- Canada

- /

- Construction

- /

- TSX:BDGI

TSX Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Despite recent concerns over rising tariffs, Canadian markets have shown resilience, with inflation and economic data remaining stable. In this environment, identifying stocks that may be trading below their estimated value can offer investors potential opportunities to capitalize on market fluctuations while navigating ongoing trade negotiations and tariff uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$43.69 | CA$86.25 | 49.3% |

| TerraVest Industries (TSX:TVK) | CA$164.00 | CA$319.45 | 48.7% |

| Teck Resources (TSX:TECK.B) | CA$52.72 | CA$88.53 | 40.4% |

| Propel Holdings (TSX:PRL) | CA$36.17 | CA$66.87 | 45.9% |

| OceanaGold (TSX:OGC) | CA$19.88 | CA$37.31 | 46.7% |

| Magna Mining (TSXV:NICU) | CA$1.82 | CA$3.40 | 46.5% |

| Ivanhoe Mines (TSX:IVN) | CA$12.05 | CA$18.27 | 34% |

| Foraco International (TSX:FAR) | CA$1.80 | CA$3.25 | 44.6% |

| Exchange Income (TSX:EIF) | CA$65.59 | CA$100.98 | 35% |

| Blackline Safety (TSX:BLN) | CA$6.50 | CA$9.95 | 34.7% |

We'll examine a selection from our screener results.

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$1.81 billion.

Operations: The company generates revenue of $756.02 million from its non-destructive excavating and related services in Canada and the United States.

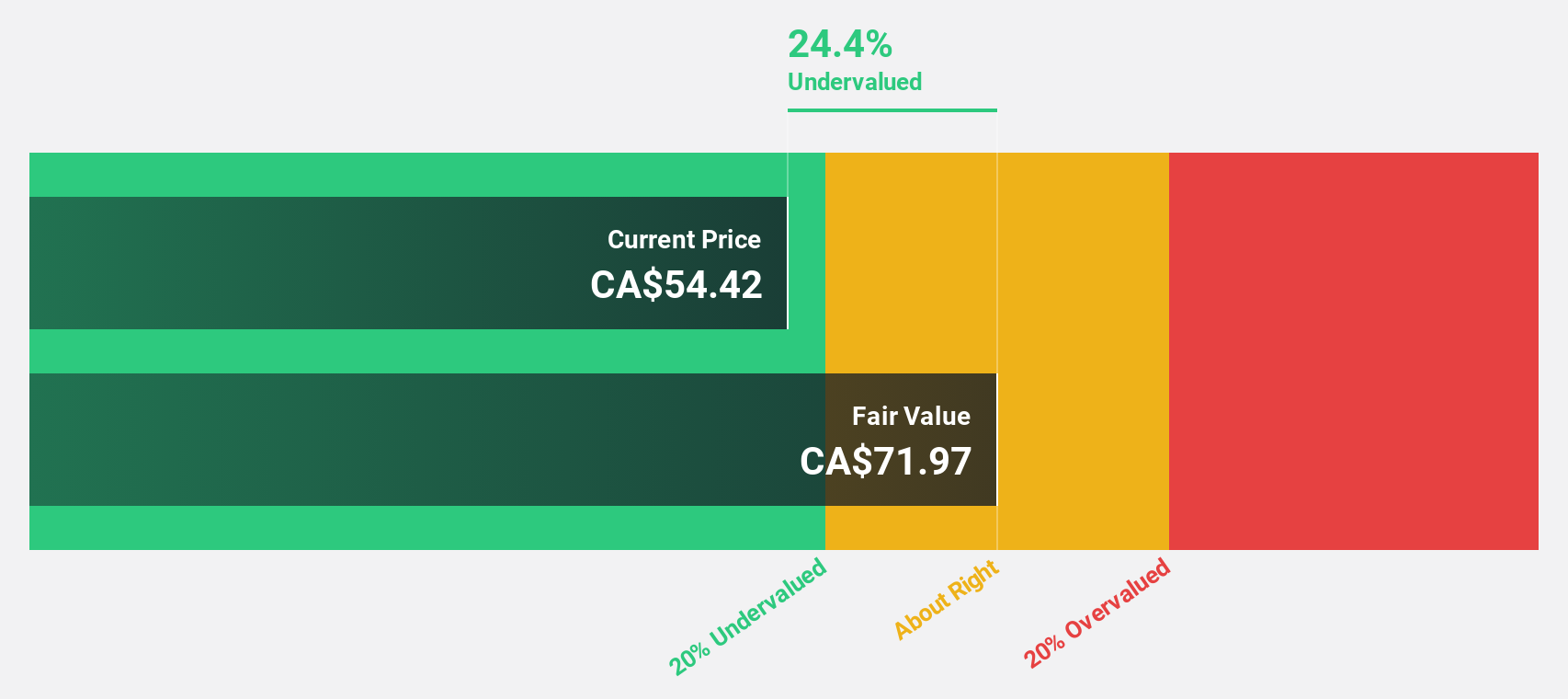

Estimated Discount To Fair Value: 24.9%

Badger Infrastructure Solutions is trading at CA$54.07, which is 24.9% below its estimated fair value of CA$71.98, indicating it may be undervalued based on cash flows. The company reported a notable increase in earnings and net income for Q1 2025 compared to the previous year, supported by significant forecasted annual profit growth of over 20%. Despite high debt levels, recent share buybacks totaling CAD 83.45 million reflect confidence in future performance.

- The growth report we've compiled suggests that Badger Infrastructure Solutions' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Badger Infrastructure Solutions.

Teck Resources (TSX:TECK.B)

Overview: Teck Resources Limited is involved in the research, exploration, development, processing, smelting, refining, and reclamation of mineral properties across Asia, the Americas, and Europe with a market capitalization of approximately CA$25.88 billion.

Operations: Teck Resources generates revenue primarily from its Zinc segment, which accounts for CA$3.76 billion, and its Copper segment, contributing CA$5.97 billion.

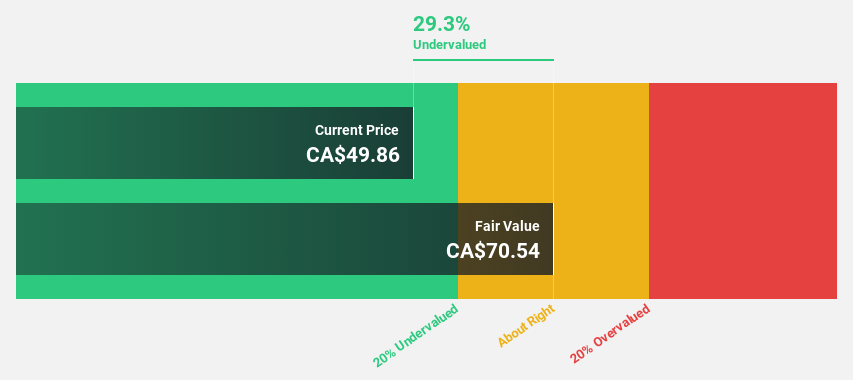

Estimated Discount To Fair Value: 40.4%

Teck Resources, trading at CA$52.72, is undervalued with an estimated fair value of CA$88.53. Despite a low forecasted return on equity of 4.4%, the company is expected to become profitable within three years and achieve above-average market growth in profits. Recent developments include an Environmental Assessment Certificate for the Highland Valley Copper Mine extension, enhancing its long-term cash flow potential and supporting Canada's critical minerals supply chain.

- In light of our recent growth report, it seems possible that Teck Resources' financial performance will exceed current levels.

- Get an in-depth perspective on Teck Resources' balance sheet by reading our health report here.

Vitalhub (TSX:VHI)

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$698.84 million.

Operations: The company generates revenue of CA$75.01 million from its healthcare software solutions provided to health and human service providers across various international markets.

