- Canada

- /

- Metals and Mining

- /

- TSX:OR

OR Royalties (TSX:OR): Assessing Valuation After Shelf Registration Filing Signals New Funding Flexibility

Reviewed by Simply Wall St

OR Royalties (TSX:OR) has just filed a shelf registration, opening the door to issuing new common shares, debt securities, warrants, or units when it chooses. While there are no immediate details about planned offerings, shelf registrations like this are designed to give companies flexibility. For investors, it often raises questions about why management is seeking this optionality at this time and what ambitions or challenges might be around the corner.

This move comes at an intriguing time for OR Royalties. Over the past year, the stock has surged an impressive 82%, and momentum has accelerated recently, with a 22% climb over the past three months alone. In addition, its net income and revenues have both posted solid gains. Investors have already enjoyed major returns, and the stock’s rapid appreciation signals that the market sees something to get excited about, or perhaps is adjusting expectations for future growth or risk.

After such a strong run and with a fresh shelf registration now in place, is OR Royalties a bargain waiting to be discovered, or is the market simply pricing in all the future upside already?

Price-to-Earnings of 73.5x: Is it justified?

On a price-to-earnings (P/E) basis, OR Royalties currently trades at a multiple of 73.5 times its earnings. This is significantly higher than both its industry peers and broader market averages, suggesting the stock is considered expensive compared to similar companies.

The P/E ratio compares a company's share price to its per-share earnings. In the metals and mining sector, investors use this metric to evaluate how much they are paying for a company’s current and future profitability. A high P/E can signal strong growth expectations, but it may also indicate that the market is overestimating future earnings potential.

The implication is clear: the market is pricing in a great deal of optimism for OR Royalties relative to its current profits. Whether this confidence is due to anticipated growth or other factors remains open for further analysis.

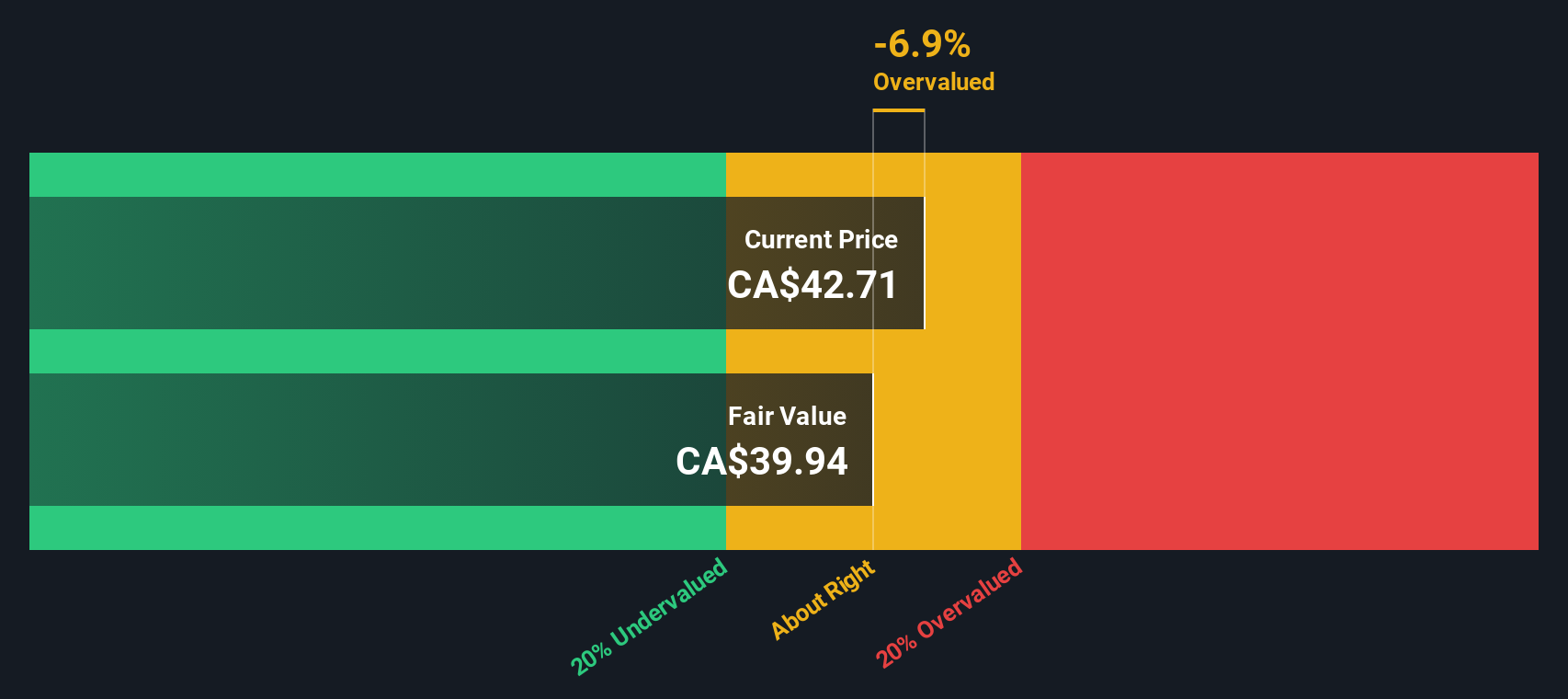

Result: Fair Value of $39.44 (OVERVALUED)

See our latest analysis for OR Royalties.However, slowing revenue growth and a recent premium valuation could expose OR Royalties to volatility if investor sentiment shifts or earnings disappoint.

Find out about the key risks to this OR Royalties narrative.Another View: What Does Our DCF Model Suggest?

Taking a step back from headline multiples, our DCF model provides a different perspective. According to this approach, the stock’s price appears above its estimated value, supporting the case raised by the earnings multiple. Is the market underestimating risks, or will growth ultimately challenge these metrics?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OR Royalties Narrative

If you have a different perspective or want to form your own view, you can easily dive into the numbers to create your own narrative in just minutes. do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding OR Royalties.

Looking for more investment ideas?

Don’t let your next great opportunity pass you by. The Simply Wall Street screener is packed with hand-picked ideas for investors who want to get ahead of the curve. Here are some effective ways you can spot high-potential stocks right now:

- Discover the smartest value plays by finding undervalued stocks based on cash flows that the market may be overlooking, using real cash flow metrics.

- Find consistent income and growth potential by scanning for dividend stocks with yields > 3% with attractive yields and strong fundamentals.

- Explore momentum in frontier technology by identifying AI penny stocks leading the artificial intelligence revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OR

OR Royalties

Acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives