- Canada

- /

- Metals and Mining

- /

- TSX:ORE

Why Orezone Gold (TSX:ORE) Is Up 12.9% After Joining S&P Global and Mining Indexes

Reviewed by Simply Wall St

- Orezone Gold Corporation (TSX:ORE) was recently added to both the S&P Global BMI Index and the S&P/TSX Global Mining Index, marking a significant milestone for the company.

- This dual index inclusion can enhance Orezone Gold's visibility among global investors and potentially prompt increased index fund participation.

- We'll explore how heightened index presence might reshape Orezone Gold's investment narrative by influencing capital flows and investor perception.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Orezone Gold Investment Narrative Recap

To own Orezone Gold, you need to believe in the company’s ability to execute rapid, multi-stage expansion at the Bomboré mine in Burkina Faso, while carefully managing operational and country-specific risks. The recent dual index inclusion bolsters Orezone’s visibility, but it does not materially change the most important near-term catalyst, the successful ramp-up of Bomboré’s Stage I and II expansions. It also does not mitigate the biggest risk: heavy reliance on a single asset in a challenging jurisdiction.

Among recent announcements, the August drill results revealing significant new high-grade gold intersections at Bomboré stand out. These results support the company’s efforts to expand its reserve base toward the targeted 7 to 10 million ounces, an important potential buffer if operational or political risks materialize and a core component of future growth catalysts.

Yet, in contrast to the many positives from index inclusion and resource growth, investors should be mindful of...

Read the full narrative on Orezone Gold (it's free!)

Orezone Gold's narrative projects $949.4 million revenue and $421.3 million earnings by 2028. This requires 41.1% yearly revenue growth and a $354.3 million earnings increase from $67.0 million today.

Uncover how Orezone Gold's forecasts yield a CA$2.01 fair value, a 44% upside to its current price.

Exploring Other Perspectives

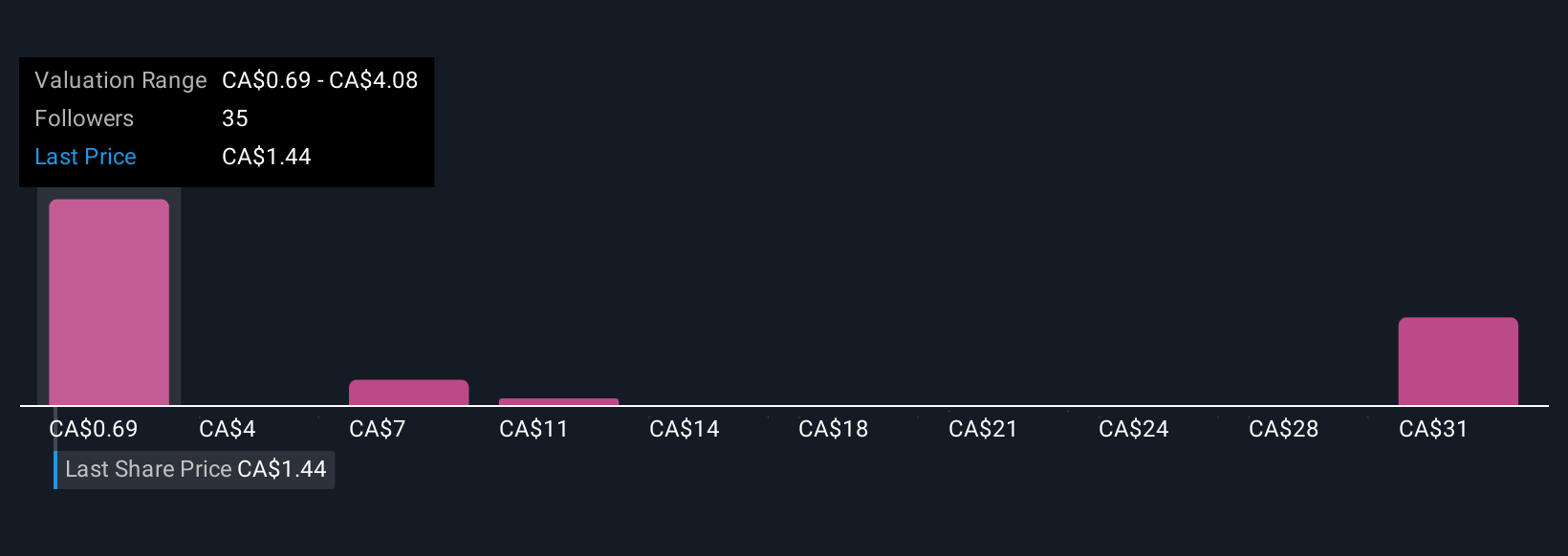

You are seeing fair value views from 10 individuals in the Simply Wall St Community, ranging from as low as CA$0.69 up to CA$34.19 per share. While many see compelling growth catalysts in Orezone’s expansion plans, such diversity reflects how expectations for execution and risk management can shape future performance, be sure to explore several viewpoints before deciding for yourself.

Explore 10 other fair value estimates on Orezone Gold - why the stock might be a potential multi-bagger!

Build Your Own Orezone Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orezone Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Orezone Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orezone Gold's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORE

Orezone Gold

Engages in the mining, exploration, and development of gold properties.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives