- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

Undiscovered Gems in Canada to Watch This July 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape of delayed tariff increases and resilient economic data, investors are cautiously optimistic despite potential volatility in the coming months. In this environment, identifying promising small-cap stocks that can withstand these fluctuations requires a focus on companies with robust supply chains and adaptability to evolving trade dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Zoomd Technologies | 8.92% | 10.04% | 44.63% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, is involved in the production and sale of tin concentrate and has a market capitalization of CA$1.28 billion.

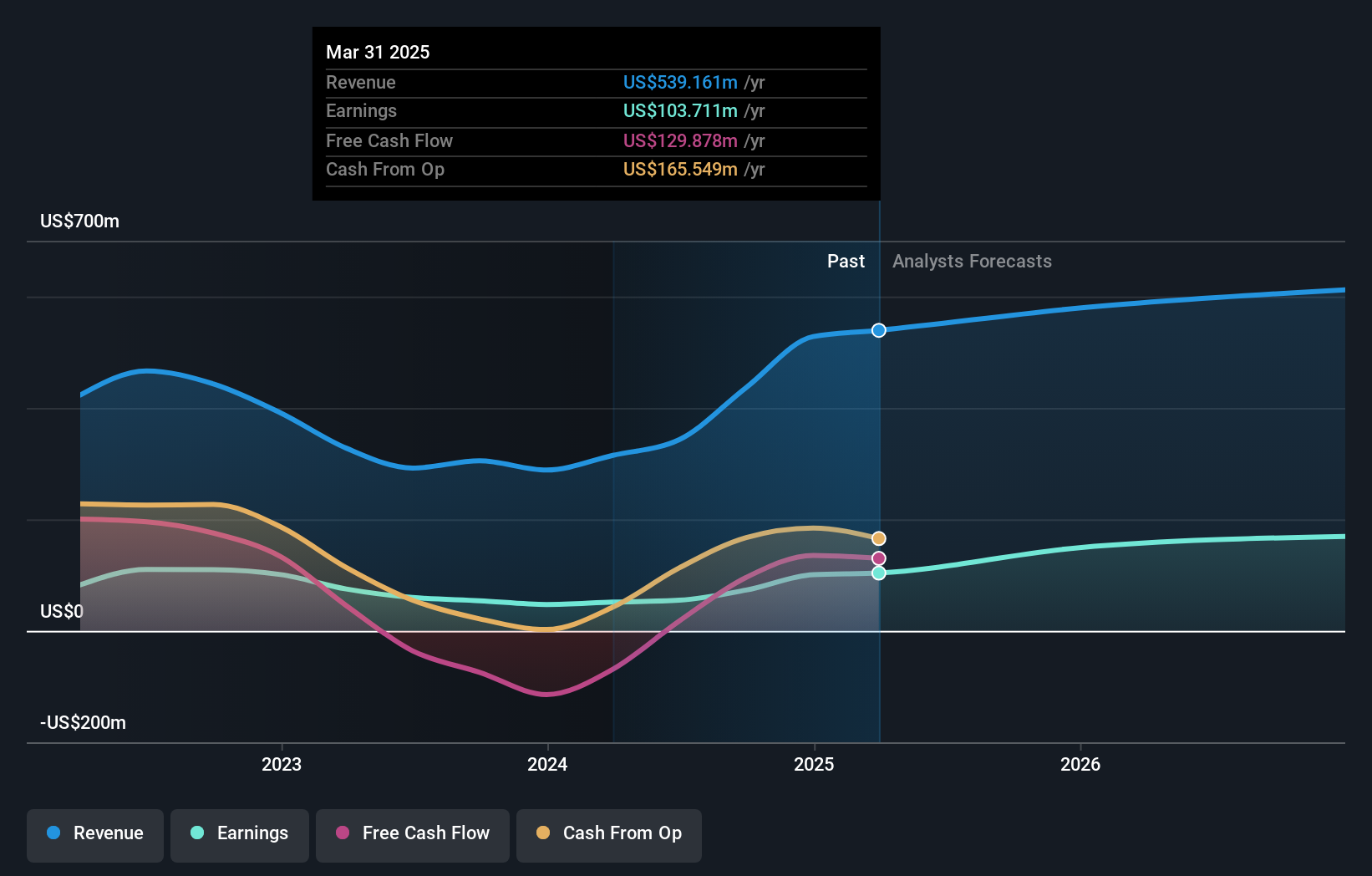

Operations: The company generates revenue primarily from the production and sale of tin concentrate, with a reported revenue of $539.16 million.

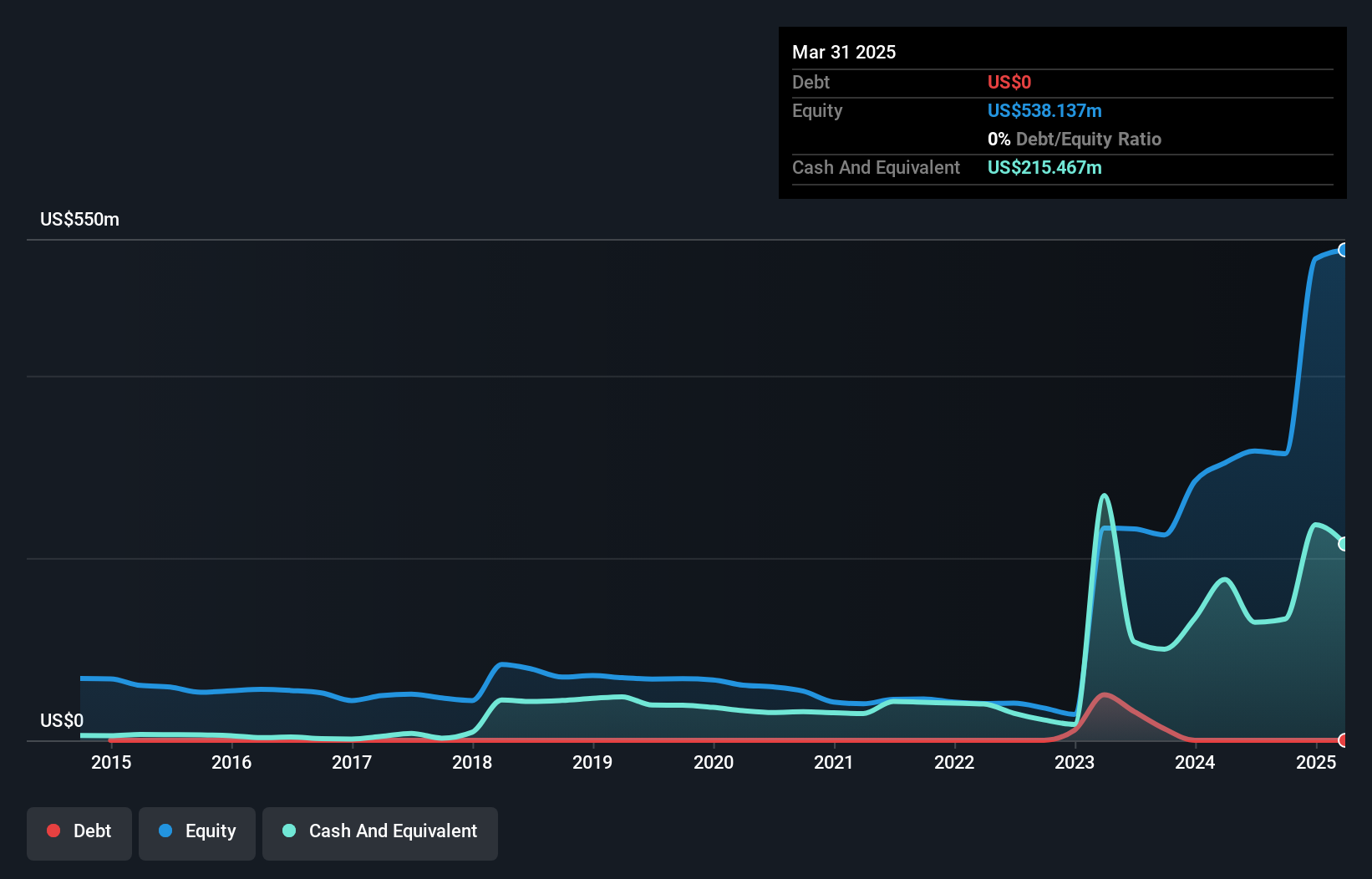

Alphamin Resources, a nimble player in the mining sector, showcases impressive financial health with earnings growth of 101% over the past year, significantly outpacing the industry average of 37%. The company trades at 26% below its estimated fair value, suggesting potential undervaluation. With a debt-to-equity ratio reduced from 55.5% to 16.2% over five years and cash exceeding total debt, financial stability is evident. Recent operational updates reveal robust tin production post-restart with Q1 sales reaching US$120 million and net income at US$23 million, reflecting strong performance despite recent leadership changes and strategic adjustments.

- Click to explore a detailed breakdown of our findings in Alphamin Resources' health report.

Evaluate Alphamin Resources' historical performance by accessing our past performance report.

Elemental Altus Royalties (TSXV:ELE)

Simply Wall St Value Rating: ★★★★★★

Overview: Elemental Altus Royalties Corp. focuses on acquiring and generating precious metal royalties, with a market capitalization of CA$523.47 million.

