- Canada

- /

- Diversified Financial

- /

- TSX:FN

February 2025's Undervalued Small Caps With Insider Action On TSX

Reviewed by Simply Wall St

In the wake of the Bank of Canada's recent rate cut, aimed at countering tariff uncertainties and a contracting economy, Canadian small-cap stocks have become an area of interest for investors seeking potential opportunities on the TSX. As economic indicators suggest a possible rebound and lower borrowing costs, identifying small-cap companies with insider action could be key to uncovering value in this evolving market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.1x | 3.2x | 45.15% | ★★★★★★ |

| Nexus Industrial REIT | 12.1x | 3.0x | 26.60% | ★★★★★☆ |

| Savaria | 28.4x | 1.5x | 32.98% | ★★★★☆☆ |

| Parex Resources | 3.6x | 0.8x | -3.78% | ★★★★☆☆ |

| Baytex Energy | NA | 0.8x | -109.97% | ★★★★☆☆ |

| Bonterra Energy | 4.9x | 0.5x | 35.12% | ★★★★☆☆ |

| Calfrac Well Services | 11.7x | 0.2x | 49.07% | ★★★☆☆☆ |

| Allied Gold | NA | 1.5x | -252.50% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.0x | 0.6x | -87.17% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.6x | 16.54% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

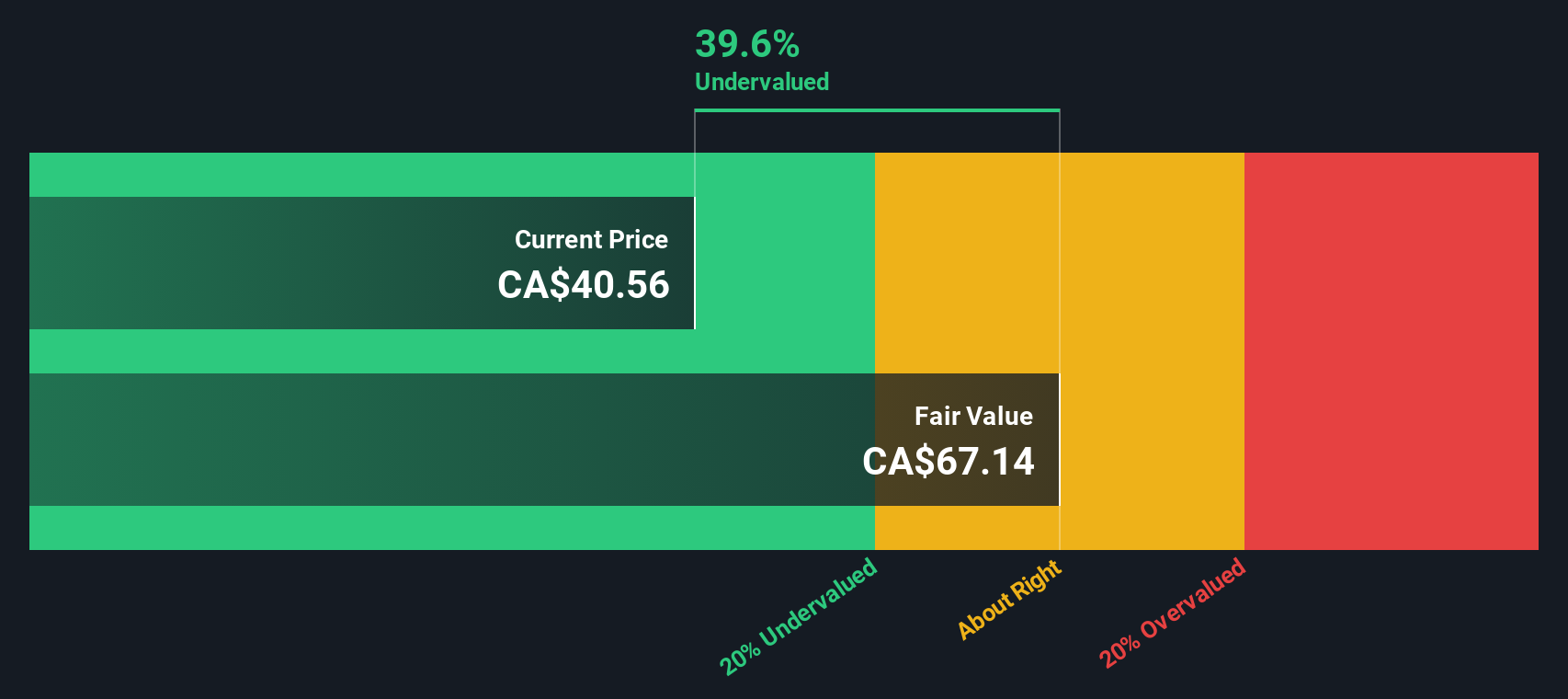

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★★☆

Overview: First National Financial is a Canadian company specializing in mortgage lending, with operations focused on commercial and residential segments, and a market cap of approximately CA$2.68 billion.

Operations: The company generates revenue primarily from residential and commercial segments, with residential contributing significantly more. Over recent periods, the gross profit margin has shown an upward trend, reaching 86.04% in September 2024. Operating expenses have been a substantial part of costs, with general and administrative expenses consistently forming a major component.

PE: 13.4x

First National Financial, a small Canadian company, attracts attention with its insider confidence shown by Stephen J. Smith's purchase of 463,300 shares for C$20.44 million in recent months. Despite relying entirely on external borrowing for funding, the firm maintains consistent dividend payments of C$0.21 per share monthly and forecasts annual earnings growth of 15.68%. While debt coverage remains a concern, these factors suggest potential value in this stock's future prospects amidst Canada's undervalued market segment.

