- Canada

- /

- Metals and Mining

- /

- TSX:WM

TSX Penny Stocks Spotlight: Haivision Systems And Two Others To Consider

Reviewed by Simply Wall St

In 2025, the Canadian market has experienced volatility, with diversification emerging as a key theme due to softened growth outlooks in Canada and the U.S. Penny stocks, often seen as investments in smaller or newer companies, still hold potential despite their somewhat outdated label. By focusing on those with strong financial foundations and growth potential, investors can explore opportunities that might offer both stability and upside.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| NTG Clarity Networks (TSXV:NCI) | CA$1.82 | CA$78.83M | ✅ 4 ⚠️ 2 View Analysis > |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$30.09M | ✅ 2 ⚠️ 2 View Analysis > |

| Madoro Metals (TSXV:MDM) | CA$0.045 | CA$4.03M | ✅ 2 ⚠️ 5 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.93 | CA$457.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.96 | CA$317.84M | ✅ 2 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.97 | CA$176.25M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$632.31M | ✅ 4 ⚠️ 1 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.19 | CA$86.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$13.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.06 | CA$39.14M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Haivision Systems (TSX:HAI)

Simply Wall St Financial Health Rating: ★★★★★☆

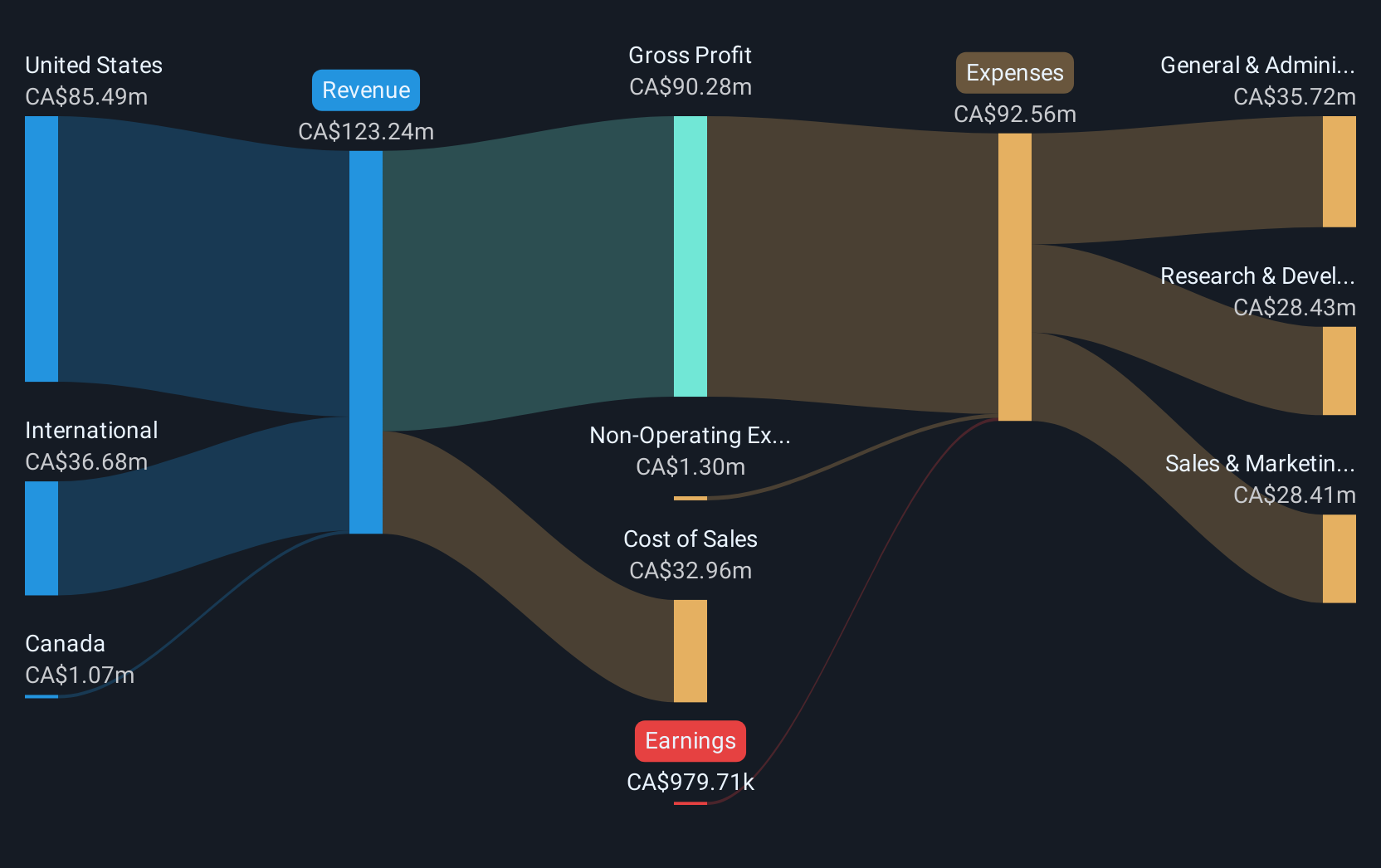

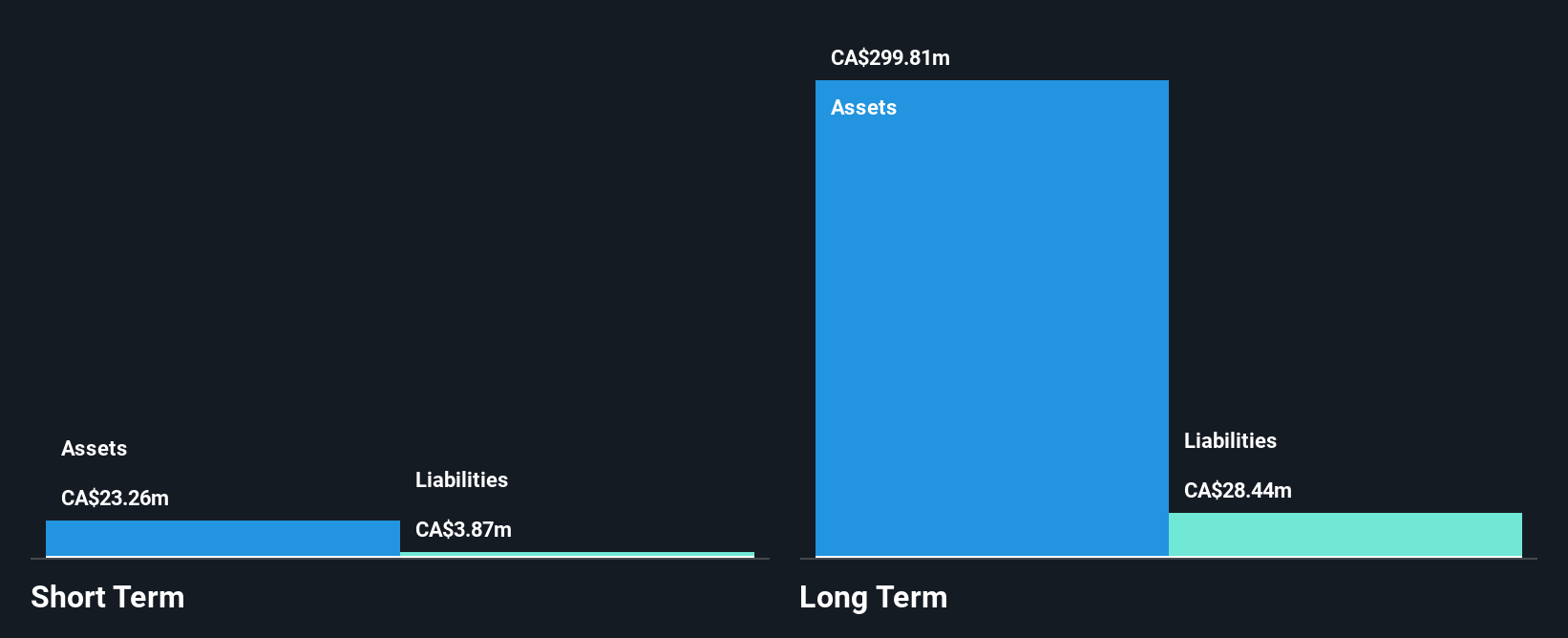

Overview: Haivision Systems Inc. offers mission-critical, real-time video networking and visual collaboration solutions across Canada, the United States, and internationally, with a market cap of CA$129.48 million.

Operations: Haivision Systems Inc. has not reported any specific revenue segments.

Market Cap: CA$129.48M

Haivision Systems Inc., with a market cap of CA$129.48 million, has demonstrated robust earnings growth, exceeding industry averages with a 63.5% increase over the past year. Despite this, its recent quarterly results showed a decline in sales to CA$28.16 million and a net loss of CA$1.08 million compared to the previous year's profits, highlighting volatility in performance typical for penny stocks. The company maintains strong liquidity with short-term assets covering both short and long-term liabilities and is undertaking a share repurchase program to potentially enhance shareholder value amidst these fluctuations.

- Dive into the specifics of Haivision Systems here with our thorough balance sheet health report.

- Understand Haivision Systems' earnings outlook by examining our growth report.

California Nanotechnologies (TSXV:CNO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: California Nanotechnologies Corp. focuses on the research, development, and production of nanocrystalline materials through grain size reduction, with a market cap of CA$35.31 million.

Operations: California Nanotechnologies Corp. has not reported any specific revenue segments.

Market Cap: CA$35.31M

California Nanotechnologies Corp., with a market cap of CA$35.31 million, is navigating the penny stock landscape with its focus on nanocrystalline materials. The company has reported sales growth, achieving US$1.81 million in Q3 2024 compared to US$1.16 million the previous year, though net income declined to US$0.11 million from US$0.51 million year-over-year for the quarter. Despite being unprofitable, it boasts a positive free cash flow and a sufficient cash runway exceeding three years without debt concerns, while maintaining shareholder value through minimal dilution over the past year and trading below estimated fair value by 77.7%.

- Get an in-depth perspective on California Nanotechnologies' performance by reading our balance sheet health report here.

- Understand California Nanotechnologies' track record by examining our performance history report.

Wallbridge Mining (TSX:WM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wallbridge Mining Company Limited focuses on acquiring, exploring, discovering, developing, and producing gold properties with a market cap of CA$60.31 million.

Operations: Wallbridge Mining Company Limited has not reported any revenue segments.

Market Cap: CA$60.31M

Wallbridge Mining Company Limited, with a market cap of CA$60.31 million, is pre-revenue and focuses on gold exploration in Canada. The company recently commenced drilling at its Martiniere project and received positive assay results from the Detour East property under an option agreement with Agnico Eagle Mines. Despite being debt-free, Wallbridge faces financial challenges with short-term assets not covering long-term liabilities and only a 9-month cash runway as of September 2024. Recent capital raises have bolstered finances slightly, but management's short tenure suggests ongoing strategic adjustments amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Wallbridge Mining stock in this financial health report.

- Evaluate Wallbridge Mining's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 936 TSX Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wallbridge Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WM

Wallbridge Mining

Engages in the acquisition, exploration, discovery, and development of gold properties.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)