- Canada

- /

- Metals and Mining

- /

- TSX:OLA

Will Board Changes at Orla Mining (TSX:OLA) Reshape Its Strategic Direction and Governance?

Reviewed by Sasha Jovanovic

- Orla Mining announced on September 23, 2025, that Scott Langley resigned from its Board of Directors following Newmont Corporation’s exit as a major shareholder and the termination of their investor rights agreement.

- This change signals a shift in governance and shareholder structure, which may influence perceptions of future oversight and strategic direction at Orla Mining.

- We’ll examine how the departure of Newmont’s board nominee may influence Orla Mining’s long-term investment outlook and governance considerations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Orla Mining Investment Narrative Recap

To be a shareholder in Orla Mining, you need to believe in the company’s ability to generate consistent production growth and diversify revenues as it brings new projects like South Railroad online. The recent resignation of Newmont’s board nominee signals a meaningful shift in governance but is unlikely to materially impact the short-term production ramp at Musselwhite, the current major catalyst, or immediately alter key risks such as permitting delays in Mexico and Nevada.

Among recent developments, the August 13, 2025, announcement of the South Railroad Project entering federal permitting review stands out. This milestone is directly tied to regulatory risk, as the timely receipt of approvals will be crucial for unlocking future growth and remains under close investor watch given past delays in mining permits.

On the other hand, investors should keep an eye on the ongoing regulatory and permitting uncertainty, as even minor changes in project timelines...

Read the full narrative on Orla Mining (it's free!)

Orla Mining's outlook anticipates $1.4 billion in revenue and $721.9 million in earnings by 2028. This scenario relies on 31.5% annual revenue growth and an increase in earnings of approximately $696 million from the current $25.6 million.

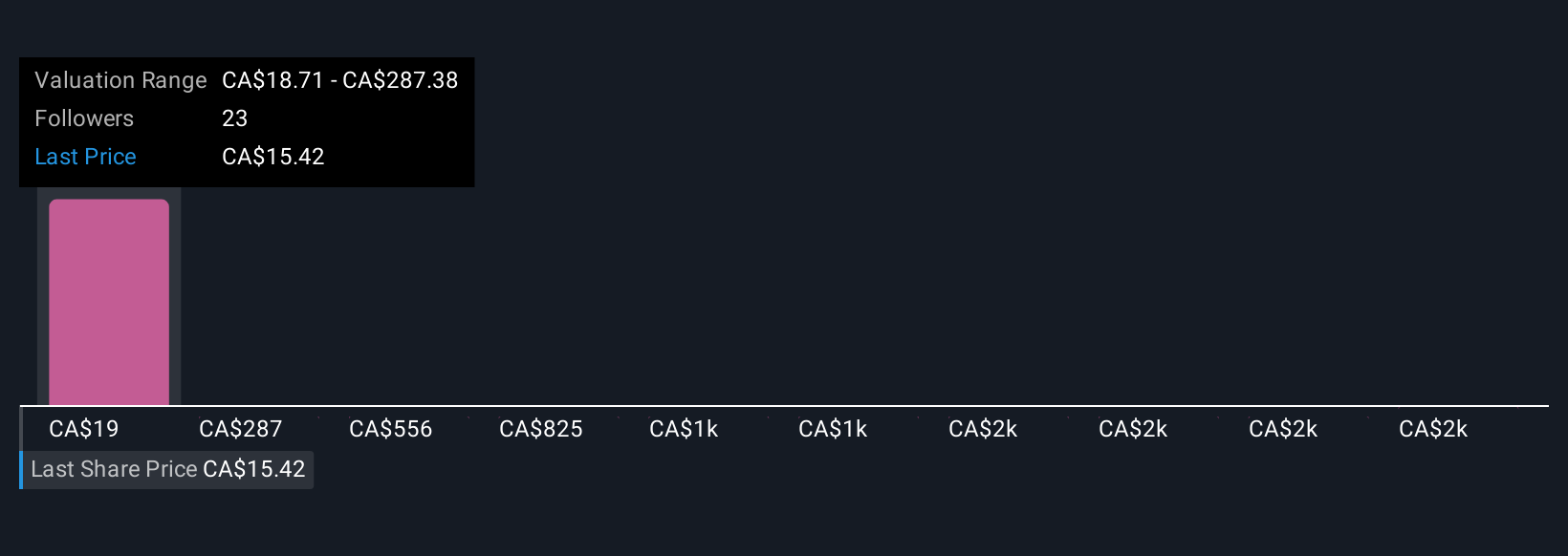

Uncover how Orla Mining's forecasts yield a CA$18.26 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Seven individual fair value estimates from the Simply Wall St Community span a wide range, from CA$18.26 to CA$2,705.39. Regulatory bottlenecks highlighted in analyst discussions may weigh heavily in how you assess these outlier viewpoints and the company’s potential for stable growth.

Explore 7 other fair value estimates on Orla Mining - why the stock might be a potential multi-bagger!

Build Your Own Orla Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orla Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Orla Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orla Mining's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

Exceptional growth potential and fair value.

Market Insights

Community Narratives