Last Update 15 Aug 25

Fair value Decreased 5.40%Valeura Energy’s consensus price target has been revised downward, primarily reflecting a significant rise in its future P/E ratio which suggests lower expected earnings growth or higher valuation risk, resulting in a new fair value estimate of CA$12.45.

What's in the News

- Valeura Energy entered into a farm-in agreement with PTTEP, acquiring a 40% interest in Blocks G1/65 and G3/65 in the offshore Gulf of Thailand, aiming for both near-term development and longer-term growth through infrastructure-led exploration and gas developments.

- Maintained full-year 2025 production guidance at 23.0–25.5 mbbls/d, despite the second quarter being the lowest production quarter with stronger rates expected in the second half.

- Reported Q2 2025 working interest production of 21.4 mbbls/d, down 10.2% sequentially due to planned downtime and natural declines, consistent with company plans.

- Successfully completed an eight-well drilling campaign at Licence B5/27, with development wells exceeding expectations, maintaining production rates, and identifying new exploration opportunities. Drilling rig mobilized for a new 10-well programme at the Nong Yao field.

Valuation Changes

Summary of Valuation Changes for Valeura Energy

- The Consensus Analyst Price Target has fallen from CA$13.16 to CA$12.45.

- The Future P/E for Valeura Energy has significantly risen from 83.92x to 109.28x.

- The Discount Rate for Valeura Energy remained effectively unchanged, at 6.14%.

Key Takeaways

- Successful drilling and production strategies are set to boost reserves and production, driving growth in revenue and cash flow.

- Operational efficiencies and tax integration are projected to enhance net margins and reduce costs, improving cash flow and sustainability.

- Regulatory delays, cost overruns, and timing mismatches in oil production and tax impacts may strain Valeura's financial performance and cash flow visibility.

Catalysts

About Valeura Energy- Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

- The successful infill development drilling and exploration activities, which resulted in a 250% reserve replacement ratio and an increase in 2C reserves by 140%, are likely to drive future production growth and contribute positively to future revenue.

- The Wassana Field redevelopment, expected to reach FID in early Q2 2025, could significantly increase the 2P reserves and double production upon completion, enhancing revenue and cash flow in the coming years.

- Operational efficiencies have lowered OpEx, coming in at $22.8 per barrel in Q4, and capitalized on cost-effectiveness in drilling activities. This efficiency is expected to improve net margins by reducing production costs further.

- The integration and tax consolidation of Thai III companies, accessing approximately $400 million in tax losses, will substantially decrease future tax burdens, boosting after-tax earnings and cash flow.

- The development of projects such as the low-BTU generator for waste gas power and Manora's debottlenecking project, aimed at reducing greenhouse gas emissions and operational costs, are poised to enhance net margins and contribute to environmental sustainability goals.

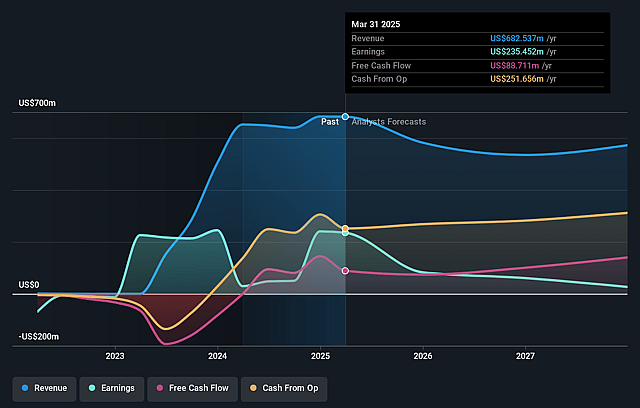

Valeura Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Valeura Energy's revenue will decrease by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 35.3% today to 2.6% in 3 years time.

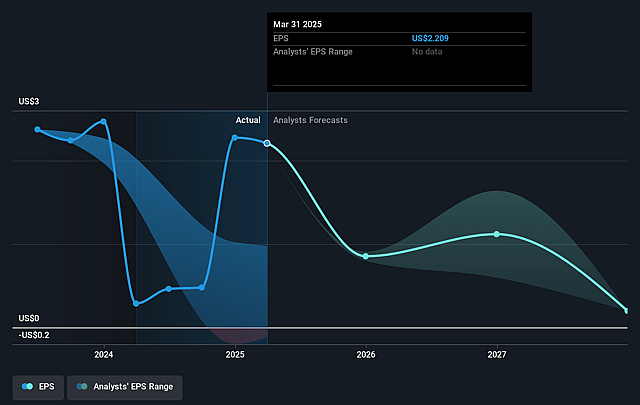

- Analysts expect earnings to reach $14.2 million (and earnings per share of $0.3) by about September 2028, down from $229.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 78.5x on those 2028 earnings, up from 2.6x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.17%, as per the Simply Wall St company report.

Valeura Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory delays or changes in government policies, as noted in the approval delay for the exploration phase in Turkey, could impact the company's ability to explore and develop new fields, affecting future reserves and revenue.

- The necessity of a successful final investment decision (FID) for the Wassana redevelopment project to increase reserves and production might lead to increased financial pressure if there are delays or cost overruns, affecting future earnings.

- The potential mismatch in timing between production and lifting of oil may cause temporary fluctuations in reported quarterly revenues, which could impact short-term cash flow visibility for investors.

- Uncertainties regarding the timing and financial impact of tax payments and consolidation benefits may affect net margins and the predictability of after-tax cash flows.

- The ambition to grow through large development assets rather than focusing more on cash flow-accretive acquisitions could lead to increased capital expenditures, potentially affecting net cash flow if the production timelines are delayed or the expected returns are not realized.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$12.45 for Valeura Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$14.0, and the most bearish reporting a price target of just CA$11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $536.1 million, earnings will come to $14.2 million, and it would be trading on a PE ratio of 78.5x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$7.65, the analyst price target of CA$12.45 is 38.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Valeura Energy?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.