Key Takeaways

- Aggressive reserve replacement and exploration efforts drive sustained production growth, extended field life, and long-term earnings visibility.

- Strong Southeast Asian market position and financial flexibility enable premium pricing, robust margins, and rapid value-accretive M&A opportunities.

- Over-dependence on maturing oil assets, regulatory uncertainty, and global decarbonization efforts threaten Valeura's revenues, profitability, and long-term valuation.

Catalysts

About Valeura Energy- Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

- Analyst consensus expects the Wassana Field redevelopment to significantly boost 2P reserves and double production, but with additional low-cost satellite tie-ins and conversion of a much larger portion of 2C resources to 2P, the ultimate uplift could materially exceed current market expectations, potentially driving multi-year revenue growth and a higher asset base.

- Analysts broadly agree that infill drilling and exploration underpin high reserve replacement and field life extension, but the ongoing 200%–250% reserve replacement rates, combined with over 100 new drilling locations and an underappreciated pipeline of appraisal targets, suggest sustained above-trend production growth and earnings power into the next decade.

- Valeura's preeminent position in Southeast Asia, where energy demand continues to outpace global averages and sellers realize Brent premiums, positions the company to leverage structurally high oil prices and rapidly expanding regional markets for higher realized prices and robust margin expansion.

- The company's strong balance sheet, substantial cash reserves, and consistent operational outperformance enable rapid, accretive M&A targeting large, cash-generative assets overlooked by majors, which could accelerate step-changes in cash flow and scale, driving substantial EPS and NAV growth.

- With proven ability to extend mature field life well beyond third-party forecasts and an increasingly favorable regulatory environment for production extension and potential new ventures (e.g., in Turkey), Valeura's asset longevity and incremental production potential are likely underestimated, supporting durable free cash flow and long-term earnings visibility.

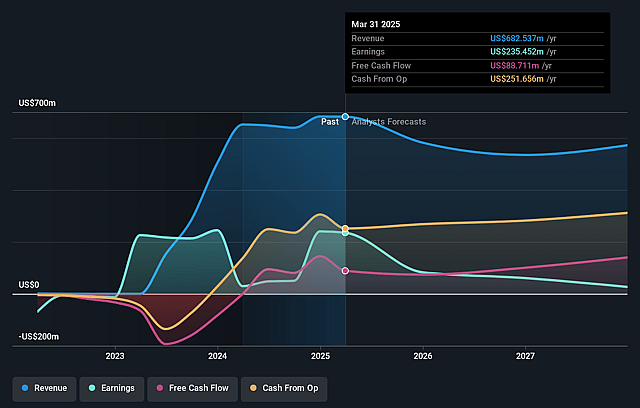

Valeura Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Valeura Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Valeura Energy's revenue will decrease by 4.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 35.3% today to 2.3% in 3 years time.

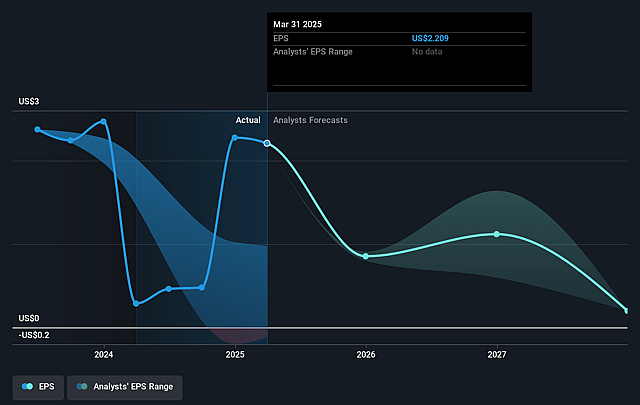

- The bullish analysts expect earnings to reach $13.0 million (and earnings per share of $0.18) by about September 2028, down from $229.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 96.0x on those 2028 earnings, up from 2.6x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.18%, as per the Simply Wall St company report.

Valeura Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating global energy transition and decarbonization efforts are expected to reduce long-term demand for oil and gas, putting sustained pressure on commodity prices and potentially eroding Valeura Energy's future revenues and asset values.

- Valeura's heavy reliance on mature, depleting fields in Thailand, despite recent reserve extensions, increases the risk of declining production over time, which could lead to higher sustaining capital costs and shrinking net cash flow and margins if infill drilling becomes less effective.

- The company's primary focus on Southeast Asia, and limited portfolio diversification into non-fossil segments, exposes it to heightened geopolitical, regulatory, and fiscal uncertainties that could disrupt operations or reduce revenue predictability.

- Growing global enforcement of carbon pricing, emissions penalties, and investor-driven ESG mandates could drive up Valeura's cost of capital and operating expenses, squeezing profitability margins and limiting access to institutional funding in the long run.

- The accelerating shift towards electric vehicles, renewable energy, and advances in energy storage threaten to structurally reduce global oil and gas demand, raising long-term risks of asset write-downs and increased earnings volatility, which could negatively impact valuation multiples and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Valeura Energy is CA$14.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Valeura Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$14.0, and the most bearish reporting a price target of just CA$11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $575.9 million, earnings will come to $13.0 million, and it would be trading on a PE ratio of 96.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$7.64, the bullish analyst price target of CA$14.0 is 45.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.