- Canada

- /

- Metals and Mining

- /

- TSX:TRX

Investors in TRX Gold (TSE:TRX) from five years ago are still down 56%, even after 11% gain this past week

TRX Gold Corporation (TSE:TRX) shareholders should be happy to see the share price up 11% in the last week. But that doesn't change the fact that the returns over the last half decade have been disappointing. In fact, the share price has declined rather badly, down some 56% in that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

While the last five years has been tough for TRX Gold shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for TRX Gold

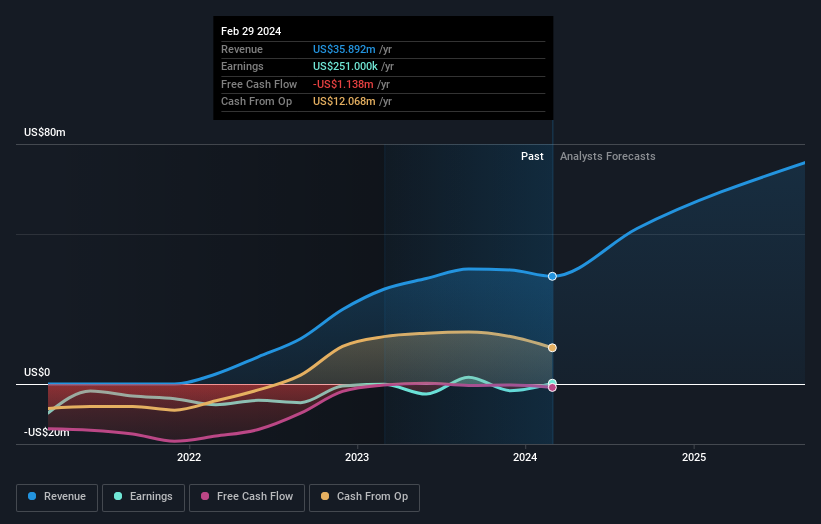

While TRX Gold made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over five years, TRX Gold grew its revenue at 78% per year. That's better than most loss-making companies. In contrast, the share price is has averaged a loss of 9% per year - that's quite disappointing. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

TRX Gold shareholders are down 1.7% for the year, but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 9% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

If you're looking to trade TRX Gold, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TRX Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRX

TRX Gold

A junior gold mining company, engages in the exploration, development, and production of mineral property in Tanzania.

Excellent balance sheet and fair value.

Market Insights

Community Narratives