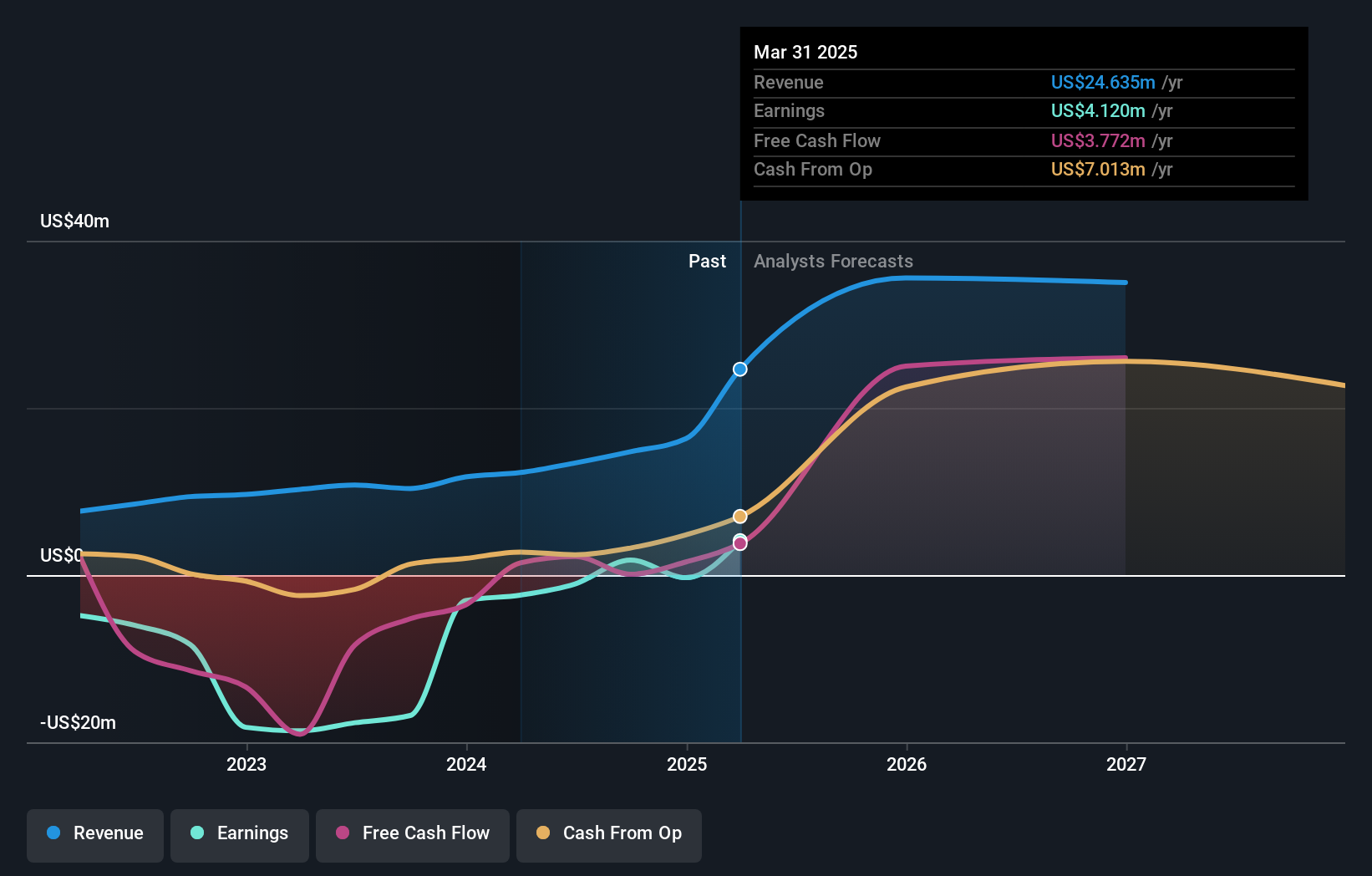

Operations: Elemental Altus Royalties generates revenue primarily from the acquisition of royalties, streams, and similar production-based interests, totaling $24.64 million.

Elemental Altus Royalties, a player in the royalties sector, has recently turned profitable, reporting a net income of US$3.45 million for Q1 2025 compared to a previous loss. The company is trading at 41% below its estimated fair value and boasts high-quality earnings with no debt on its books now versus a debt-to-equity ratio of 144.3% five years ago. Despite shareholder dilution last year, Elemental's revenue jumped to US$11.64 million from US$3.33 million year-over-year, indicating robust growth prospects with forecasted annual revenue growth of over 20%.

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★★

Overview: Valeura Energy Inc. is involved in the exploration, development, and production of petroleum and natural gas in Thailand and Turkey, with a market cap of CA$742.53 million.

Operations: Valeura Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to $682.54 million.

Valeura Energy, a smaller player in the oil and gas sector, has made significant strides with a 699% earnings growth over the past year, outpacing industry norms. Trading at 40.8% below its estimated fair value suggests potential upside for investors. The company remains debt-free, enhancing its financial flexibility for future projects like the Wassana Field redevelopment aimed at boosting production and cash flow. Despite these positives, challenges such as regulatory hurdles and cost overruns persist. Recent developments include a successful drilling campaign in Thailand and share repurchases totaling CAD 3.98 million in early 2025.

Summing It All Up

- Reveal the 50 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives