- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Silvercorp Metals (TSX:SVM): Revisiting Valuation After Bullish Analyst Upgrade and Strong Performance Signals

Reviewed by Simply Wall St

Roth Capital’s latest move on Silvercorp Metals (TSX:SVM), keeping its Buy call while lifting its expectations, is the kind of steady vote of confidence that often nudges investors to take a closer look.

See our latest analysis for Silvercorp Metals.

The upbeat call comes as Silvercorp’s share price has climbed to $11.79, with a powerful 30 day share price return of 24.50% and 90 day share price return of 66.06%. The 1 year total shareholder return of 171.05% and 3 year total shareholder return of 199.49% underline that momentum has been building for some time.

If you are rethinking your exposure to materials and high momentum names, it can be useful to compare Silvercorp’s run with fast growing stocks with high insider ownership.

Yet with the shares now closing in on analyst targets after such a rapid climb, investors have to ask whether Silvercorp is still trading below its true worth or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 8.5% Undervalued

With Silvercorp Metals last closing at CA$11.79 against a narrative fair value of roughly CA$12.88, the dominant storyline leans toward modest upside still on the table.

The analysts have a consensus price target of CA$8.38 for Silvercorp Metals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$9.56, and the most bearish reporting a price target of just CA$7.57.

Curious how strong growth, rising margins and a surprisingly low future earnings multiple can still point to upside at today’s price, even after such a massive run?

Result: Fair Value of $12.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cost inflation and regulatory setbacks in China or Ecuador could quickly dent margins and delay the growth that is now embedded in expectations.

Find out about the key risks to this Silvercorp Metals narrative.

Another Angle on Value

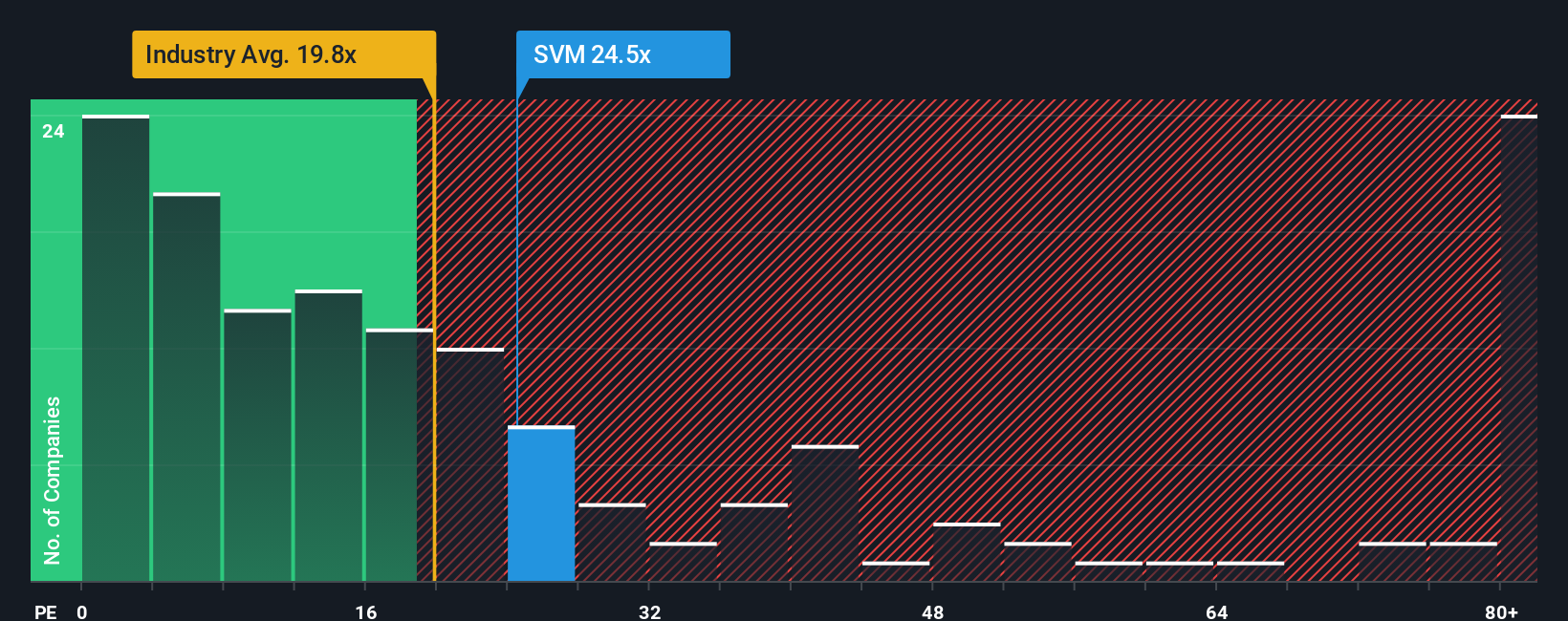

Looked at through its earnings multiple, Silvercorp paints a tougher picture. The shares trade at about 75 times earnings, versus roughly 21 times for the Canadian metals and mining industry and a fair ratio of around 36.8 times, suggesting meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silvercorp Metals Narrative

If this perspective does not quite fit how you see Silvercorp, or you prefer to dive into the numbers yourself, you can build a fresh view in just a few minutes, Do it your way.

A great starting point for your Silvercorp Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity, let Simply Wall Street’s powerful Screener guide you to fresh, data backed stock ideas before the crowd reacts.

- Capitalize on mispriced quality by scanning these 907 undervalued stocks based on cash flows that may still trade below their long term cash flow potential.

- Ride structural growth trends by targeting these 30 healthcare AI stocks transforming how medicine is delivered, diagnosed and personalized.

- Position ahead of financial innovation shifts by filtering these 80 cryptocurrency and blockchain stocks shaping the future of payments, security and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)