Key Takeaways

- Reliance on Southeast Asian assets and fossil fuels exposes Valeura to regulatory, political, and decarbonization risks, threatening future earnings and capital access.

- Operational strengths and reserve additions may not offset headwinds from ESG regulation, shrinking demand, and declining long-term profitability in the oil and gas sector.

- Heavy reliance on offshore Thailand oil assets exposes Valeura to significant geographic, regulatory, and industry risks that may threaten earnings stability and long-term growth.

Catalysts

About Valeura Energy- Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

- While Valeura Energy has delivered strong reserve replacement and successful field extensions in its Thailand offshore assets, the company remains heavily exposed to the risk of accelerating global decarbonization policies and the rise of renewables, which could erode long-term demand for oil and gas and weigh on future revenue growth.

- Despite the company's efficiency gains and robust operating cash flow supported by lower OpEx and tax optimization, persistent uncertainties around stricter ESG-driven regulation and potential carbon pricing could significantly raise operating costs and reduce net margins going forward.

- Although substantial reserves have been added and field life has been extended well into the 2030s, ongoing geographic concentration in Southeast Asia exposes Valeura to political or regulatory changes that may negatively impact earnings, especially if local fiscal regimes become less favourable.

- While the energy sector is seeing strengthened commodity price support due to global underinvestment in upstream capacity, Valeura faces long-term reserve replacement risks: continued strong performance in infill drilling and resource conversion may not be indefinitely sustainable, which could ultimately pressure future top-line revenue and profitability.

- Even as the company leverages its sizeable cash position and low leverage to fund organic development and potential M&A, the structural trend of global capital flows away from fossil fuels could constrain access to low-cost capital and limit shareholder returns, dampening the outlook for future dividends or buybacks.

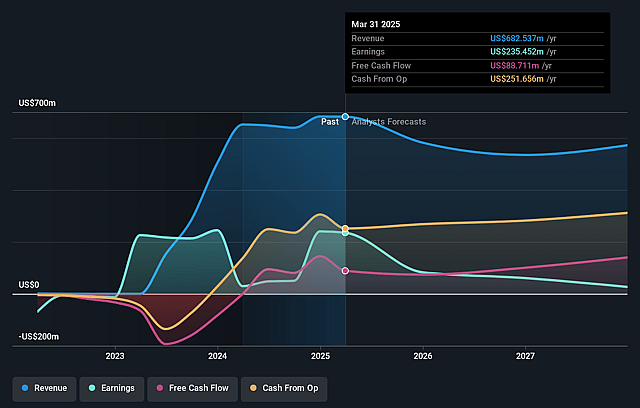

Valeura Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Valeura Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Valeura Energy's revenue will decrease by 4.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 35.3% today to 2.3% in 3 years time.

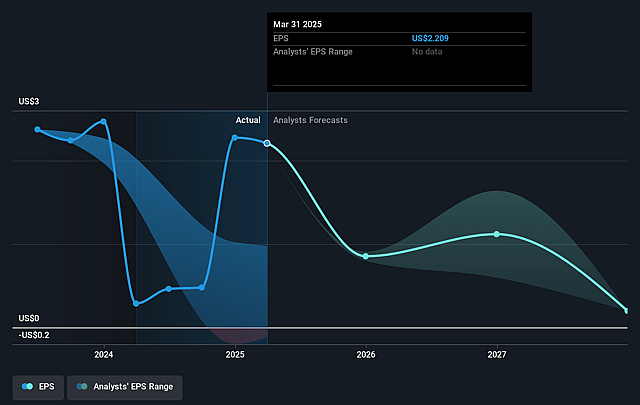

- The bearish analysts expect earnings to reach $13.0 million (and earnings per share of $0.18) by about September 2028, down from $229.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 75.4x on those 2028 earnings, up from 2.6x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 12.4x.

- Analysts expect the number of shares outstanding to decline by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.17%, as per the Simply Wall St company report.

Valeura Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Valeura Energy is heavily reliant on its offshore Thailand oil assets, which creates geographic concentration risk; any adverse changes in the regulatory, fiscal, or political landscape in Thailand could disrupt operations, impacting future revenues and earnings stability.

- The company's recent reserve growth and field life extensions are largely dependent on continued infill drilling and successful appraisal results; a slowdown in exploration success, inability to replenish reserves, or earlier-than-expected field declines could erode long-term production levels and reduce earnings.

- Structural headwinds for oil due to global decarbonization policies and rapid uptake of renewable energy pose a risk to long-term oil demand, potentially placing downward pressure on realized oil prices and constraining Valeura's ability to sustain its margins and cash flow into the 2030s.

- Intensifying ESG regulations and anticipated increases in carbon pricing could drive higher operating costs for Valeura, directly lowering future net margins and potentially reducing access to low-cost capital needed for project expansions.

- Valeura's growth narrative is supported by aggressive expansion plans and potential M&A activity, which carry execution risks; integration missteps or acquisition of non-accretive assets could lead to increased financial leverage, lower returns on capital, and diminished shareholder value reflected in future net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Valeura Energy is CA$11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Valeura Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$14.0, and the most bearish reporting a price target of just CA$11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $559.2 million, earnings will come to $13.0 million, and it would be trading on a PE ratio of 75.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$7.65, the bearish analyst price target of CA$11.0 is 30.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Valeura Energy?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.