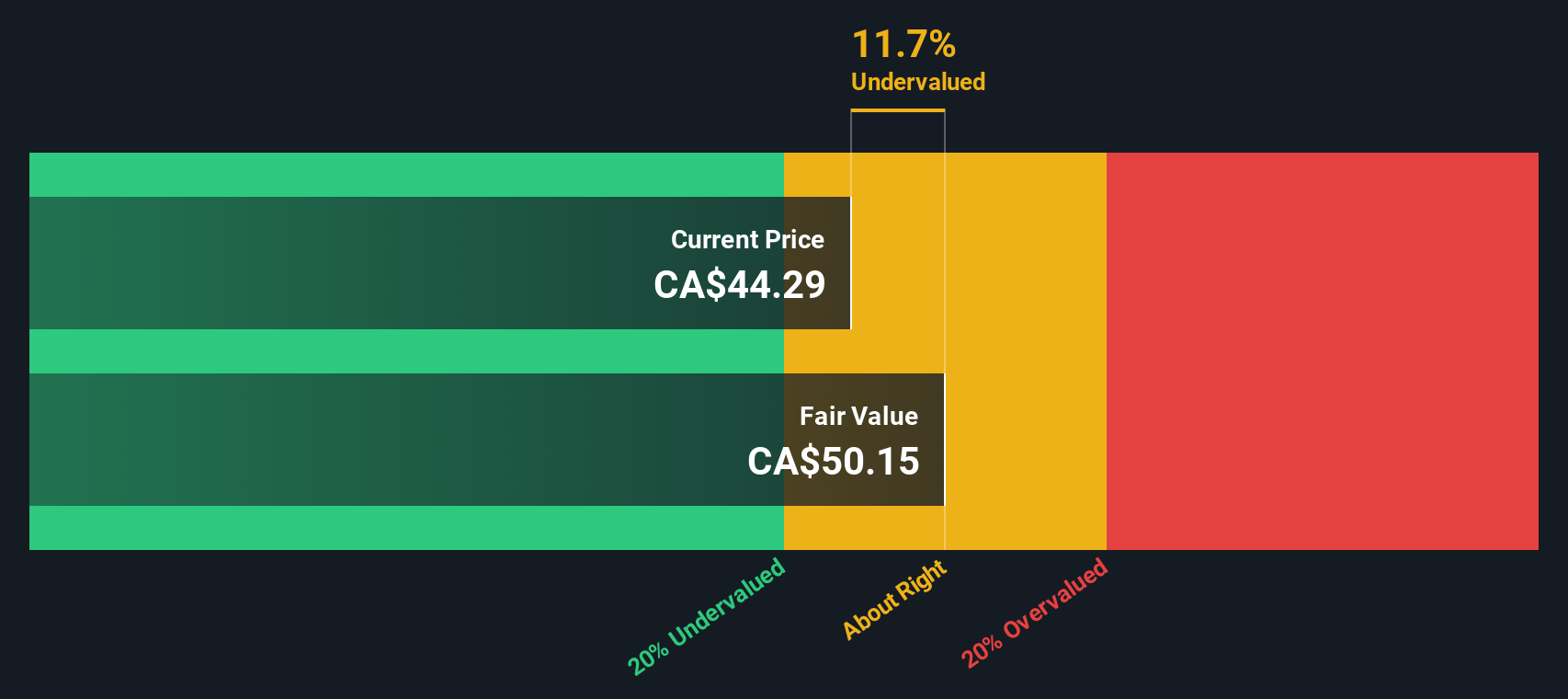

Savaria (TSX:SIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Savaria is a company that specializes in manufacturing and distributing accessibility solutions, such as stairlifts and wheelchair lifts, with a market capitalization of CA$1.14 billion.

Operations: The company generates revenue primarily from its Patient Care segment, with significant adjustments contributing to the total. Over recent periods, the gross profit margin has shown an upward trend, reaching 36.20% by September 2024. Operating expenses and non-operating expenses are notable cost components impacting net income.

PE: 28.4x

Savaria, a Canadian company in the accessibility industry, shows potential as an undervalued investment. With insider confidence reflected by Marcel Bourassa's recent purchase of 65,000 shares worth approximately C$1.06 million in January 2025, there's a positive signal about its prospects. Despite relying solely on external borrowing for funding and facing large one-off items affecting earnings quality, the company maintains consistent monthly dividends of C$0.045 per share and anticipates annual earnings growth of 31%.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Winpak is a company that specializes in manufacturing and distributing packaging materials and machinery, with a market capitalization of approximately C$2.63 billion.

Operations: Winpak generates revenue primarily from three segments: Flexible Packaging, Rigid Packaging and Flexible Lidding, and Packaging Machinery. The company has experienced fluctuations in its gross profit margin, reaching 31.12% in the latest period.

PE: 12.4x

Winpak, a Canadian packaging company, has caught attention as a potential undervalued opportunity. Despite relying entirely on external borrowing for funding, which poses higher risks compared to customer deposits, the company's earnings are projected to grow at 5% annually. Insider confidence is evident from recent share purchases by key stakeholders over the past year. Additionally, Winpak announced a special one-time dividend of C$3 per share and a regular dividend of C$0.05 per share payable in January 2025, signaling robust cash flow management and shareholder value focus.

- Navigate through the intricacies of Winpak with our comprehensive valuation report here.

Assess Winpak's past performance with our detailed historical performance reports.

Seize The Opportunity

- Access the full spectrum of 26 Undervalued TSX Small Caps With Insider Buying by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FN

First National Financial

First National Financial Corporation, together with its subsidiaries, originates, underwrites, and services residential and commercial mortgages in Canada.

Established dividend payer with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>