- Canada

- /

- Metals and Mining

- /

- TSX:OLA

Assessing Orla Mining (TSX:OLA) Valuation After Musselwhite Drill Results Reveal New Growth Potential

Reviewed by Kshitija Bhandaru

Orla Mining (TSX:OLA) shares are catching attention after the company reported strong exploration results at the Musselwhite Mine in Ontario. The results confirm a potential two-kilometre gold trend extension and open the door to increased gold production.

See our latest analysis for Orla Mining.

Momentum has been building for Orla Mining shares this year, with a share price return of 81.2% year-to-date as investors react to ongoing exploration success and expansion prospects. The one-year total shareholder return of 149.1% highlights just how much optimism has increased around its growth track and outpaces many gold peers despite some recent price volatility.

If you’re interested in broadening your perspective, now is the perfect moment to discover fast growing stocks with high insider ownership.

With such impressive gains and strong growth signals, the key question facing investors now is whether Orla Mining stock remains undervalued given its outlook, or if future production upside is already fully priced in?

Most Popular Narrative: 21.2% Undervalued

Orla Mining's fair value, based on the most popular narrative, stands at $19.56 per share compared to its last close at $15.42. This sets the stage for expectations of continued outperformance driven by robust growth projections.

Robust production growth and revenue diversification from integrating Musselwhite, as well as future contributions from South Railroad and expanded Camino Rojo underground, are likely underappreciated catalysts that will increase long-term revenue and reduce operational risk.

Curious which set of aggressive earnings and profit margin forecasts power this valuation? The full narrative unpacks the bold revenue expectations that could reshape this stock’s future. Click through to see what makes this calculation so compelling.

Result: Fair Value of $19.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, substantial delays in permitting or unexpected operational setbacks could quickly undermine these bullish forecasts and affect Orla Mining’s near-term growth momentum.

Find out about the key risks to this Orla Mining narrative.

Another View: Looking at the Numbers from a Different Angle

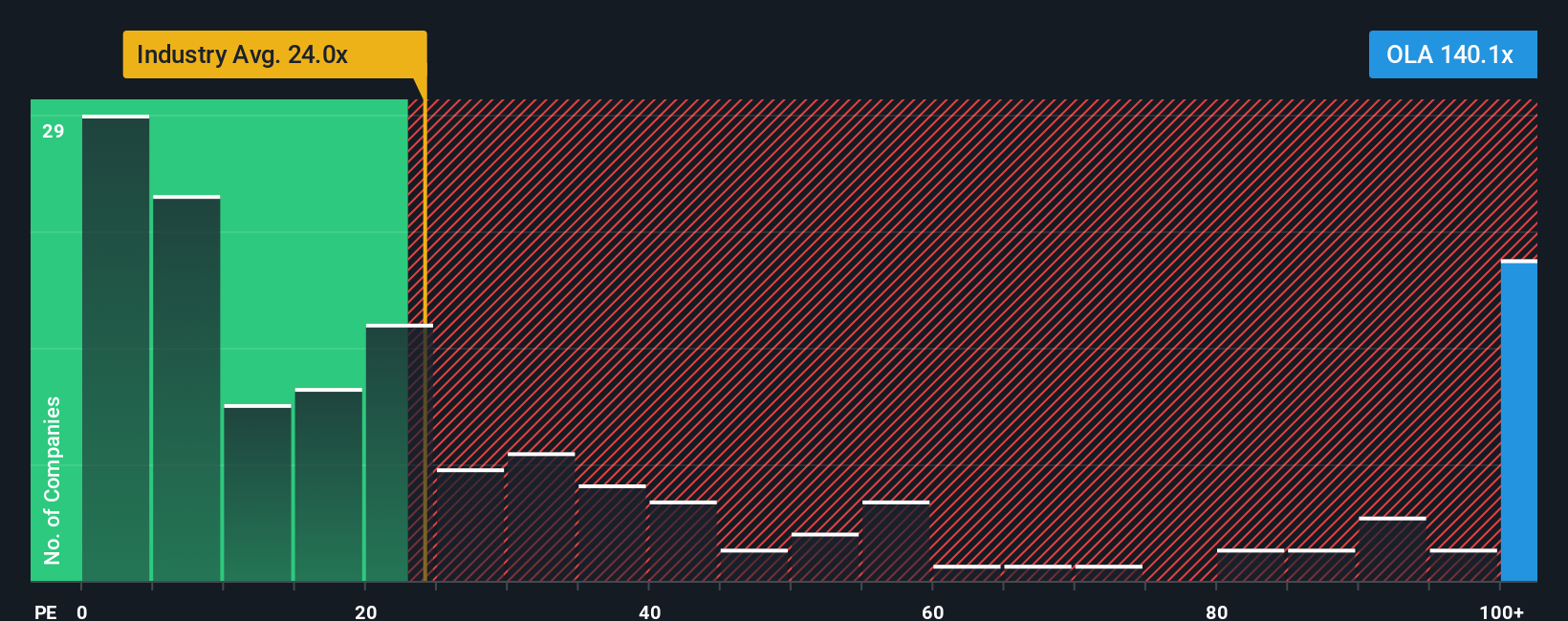

While the fair value narrative and analyst targets indicate Orla Mining is trading below where optimists believe it should be, a closer look at the price-to-earnings ratio tells a more cautious story. Orla’s ratio sits at 140.1x, which is much higher than both the Canadian Metals and Mining industry average of 24x and the peer average of 37.3x. Compared to a fair ratio of 73.8x, this premium may signal higher market expectations, or simply a valuation risk if future earnings growth does not arrive as swiftly as forecast.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orla Mining Narrative

If you see the numbers differently or want to dig deeper yourself, you can craft your own take on Orla Mining’s story in just a few minutes. Do it your way

A great starting point for your Orla Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Turn your research into opportunity by checking out stocks with unique growth signatures and sector trends picked by our specialist screeners before others catch on.

- Unlock high yields and reliable income. Tap into these 19 dividend stocks with yields > 3% that consistently boast dividend rates over 3% and strong fundamentals.

- Jump ahead of the curve with these 24 AI penny stocks poised to disrupt industries with artificial intelligence innovation and exceptional earnings potential.

- Catch the undervalued market gems. See these 892 undervalued stocks based on cash flows offering attractive entry points based on robust cash flow analysis and real value upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

Exceptional growth potential and fair value.

Market Insights

Community Narratives