- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

TSX Stocks Believed To Be Trading Below Estimated Value

Reviewed by Simply Wall St

The Canadian stock market has experienced a rollercoaster first half of the year, with the TSX reaching new all-time highs after overcoming significant volatility and policy uncertainties. As investors navigate these fluctuating conditions, identifying undervalued stocks becomes crucial, as they have the potential to offer opportunities for growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$43.70 | CA$85.65 | 49% |

| Timbercreek Financial (TSX:TF) | CA$7.60 | CA$10.88 | 30.2% |

| TerraVest Industries (TSX:TVK) | CA$170.05 | CA$314.23 | 45.9% |

| Magna Mining (TSXV:NICU) | CA$1.87 | CA$3.44 | 45.6% |

| Lithium Royalty (TSX:LIRC) | CA$5.10 | CA$8.79 | 42% |

| K92 Mining (TSX:KNT) | CA$15.16 | CA$21.37 | 29.1% |

| Journey Energy (TSX:JOY) | CA$2.01 | CA$2.96 | 32% |

| High Tide (TSXV:HITI) | CA$3.19 | CA$4.56 | 30.1% |

| Blackline Safety (TSX:BLN) | CA$7.14 | CA$10.07 | 29.1% |

| Alphamin Resources (TSXV:AFM) | CA$0.89 | CA$1.30 | 31.4% |

Here's a peek at a few of the choices from the screener.

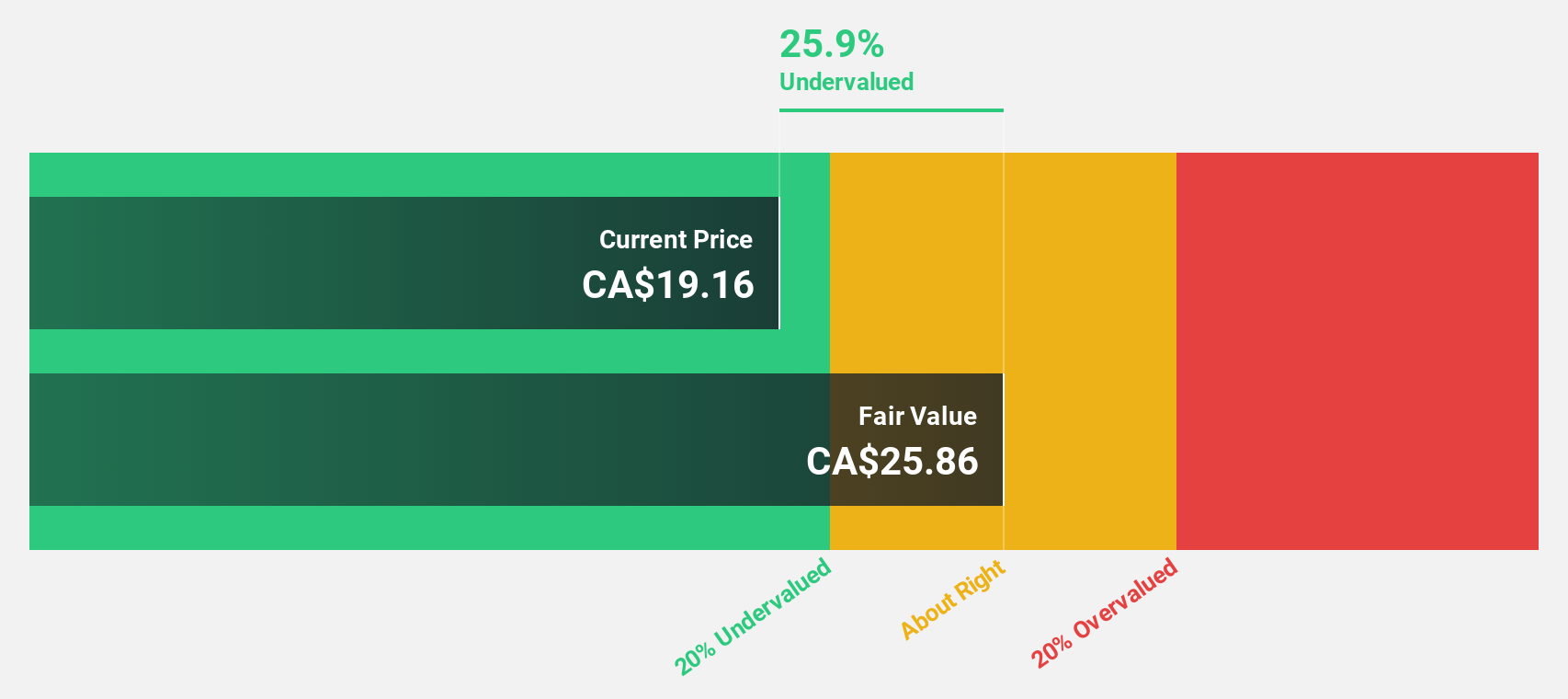

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and other international markets, with a market cap of CA$1.40 billion.

Operations: The company's revenue segments include Patient Care, which generated CA$194.92 million, and Segment Adjustment, contributing CA$683.63 million.

Estimated Discount To Fair Value: 25.6%

Savaria is trading at CA$19.76, approximately 25.6% below its estimated fair value of CA$26.57, indicating potential undervaluation based on cash flows. The company reported Q1 2025 sales of CAD 220.23 million and net income of CAD 12.48 million, showing growth from the previous year. Earnings are expected to grow significantly by 28.9% annually over the next three years, outpacing the Canadian market's projected growth rate of 12.4%.

- Our comprehensive growth report raises the possibility that Savaria is poised for substantial financial growth.

- Dive into the specifics of Savaria here with our thorough financial health report.

Alphamin Resources (TSXV:AFM)

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrate and has a market capitalization of approximately CA$1.11 billion.

Operations: The company's revenue segment is primarily derived from the production and sale of tin from its Bisie Tin Mine, amounting to $539.16 million.

Estimated Discount To Fair Value: 31.4%

Alphamin Resources is trading at CA$0.89, significantly below its estimated fair value of CA$1.3, highlighting potential undervaluation based on cash flows. Despite an unstable dividend history and recent operational disruptions, earnings are projected to grow substantially by 26% annually over the next three years, surpassing Canadian market expectations. Recent production results show a recovery with 4,106 tonnes of tin produced in Q2 2025 following a phased restart after security-related interruptions earlier this year.

- Insights from our recent growth report point to a promising forecast for Alphamin Resources' business outlook.

- Take a closer look at Alphamin Resources' balance sheet health here in our report.

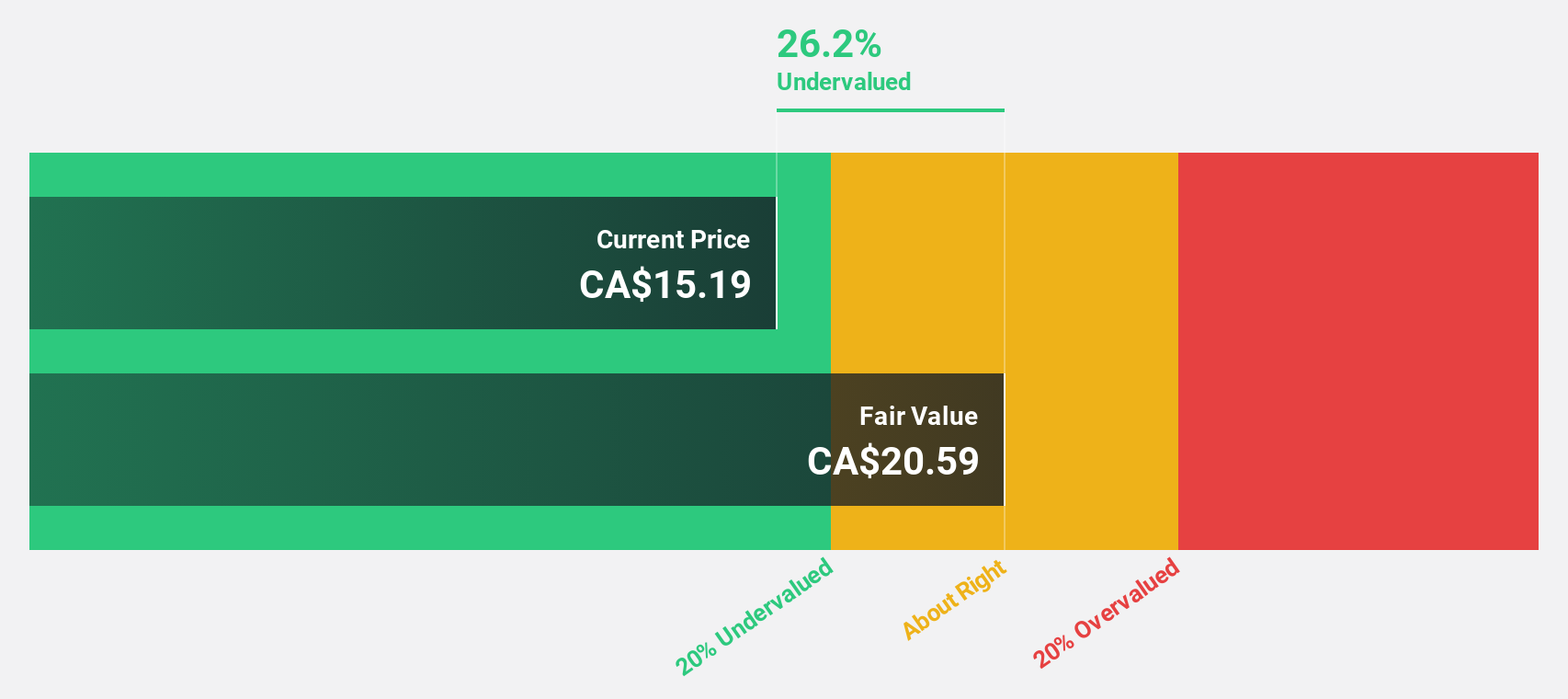

VersaBank (TSX:VBNK)

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$519.98 million.

Operations: The company's revenue segments consist of CA$96.26 million from Digital Banking Canada and CA$9.24 million from DRTC, which includes cybersecurity services and financial technology development.

Estimated Discount To Fair Value: 23.3%

VersaBank, trading at CA$15.8, is significantly undervalued compared to its estimated fair value of CA$20.6 and shows potential for growth based on cash flows. Despite a decline in net income to CA$8.53 million from CA$11.83 million year-over-year, revenue is forecasted to grow at 31.4% annually, outpacing the Canadian market's 3.9%. The company has initiated a share buyback program and maintains a low allowance for bad loans at 16%.

- The analysis detailed in our VersaBank growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of VersaBank.

Seize The Opportunity

- Click this link to deep-dive into the 20 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives