:VLC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Velocity Minerals Ltd. is involved in the acquisition, exploration, evaluation, development, and investment of mineral resource properties in Bulgaria with a market capitalization of CA$33.37 million.

Operations: Velocity Minerals Ltd. currently does not report any revenue segments.

Market Cap: CA$33.37M

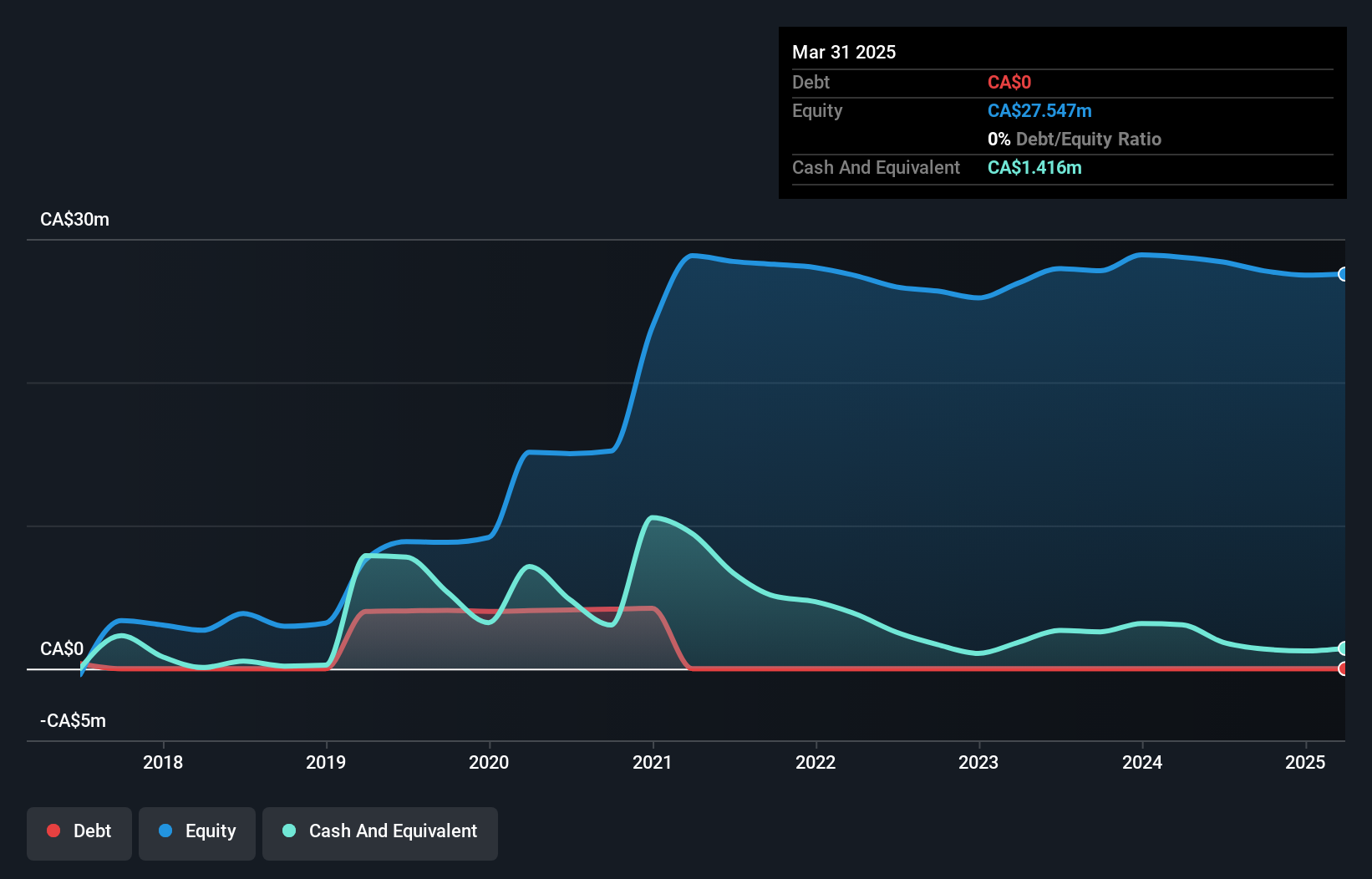

Velocity Minerals Ltd., with a market cap of CA$33.37 million, is pre-revenue and focused on expanding its mineral resources in Bulgaria. Recent developments include an agreement to acquire a 100% interest in the Toledo gold-silver property, which boasts significant historical exploration data and potential for further resource expansion. Despite being debt-free and having short-term assets of CA$2.3 million that cover liabilities, the company faces financial challenges with less than a year of cash runway and ongoing shareholder dilution. Management is experienced but must navigate these hurdles to capitalize on its strategic acquisitions effectively.

- Get an in-depth perspective on Velocity Minerals' performance by reading our balance sheet health report here.

- Gain insights into Velocity Minerals' historical outcomes by reviewing our past performance report.

Next Steps

- Click this link to deep-dive into the 953 companies within our TSX Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VLC

Velocity Minerals

Engages in the acquisition, exploration, evaluation, development, and investment in mineral resource properties in Bulgaria.

Adequate balance sheet low.