- Canada

- /

- Metals and Mining

- /

- TSXV:RK

TSX Penny Stocks Spotlight 3 Companies With At Least CA$40M Market Cap

Reviewed by Simply Wall St

Canadian equities have recently reached new record highs, buoyed by dovish signals from the Bank of Canada and a supportive stance from the Federal Reserve. Amidst these market conditions, investors might find opportunities in penny stocks—companies typically smaller or newer that offer growth potential at lower price points. Despite being an outdated term, penny stocks can still hold significant value when backed by strong financials and solid fundamentals, making them intriguing options for those looking to explore beyond mainstream investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.14 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$257.26M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.21 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.47 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.28 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$22.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.96 | CA$154.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$190.2M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Tree Island Steel (TSX:TSL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tree Island Steel Ltd. manufactures and sells steel wire and fabricated steel wire products across Canada, the United States, and internationally, with a market cap of CA$76.42 million.

Operations: The company's revenue is primarily derived from sales in the United States (CA$86.81 million) and Canada (CA$83.82 million), with a smaller portion coming from international markets (CA$3.58 million).

Market Cap: CA$76.42M

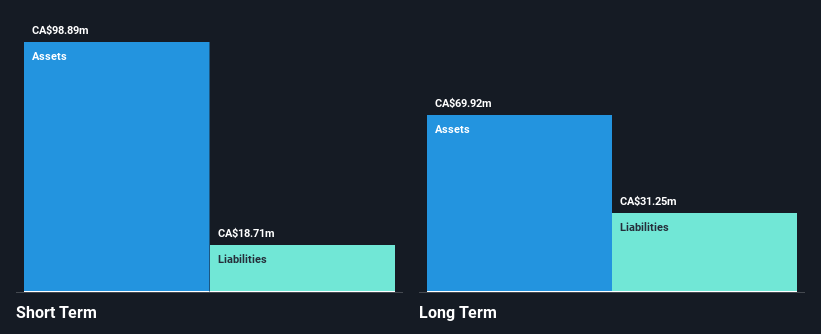

Tree Island Steel Ltd. shows a mixed profile as a penny stock. Despite being unprofitable with increasing losses over the past five years, its financial structure is relatively stable, with short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 2.5%. The company recently declared a dividend of CA$0.015 per share, although this is not well covered by earnings or free cash flows. Additionally, Tree Island has initiated a share buyback program to repurchase up to 4.99% of its issued shares, potentially signaling confidence in its long-term prospects despite current challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Tree Island Steel.

- Evaluate Tree Island Steel's historical performance by accessing our past performance report.

Li-FT Power (TSXV:LIFT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-FT Power Ltd. is a mineral exploration company focused on acquiring, exploring, and developing lithium pegmatite projects in Canada, with a market cap of CA$204.08 million.

Operations: Li-FT Power Ltd. does not currently report any revenue segments.

Market Cap: CA$204.08M

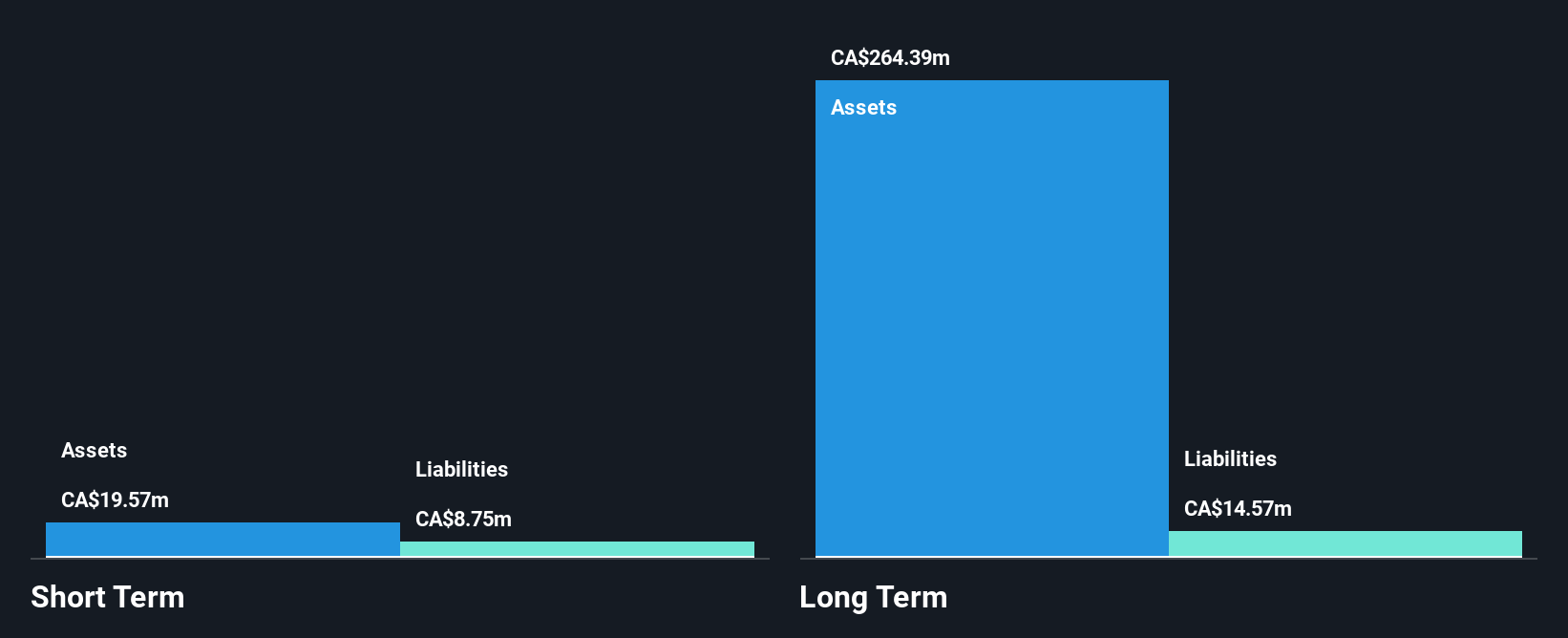

Li-FT Power Ltd. presents a compelling yet cautious opportunity in the penny stock realm, marked by its focus on lithium pegmatite exploration in Canada. The company remains pre-revenue but recently secured CA$40 million through a private placement, enhancing its financial position for ongoing projects. Recent exploration at the Nottaway and Cali Lithium Projects revealed promising spodumene mineralization, suggesting potential resource development upside. Despite being debt-free with short-term assets covering liabilities, Li-FT's high volatility and unprofitability warrant careful consideration by investors seeking exposure to early-stage mining ventures with speculative growth potential.

- Click here to discover the nuances of Li-FT Power with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Li-FT Power's track record.

Rockhaven Resources (TSXV:RK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rockhaven Resources Ltd. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in Canada with a market cap of CA$46.85 million.

Operations: Rockhaven Resources Ltd. does not report any revenue segments as it is an exploration stage company focused on mineral properties in Canada.

Market Cap: CA$46.85M

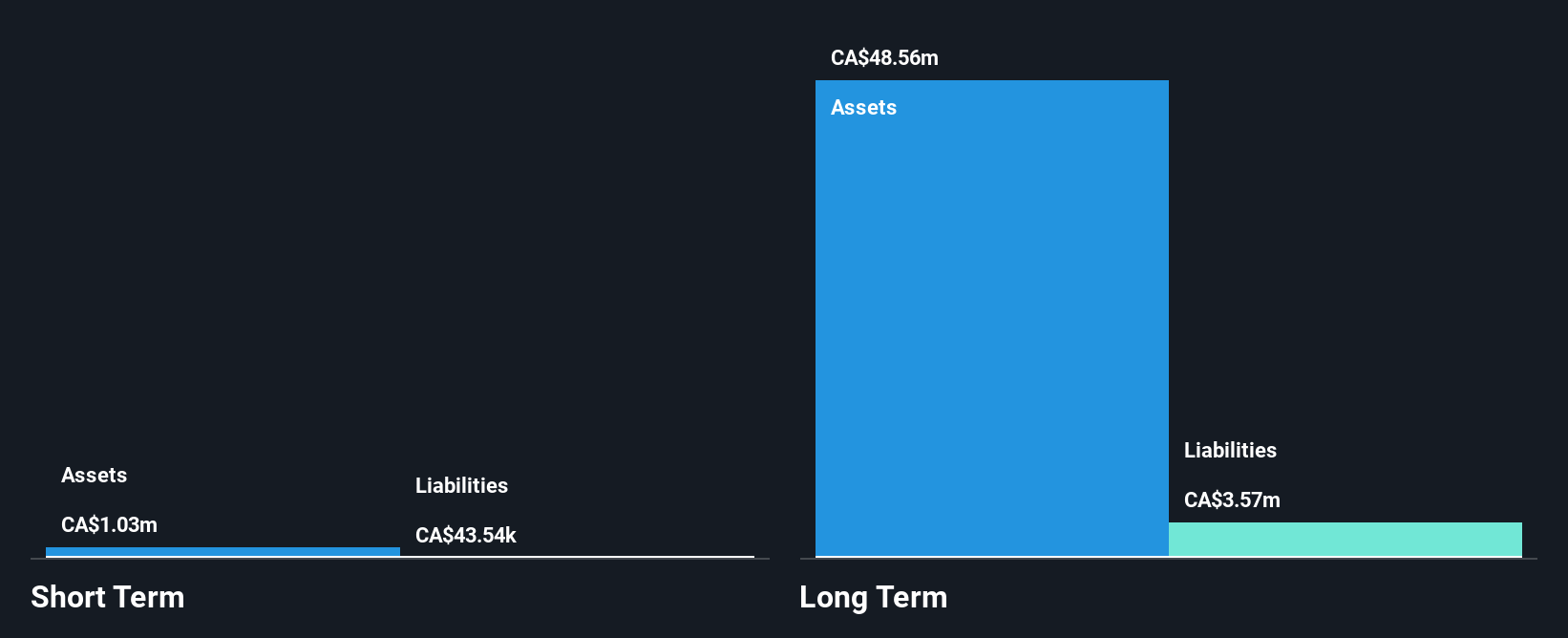

Rockhaven Resources Ltd., a pre-revenue exploration stage company, presents both opportunities and challenges within the penny stock space. The recent assay results from its Klaza property reveal high-grade gold-silver mineralization, indicating potential for future development. Despite being debt-free with short-term assets covering liabilities, Rockhaven's financials show an increasing net loss over the past year. The company's management and board are experienced, providing stability amidst its high share price volatility. With a cash runway extending over two years based on current free cash flow, Rockhaven remains positioned for continued exploration efforts without immediate financial strain.

- Click to explore a detailed breakdown of our findings in Rockhaven Resources' financial health report.

- Assess Rockhaven Resources' previous results with our detailed historical performance reports.

Make It Happen

- Gain an insight into the universe of 390 TSX Penny Stocks by clicking here.

- Searching for a Fresh Perspective? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RK

Rockhaven Resources

An exploration stage company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)