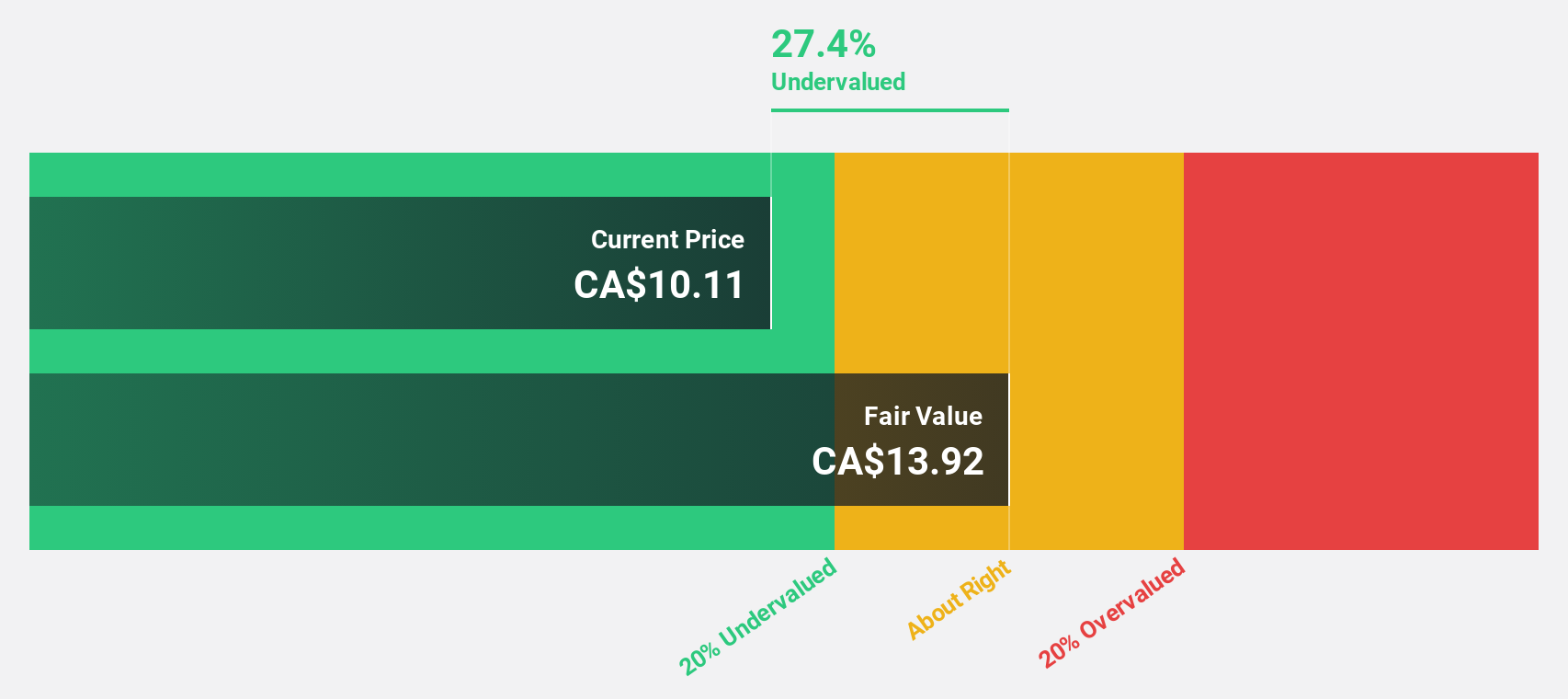

Estimated Discount To Fair Value: 19.4%

Vitalhub, trading at CA$12.53, is undervalued with a fair value estimate of CA$15.54. Despite a low future return on equity forecast of 7.2%, earnings are expected to grow significantly at 55.6% annually over the next three years, outpacing the Canadian market's average growth rate. Recent first-quarter results showed revenue growth from CA$15.26 million to CA$21.67 million year-over-year, although profit margins decreased from 10.3% to 3.8%.

- Insights from our recent growth report point to a promising forecast for Vitalhub's business outlook.

- Click here to discover the nuances of Vitalhub with our detailed financial health report.

Where To Now?

- Investigate our full lineup of 27 Undervalued TSX Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives