- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

Triple Flag’s Wild Price Swings Spark Fresh Debate on 2025 Valuation Prospects

Reviewed by Bailey Pemberton

If you’ve been watching Triple Flag Precious Metals lately, you’re probably wondering what to make of the stock’s wild ride. In just seven days, the price dropped by nearly 14%, putting short-term traders on edge. But zoom out a little, and the big picture looks a bit brighter. Triple Flag has climbed 2.6% over the past month, an eye-popping 83.4% year-to-date, and an impressive 61.3% over the last year. Stretch that lens to three years and you’ll see remarkable growth of 177.1%. Clearly, this is a company that is no stranger to momentum shifts.

What is behind these moves? Some of the recent price action appears to connect with ongoing industry shifts and investor sentiment around gold and precious metals. Changes in global demand, a steady drumbeat of geopolitical uncertainty, and increased attention on alternative income sources all play a role, fueling both optimism and caution among investors. None of the latest headlines have been game changers in themselves, but they provide important color around how risk and opportunity are being weighed for Triple Flag right now.

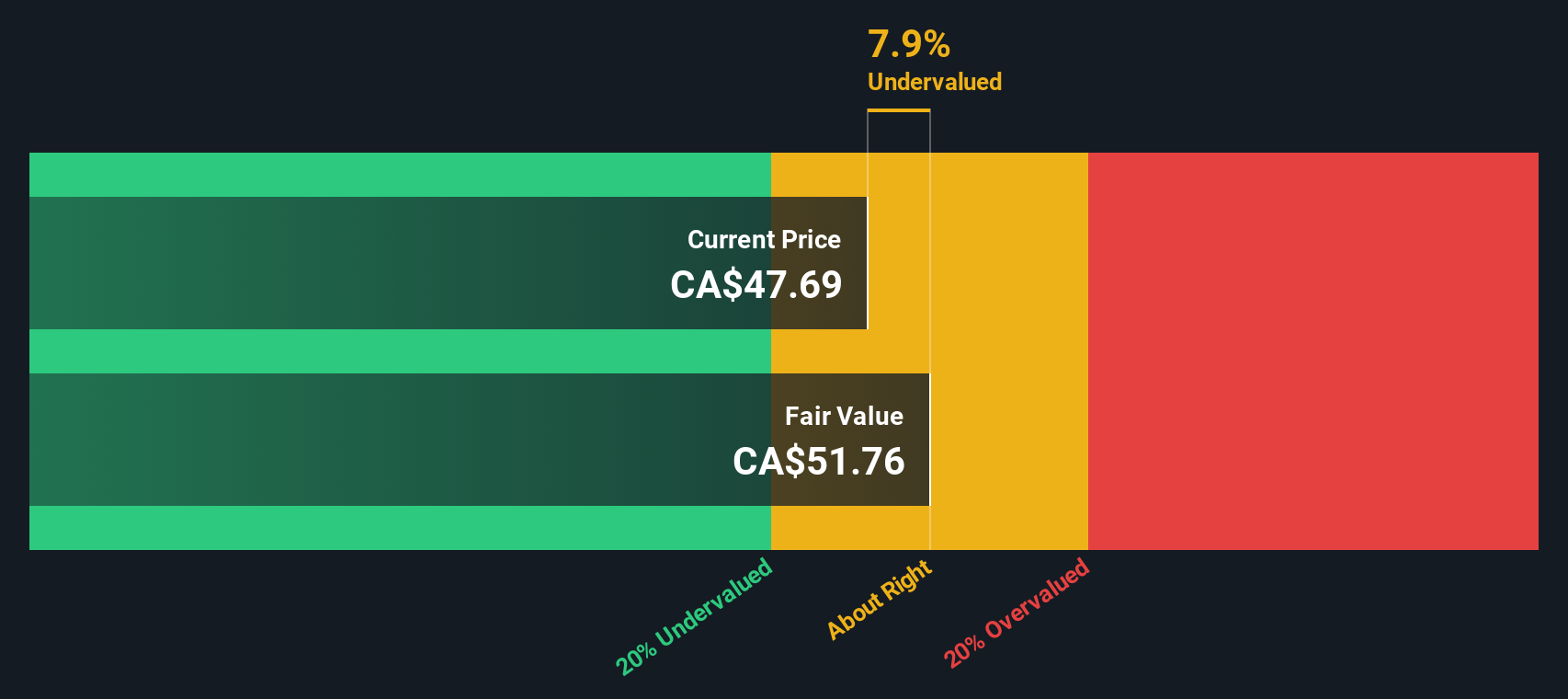

Still, valuation is where things get interesting. According to commonly used metrics, Triple Flag Precious Metals is only undervalued in one out of six key checks, earning a modest valuation score of 1. For investors, that means it does not scream “deep value” on paper, but numbers rarely tell the whole story. Let’s dig deeper into what these valuation methods actually reveal and why thinking beyond just the metrics could offer a more complete picture of the company’s future potential.

Triple Flag Precious Metals scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Triple Flag Precious Metals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's dollars. The logic is simple: what will this company actually generate for shareholders in the future, adjusted for risk and the time value of money?

For Triple Flag Precious Metals, the DCF analysis uses a 2 Stage Free Cash Flow to Equity method. The company’s current Free Cash Flow stands at $109.5 Million. Projections show strong growth in the near term, with analysts expecting Free Cash Flow to reach $271 Million by 2028. Beyond that, estimates are extrapolated, suggesting cash flows could rise as high as $233.5 Million by 2035. These forecasts combine analyst insight for the first five years, while longer-term figures are computed by extrapolating industry trends and company performance.

Based on these projections, the DCF model calculates an intrinsic value of $33.67 per share. Compared to today's share price, this implies the stock is trading at a 19.8% premium. This indicates Triple Flag is currently overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Triple Flag Precious Metals may be overvalued by 19.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Triple Flag Precious Metals Price vs Earnings

When it comes to valuing profitable companies like Triple Flag Precious Metals, the Price-to-Earnings (PE) ratio is a popular and useful tool. This metric shows how much investors are willing to pay for each dollar of earnings, and it works best for companies that consistently generate profits.

What counts as a "normal" PE ratio depends on several factors. Companies with higher growth prospects or lower risk typically trade at higher PE ratios, as investors expect greater future earnings. On the other hand, if there are uncertainties or lower growth expectations, the market often assigns a lower multiple.

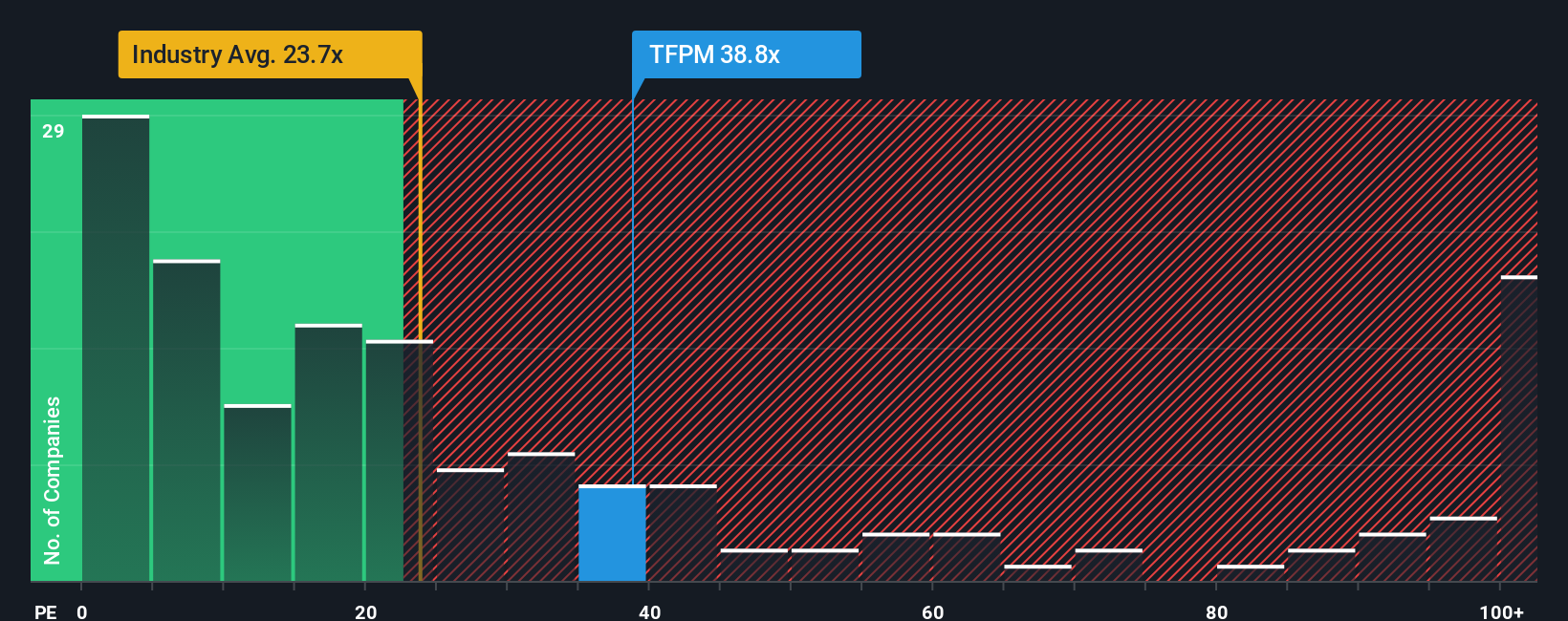

Triple Flag Precious Metals currently trades at a PE ratio of 34.6x. For context, its peer average is 17.7x, while the broader metals and mining industry sits at 20.3x. Comparing these numbers, Triple Flag’s PE is significantly above both benchmarks, which could raise concerns about overvaluation at first glance.

However, Simply Wall St's proprietary "Fair Ratio" adjusts for the company’s unique profile. This metric, calculated as 18.4x for Triple Flag, factors in earnings growth, risk, profit margins, industry standards, and market cap to provide a tailored view of fair value. Unlike raw peer or industry comparisons, the Fair Ratio offers a more nuanced and relevant benchmark.

With Triple Flag's current PE standing well above the Fair Ratio, the stock appears overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

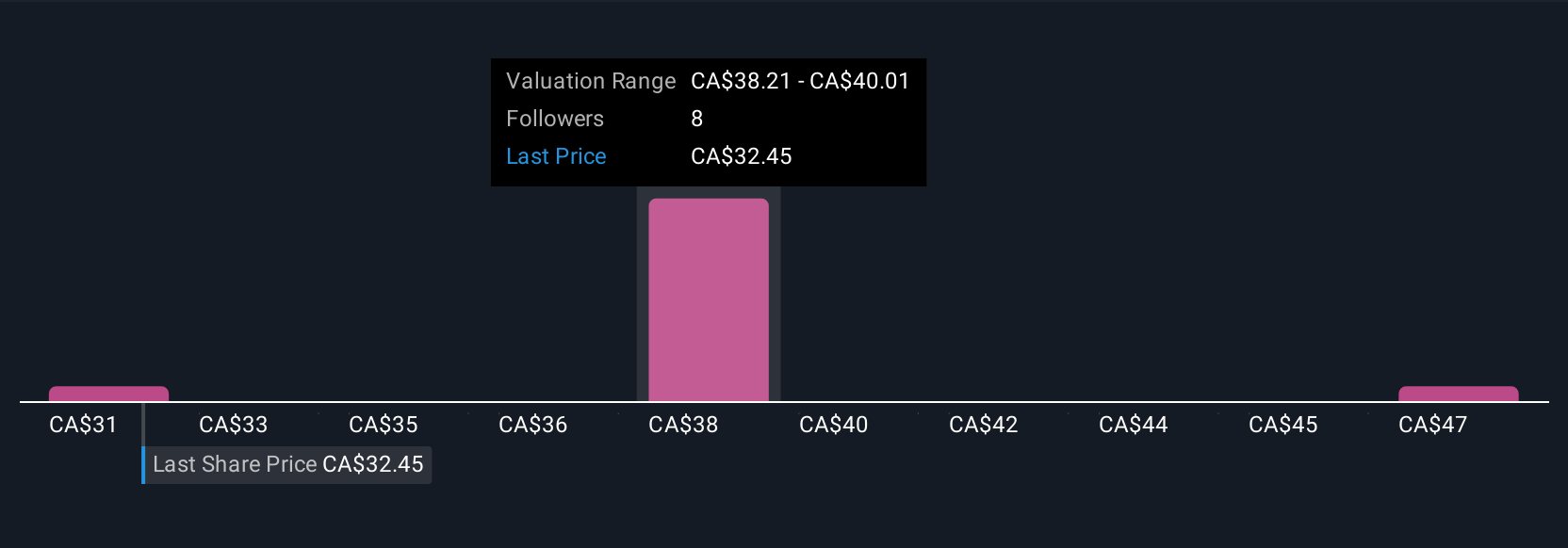

Upgrade Your Decision Making: Choose your Triple Flag Precious Metals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about what you believe is happening with a company, blending your own perspective on its future revenue, earnings, and margins with your idea of fair value, all grounded in real facts and forecasts. Rather than relying solely on financial ratios or models, Narratives connect a company’s unique storyline directly to a financial outlook and an actionable estimate of fair value. This approach makes it much easier to see how the numbers are built from real-life expectations.

Narratives are available on Simply Wall St’s Community page, making it simple for millions of investors to frame, share, and refine their views. With Narratives, you can instantly see whether your own valuation suggests it is time to buy or sell by comparing your Fair Value with the current market Price. These insights keep evolving as new news or earnings are released, updating your Narrative and fair value in real time.

For example, on Triple Flag Precious Metals, some investors see robust commodity prices and new royalty deals bringing strong margin growth and set a much higher fair value, while others focus on operational risks and sector headwinds, landing on a more cautious estimate. Narratives put your outlook, your numbers, and your decisions front and center.

Do you think there's more to the story for Triple Flag Precious Metals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>