- Canada

- /

- Metals and Mining

- /

- TSX:TLO

Will Talon Metals’ (TSX:TLO) Flexible Exploration Strategy Unlock More Value at Tamarack and Boulderdash?

Reviewed by Sasha Jovanovic

- Talon Metals announced a successful conclusion to its 2025 Michigan drilling season, highlighting significant exploration progress at the Boulderdash discovery and the transition of drilling operations to the Tamarack Nickel-Copper-Cobalt Project in Minnesota, where an expanded Fall and Winter 2025/2026 program is underway.

- This shift of rigs and resources underscores how Talon is adapting its exploration strategy to seasonal conditions, while maintaining momentum and fulfilling key earn-in commitments in Michigan.

- We'll take a look at how expanded drilling at the Minnesota Vault Zone shapes Talon's investment narrative and resource development outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Talon Metals' Investment Narrative?

For anyone considering Talon Metals, it’s clear the investment story hinges on the company’s ability to turn promising exploration progress into tangible resource growth, particularly at Minnesota’s Tamarack Nickel-Copper-Cobalt Project. The recent news that Talon wrapped up its Michigan drilling for the season and switched focus, and rigs, to Minnesota fits well with their seasonal exploration approach, aiming to keep the pace up despite tough Midwest winters. This move could accelerate short-term catalysts, as more work at the Vault Zone may yield new resource estimates or discoveries sooner than many were expecting. However, the end of the exclusivity agreement with Lundin and a continued lack of revenue may sharpen concerns over near-term funding and dilution risks. Investors will want to watch closely as Talon’s exploration and financing strategies evolve in real time.

But with the Lundin agreement’s collapse, funding remains a key issue to keep an eye on.

Exploring Other Perspectives

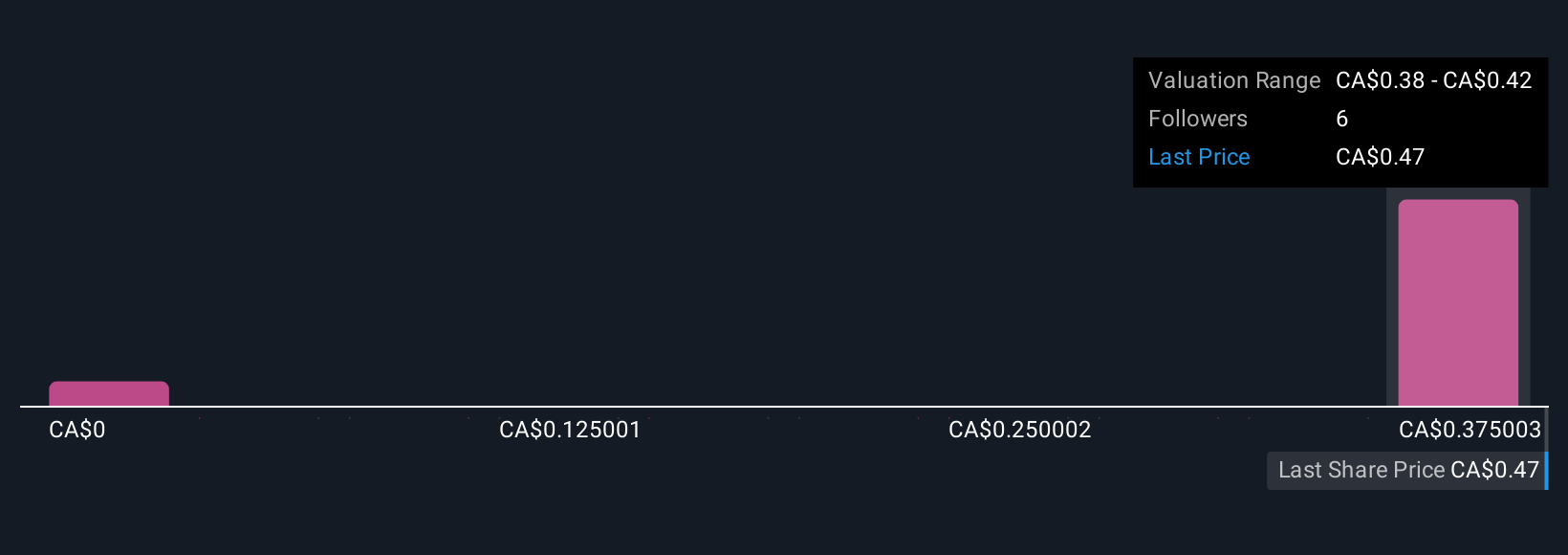

Explore 2 other fair value estimates on Talon Metals - why the stock might be worth less than half the current price!

Build Your Own Talon Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talon Metals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Talon Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talon Metals' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Talon Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TLO

Talon Metals

A mineral exploration company, explores for and develops mineral properties in the United States.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)