- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

Discovering Canadian Hidden Gems With Solid Potential

Reviewed by Simply Wall St

As the Canadian economy navigates a period of uncertainty with the Bank of Canada's recent rate cut and anticipated economic rebound, investors are increasingly focused on uncovering opportunities within small-cap stocks. In this environment, finding hidden gems requires identifying companies that can thrive despite market volatility, often characterized by strong fundamentals and resilience to economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sol Strategies (CNSX:HODL)

Simply Wall St Value Rating: ★★★★★★

Overview: Sol Strategies Inc. is a company that invests in cryptocurrencies and blockchain technologies, with a market cap of CA$635.02 million.

Operations: Sol Strategies generates revenue through investments in cryptocurrencies and blockchain technologies. The company has a market capitalization of CA$635.02 million, reflecting its valuation in the financial markets.

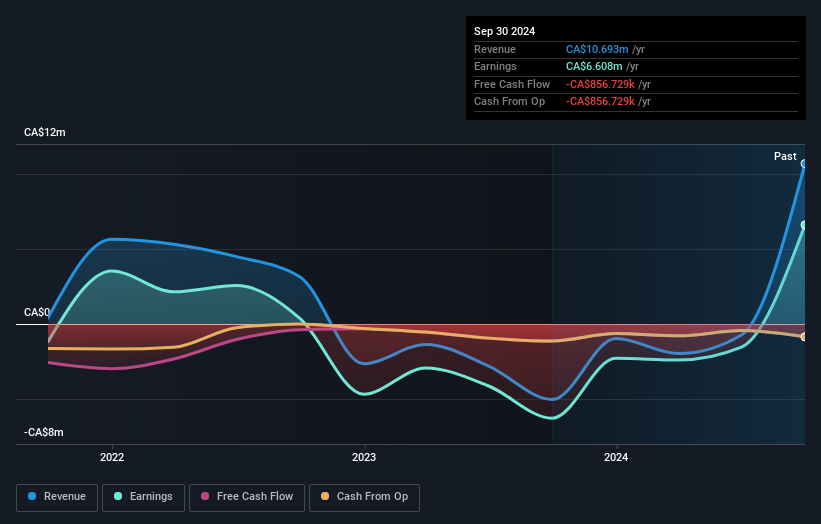

Sol Strategies, a Canadian company with a knack for innovation in cryptocurrency infrastructure, recently closed significant private placements totaling CAD 30 million. This influx of funds likely bolsters its financial position as it navigates high volatility in share prices over the past three months. The appointment of Max Kaplan as Head of Staking signals strategic growth, leveraging his expertise to enhance their validator network. Despite no substantial insider selling recently, Sol Strategies faces challenges with negative levered free cash flow at CAD -0.86 million last quarter and remains unprofitable, highlighting areas for potential improvement amidst industry competition.

- Navigate through the intricacies of Sol Strategies with our comprehensive health report here.

Understand Sol Strategies' track record by examining our Past report.

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★★★★

Overview: Headwater Exploration Inc. is a Canadian company focused on the exploration, development, and production of petroleum and natural gas, with a market capitalization of CA$1.59 billion.

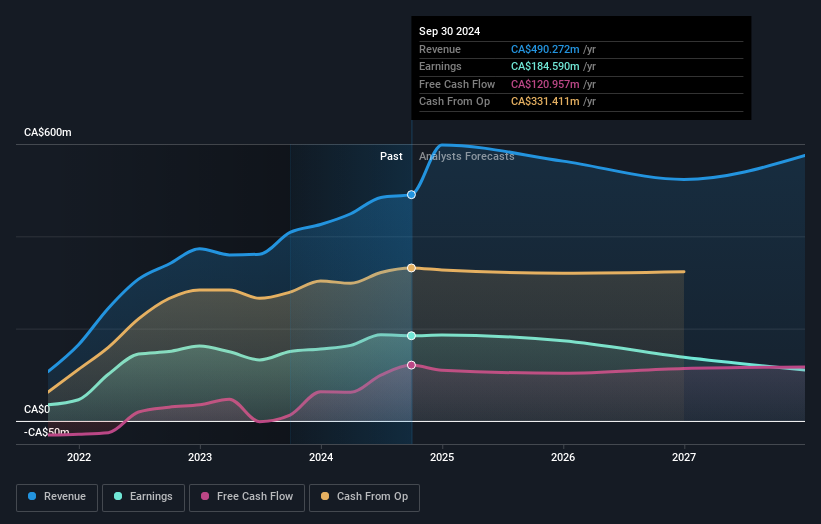

Operations: Headwater Exploration generates revenue primarily from the exploration, development, and production of petroleum and natural gas, totaling CA$490.27 million.

Headwater Exploration, a nimble player in the Canadian oil and gas sector, has been making waves with its strategic land acquisitions and partnerships. The recent collaboration with Bigstone Cree Nation could unlock new drilling opportunities across 34.5 sections of promising land. With a robust production volume of 21,500 BOE/d reported for Q4 2024, Headwater's operational momentum is evident. Despite earnings growth of 22.7% last year and trading at over 40% below fair value estimates, future earnings are expected to face challenges with a forecasted decline of around 14% annually over the next three years.

- Get an in-depth perspective on Headwater Exploration's performance by reading our health report here.

Evaluate Headwater Exploration's historical performance by accessing our past performance report.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrates, with a market capitalization of CA$1.16 billion.

Operations: Alphamin Resources generates revenue from the production and sale of tin concentrates, amounting to $436.73 million. The company has a market capitalization of CA$1.16 billion.

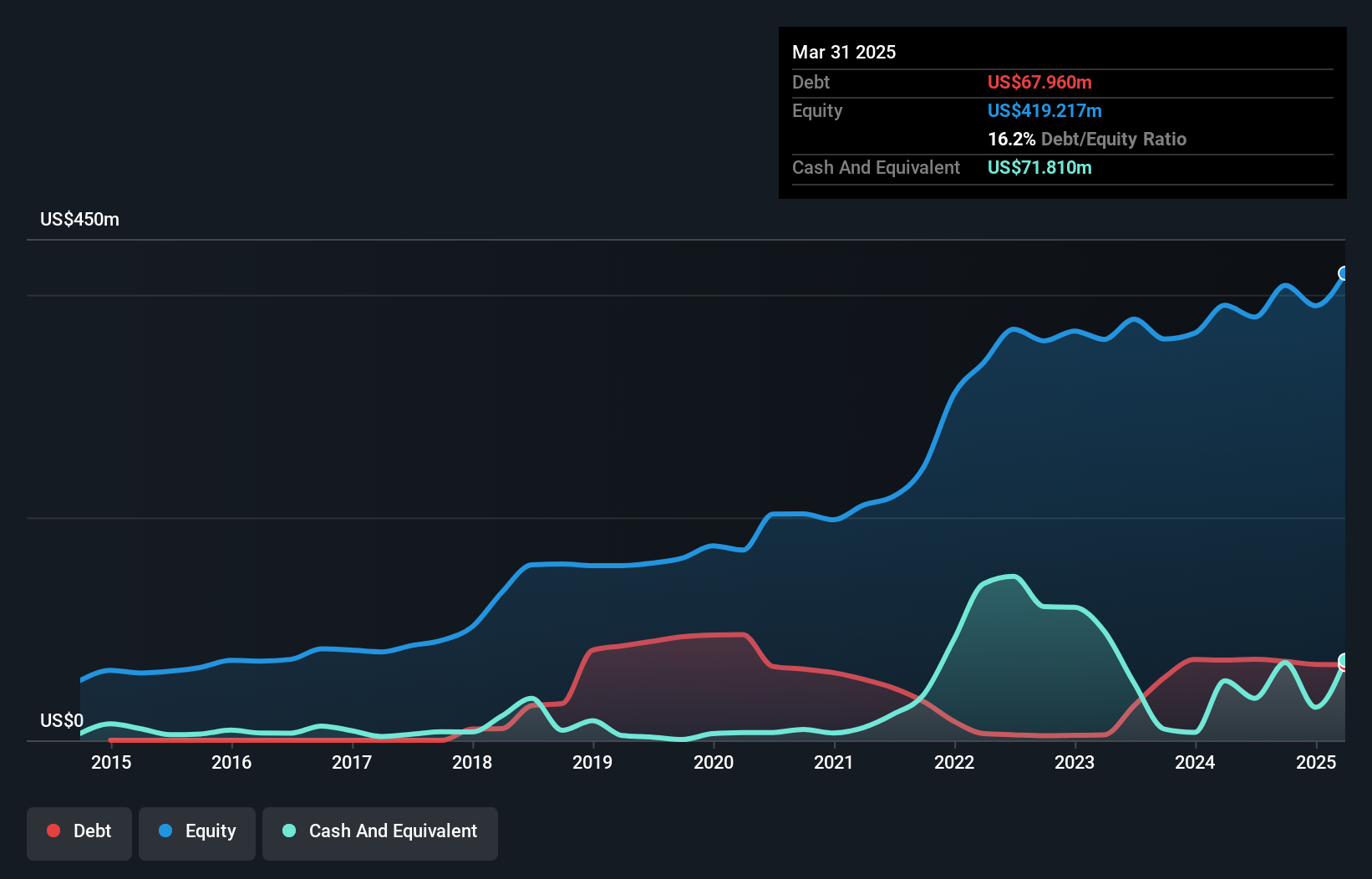

Alphamin Resources, a nimble player in the mining sector, has shown a robust performance with earnings growing at 39.2% annually over the past five years. The company boasts a satisfactory net debt to equity ratio of 0.3%, and its interest payments are well-covered by EBIT at 17.9 times coverage. Recent production results highlight an increase in contained tin produced to 17,324 tonnes for 2024 from the previous year's 12,568 tonnes. With a price-to-earnings ratio of 11x below the Canadian market average of 14.6x, Alphamin seems poised for continued value creation as it expands operations at Mpama South.

Make It Happen

- Get an in-depth perspective on all 45 TSX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives