- Canada

- /

- Diversified Financial

- /

- TSX:FN

TSX's Undervalued Small Caps With Insider Action In Canada For January 2025

Reviewed by Simply Wall St

As we step into 2025, the Canadian market continues to benefit from a supportive economic backdrop, with last year's robust performance setting an optimistic tone for investors. Amidst expectations of healthy economic growth and rising corporate profits, small-cap stocks on the TSX are drawing attention for their potential opportunities, particularly those that demonstrate strong fundamentals and strategic insider activity.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.4x | 3.3x | 45.04% | ★★★★★★ |

| Boston Pizza Royalties Income Fund | 12.1x | 7.5x | 47.23% | ★★★★★☆ |

| Calfrac Well Services | 11.5x | 0.2x | 36.74% | ★★★★★☆ |

| Nexus Industrial REIT | 12.6x | 3.2x | 27.95% | ★★★★★☆ |

| First National Financial | 13.1x | 3.7x | 47.54% | ★★★★☆☆ |

| Parex Resources | 4.0x | 0.9x | 15.66% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.3x | -988.33% | ★★★★☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.5x | 20.45% | ★★★★☆☆ |

| Savaria | 30.6x | 1.6x | 28.99% | ★★★☆☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -110.30% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First National Financial operates as a mortgage lender in Canada, focusing on commercial and residential segments, with a market capitalization of CA$2.44 billion.

Operations: The company generates revenue primarily from its Commercial and Residential segments, with recent figures showing a gross profit margin of 86.04%. Operating expenses, which include significant general and administrative costs, impact the net income margin, which was 28.26% in the latest period.

PE: 13.1x

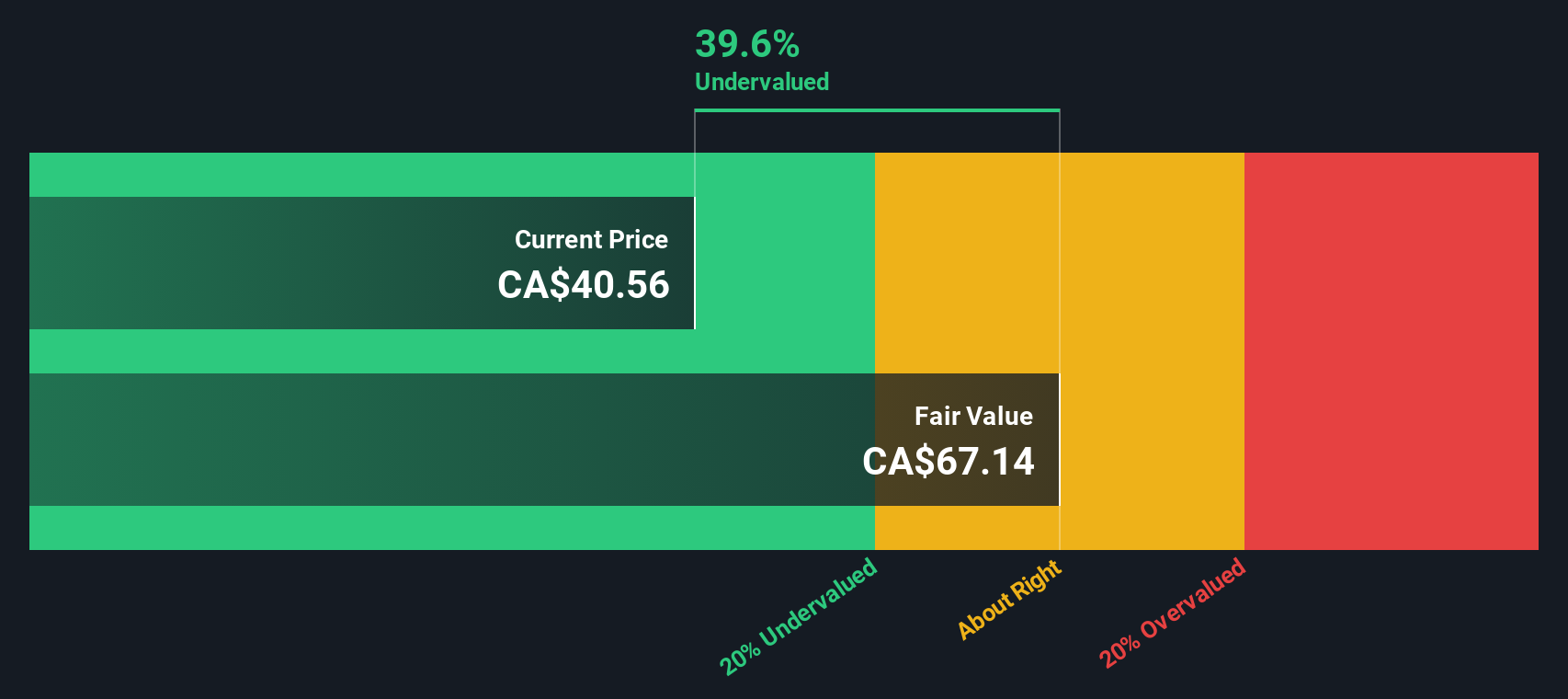

First National Financial, a Canadian mortgage lender, shows potential as an undervalued investment. Despite recent declines in net income and earnings per share, insider confidence is evident with Stephen J. Smith purchasing 463,300 shares valued at approximately C$20.44 million. The company recently increased its regular monthly dividend to an annualized rate of C$2.50 and announced a special dividend of C$0.50 per share for December 2024 payouts, suggesting strong shareholder returns amidst challenging conditions.

- Navigate through the intricacies of First National Financial with our comprehensive valuation report here.

Gain insights into First National Financial's past trends and performance with our Past report.

Savaria (TSX:SIS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Savaria focuses on providing accessibility solutions and patient care products, with a market capitalization of approximately CA$1.21 billion.

Operations: Savaria's revenue primarily stems from its Patient Care segment, with an adjusted total of CA$677.25 million. The company's gross profit margin has shown a notable upward trend, reaching 36.20% by September 2024. Operating expenses have consistently been a significant cost factor, with general and administrative expenses contributing prominently to this category.

PE: 30.6x

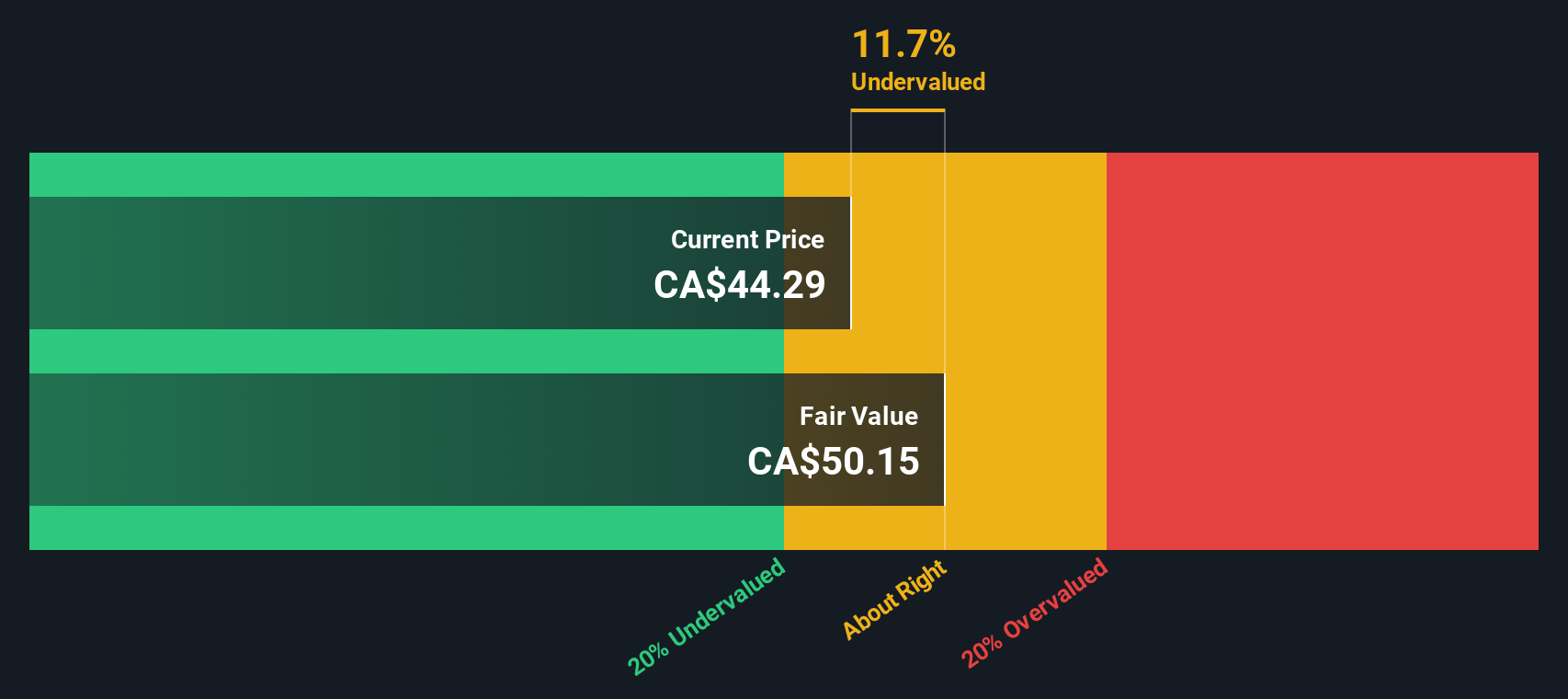

Savaria, a player in the Canadian market, has shown insider confidence with Marcel Bourassa purchasing 65,000 shares for approximately C$1.06 million in 2024. Despite past shareholder dilution and reliance on external borrowing, Savaria's earnings are projected to grow by over 31% annually. The company maintains a consistent monthly dividend of C$0.045 per share and reported increased sales and net income for Q3 2024 compared to the previous year, reflecting potential growth opportunities amidst its small-cap status.

- Click to explore a detailed breakdown of our findings in Savaria's valuation report.

Gain insights into Savaria's historical performance by reviewing our past performance report.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Winpak is a company engaged in the manufacturing and distribution of packaging materials and machinery, with a market cap of C$2.66 billion.

Operations: The company generates revenue primarily from three segments: Flexible Packaging, Rigid Packaging and Flexible Lidding, and Packaging Machinery. Over time, the net income margin has shown variability, reaching 13.17% in recent periods. Operating expenses have been a significant cost factor, with notable allocations to sales and marketing as well as research and development activities.

PE: 13.6x

Winpak, a Canadian packaging company, shows signs of being undervalued with insider confidence reflected in recent share repurchases. Between July and October 2024, they bought back 433,577 shares for C$20.31 million. Their earnings report for Q3 2024 showed sales at US$285 million and net income of US$38 million, both up from the previous year. The company's special dividend announcement of C$3 per share highlights its commitment to returning value to shareholders despite reliance on higher-risk external funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Winpak.

Examine Winpak's past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 22 Undervalued TSX Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FN

First National Financial

First National Financial Corporation, together with its subsidiaries, originates, underwrites, and services commercial and residential mortgages in Canada.

Undervalued established dividend payer.

Market Insights

Community Narratives