- Canada

- /

- Metals and Mining

- /

- TSX:SVM

3 TSX Stocks Estimated To Be Trading At A Discount Of Up To 36.2%

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of manageable yet unresolved inflation and potential interest rate cuts, investors are keenly observing how these factors might influence equity valuations. In such an environment, identifying stocks that are trading at a discount can be particularly appealing, as they may offer opportunities for growth when broader economic conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| West Fraser Timber (TSX:WFG) | CA$99.82 | CA$173.63 | 42.5% |

| Vitalhub (TSX:VHI) | CA$12.69 | CA$19.88 | 36.2% |

| TerraVest Industries (TSX:TVK) | CA$143.23 | CA$274.31 | 47.8% |

| Metalla Royalty & Streaming (TSXV:MTA) | CA$5.82 | CA$9.24 | 37% |

| Magellan Aerospace (TSX:MAL) | CA$15.13 | CA$28.63 | 47.2% |

| K92 Mining (TSX:KNT) | CA$14.56 | CA$28.06 | 48.1% |

| Ivanhoe Mines (TSX:IVN) | CA$10.83 | CA$19.89 | 45.5% |

| Groupe Dynamite (TSX:GRGD) | CA$36.86 | CA$70.88 | 48% |

| goeasy (TSX:GSY) | CA$203.65 | CA$382.52 | 46.8% |

| Blackline Safety (TSX:BLN) | CA$6.19 | CA$10.21 | 39.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

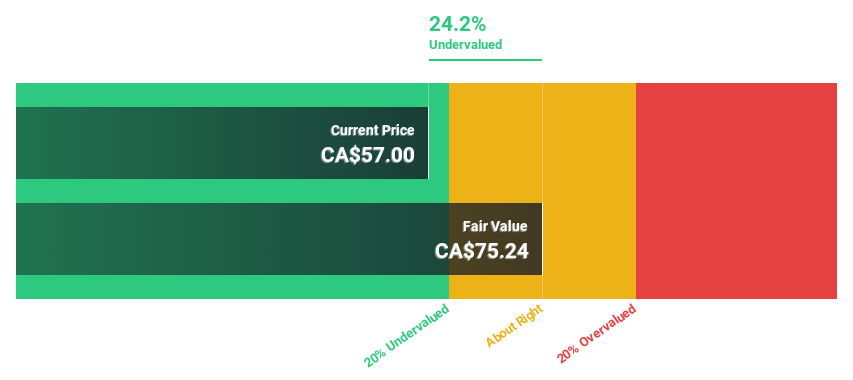

Cameco (TSX:CCO)

Overview: Cameco Corporation is involved in supplying uranium for electricity generation and has a market cap of CA$44.57 billion.

Operations: The company's revenue is primarily derived from its Uranium segment, generating CA$2.96 billion, and its Fuel Services segment, contributing CA$565.55 million, along with a significant contribution from Westinghouse (WEC) at CA$3.37 billion.

Estimated Discount To Fair Value: 12.4%

Cameco's recent earnings report showed a substantial increase in net income to C$320.89 million for Q2 2025, up from C$36.01 million the previous year, reflecting strong profitability growth. Despite a decrease in uranium production volumes, Cameco's stock is trading at approximately 12.4% below its estimated fair value of C$111.61 based on discounted cash flows (DCF). However, insider selling raises caution about potential undervaluation concerns despite the positive earnings outlook and expected annual profit growth surpassing market averages.

- Our earnings growth report unveils the potential for significant increases in Cameco's future results.

- Unlock comprehensive insights into our analysis of Cameco stock in this financial health report.

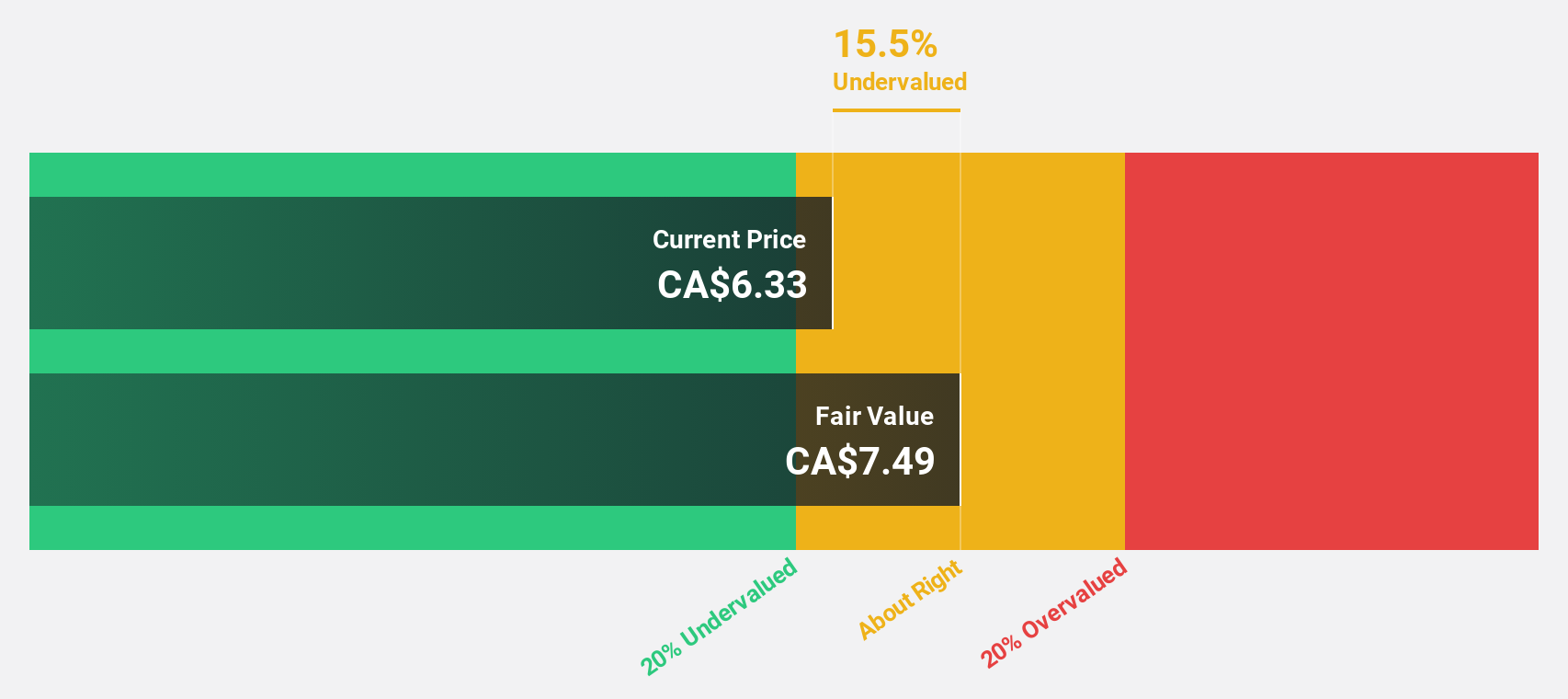

Silvercorp Metals (TSX:SVM)

Overview: Silvercorp Metals Inc. is a company that acquires, explores, develops, and mines mineral properties in China with a market capitalization of CA$1.30 billion.

Operations: The company's revenue primarily comes from its operations in China, with the Ying Mining District contributing $274.11 million and the GC Mine generating $33.95 million.

Estimated Discount To Fair Value: 18.3%

Silvercorp Metals' stock trades at CA$6.12, below its fair value estimate of CA$7.49, suggesting it is undervalued based on cash flows. Despite slower revenue growth forecasts than desired, earnings are expected to grow significantly over the next three years, outpacing the Canadian market average. Recent legal victories in Ecuador support future project developments like El Domo but significant insider selling could be a concern for investors regarding potential undervaluation risks.

- Our expertly prepared growth report on Silvercorp Metals implies its future financial outlook may be stronger than recent results.

- Take a closer look at Silvercorp Metals' balance sheet health here in our report.

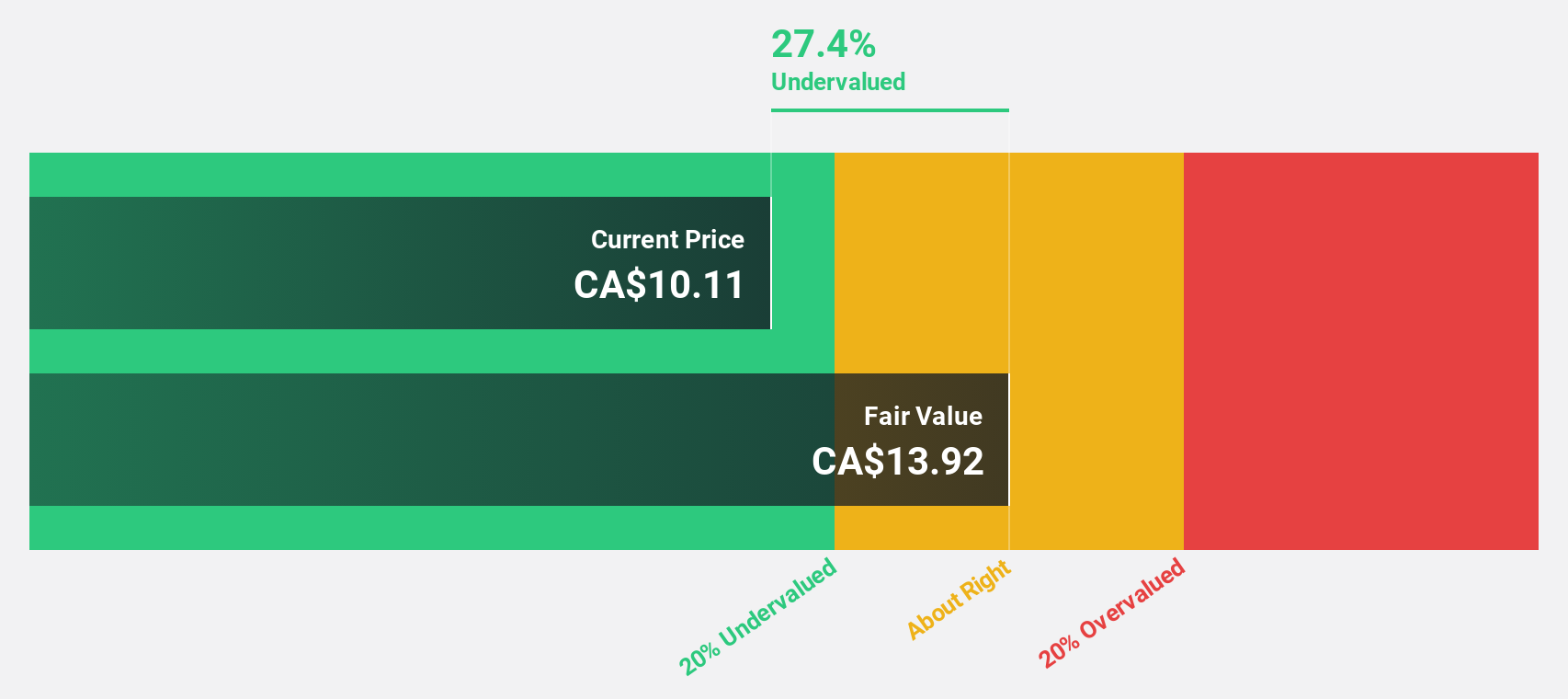

Vitalhub (TSX:VHI)

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally, with a market cap of CA$792.54 million.

Operations: The company generates revenue from its healthcare software segment, which amounts to CA$82.63 million.

Estimated Discount To Fair Value: 36.2%

Vitalhub's stock, trading at CA$12.69, is undervalued compared to its fair value estimate of CA$19.88. Despite a recent equity offering raising CA$65 million that diluted shareholders, the company reported strong revenue growth in Q2 2025 with earnings turning positive from a previous loss. With forecasted earnings growth significantly outpacing the Canadian market and trading below analyst price targets, Vitalhub presents potential for investors focusing on cash flow-based valuations amidst high-quality earnings concerns due to large one-off items.

- In light of our recent growth report, it seems possible that Vitalhub's financial performance will exceed current levels.

- Navigate through the intricacies of Vitalhub with our comprehensive financial health report here.

Taking Advantage

- Investigate our full lineup of 26 Undervalued TSX Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives