- Canada

- /

- Metals and Mining

- /

- TSX:OR

A Look at OR Royalties (TSX:OR) Valuation Following Record Revenue and Strengthened Balance Sheet

Reviewed by Kshitija Bhandaru

OR Royalties (TSX:OR) just delivered record quarterly revenues from royalties and streams in Q3 2025. The company also achieved a solid 20,326 gold equivalent ounces produced and fully repaid its credit facility.

See our latest analysis for OR Royalties.

Recent record revenue and a strengthened balance sheet have certainly caught the market’s attention. OR Royalties’ share price is up nearly 10% for the month and a stunning 96% year-to-date, with its one-year total shareholder return topping 103%. The strong operational results and fully repaid credit facility are contributing to the sense of sustained momentum, building on a track record of steady outperformance over several years.

If you’re watching how investor optimism plays out in strong performers, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

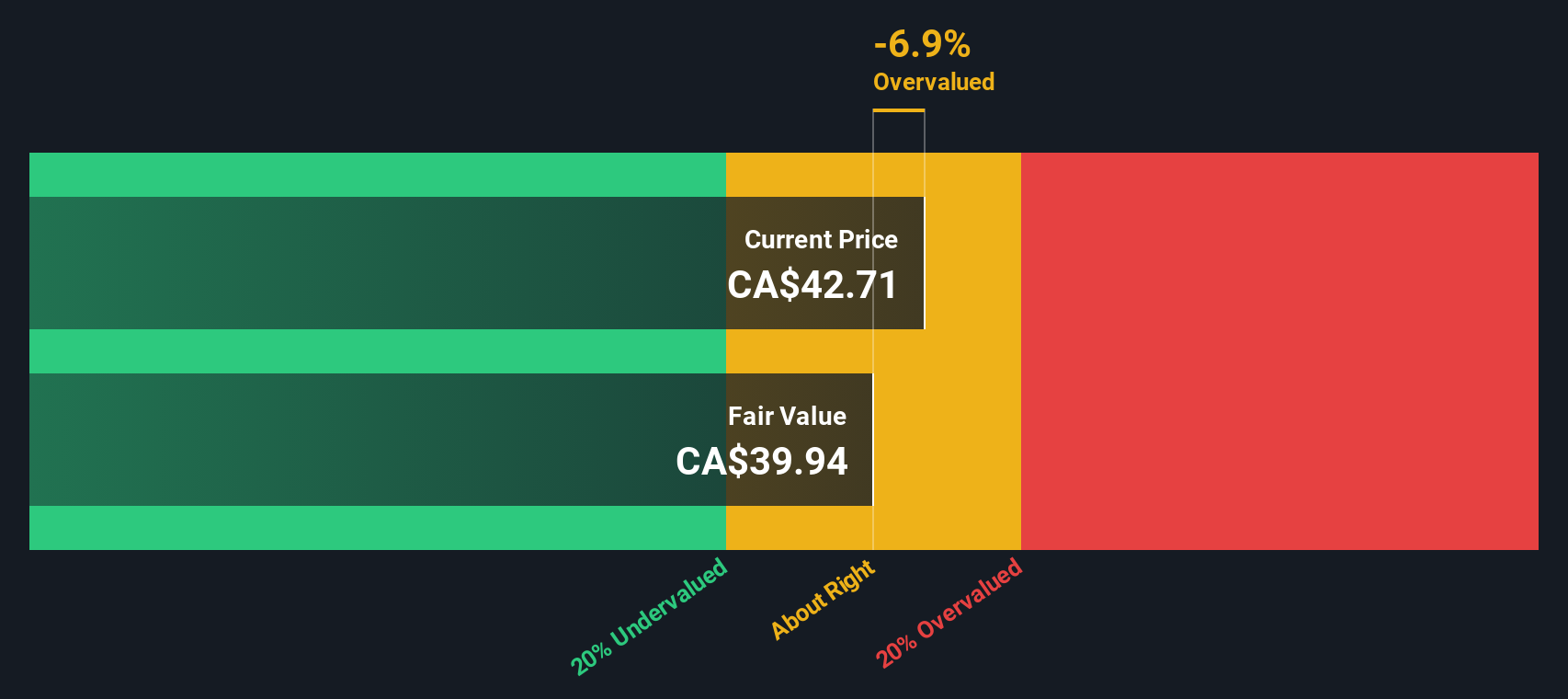

But with shares up nearly 100% this year and analysts split between upgrades and cautious holds, is OR Royalties undervalued, or has the market already priced in all the company’s future growth potential?

Price-to-Earnings of 90.1x: Is it justified?

OR Royalties trades at a price-to-earnings ratio of 90.1x, which is far above both the industry average and its peers, despite a strong share price rally.

The price-to-earnings (P/E) ratio is a common way for investors to gauge how much they are paying for a company’s future earnings potential. For a business that has only recently turned profitable, such as OR Royalties, this elevated P/E suggests high market expectations for earnings growth in the years ahead.

However, the company’s multiple stands in stark contrast not just to the Canadian Metals and Mining industry average (23.6x), but also to the peer average of 28.7x and its own estimated fair P/E ratio of 24.2x. This substantial premium could indicate that investors are pricing in exceptional growth or a scarcity premium. It also means any disappointment could trigger sharp revaluation.

Explore the SWS fair ratio for OR Royalties

Result: Price-to-Earnings of 90.1x (OVERVALUED)

However, recent momentum could quickly reverse if revenue growth slows or if the stock’s premium valuation attracts profit-taking from investors.

Find out about the key risks to this OR Royalties narrative.

Another View: SWS DCF Model Points to Undervaluation

Looking at OR Royalties through the lens of our DCF model offers a different perspective. The SWS DCF model estimates the fair value at CA$58.67, about 11% above the current share price. This suggests the stock may be undervalued. Does this mean the market has overlooked longer-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OR Royalties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OR Royalties Narrative

If you want to explore the numbers firsthand and form your own perspective, you can build a personalized story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding OR Royalties.

Looking for more investment ideas?

Don’t miss out on opportunities that could reshape your portfolio. With the Simply Wall Street Screener, you can confidently spot trends and find hidden gems before the crowd moves in.

- Capitalize on market mispricings by checking out these 892 undervalued stocks based on cash flows with untapped growth potential.

- Target reliable income streams and elevate your returns through these 18 dividend stocks with yields > 3% offering yields above 3%.

- Move ahead of the curve by following these 25 AI penny stocks, which are accelerating breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OR

OR Royalties

Acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives