- Canada

- /

- Healthtech

- /

- TSX:VHI

3 TSX Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the current Canadian market landscape, investors are closely monitoring inflation trends and potential rate cuts as the Federal Reserve considers its next moves amid mixed economic signals. With inflation appearing manageable yet unresolved, and upcoming Fed actions potentially influencing Canadian yields, identifying growth stocks with significant insider ownership can be a strategic approach for those seeking stability and alignment of interests in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 21.1% | 87.6% |

| Robex Resources (TSXV:RBX) | 23.2% | 99.4% |

| Propel Holdings (TSX:PRL) | 36.5% | 31.8% |

| PowerBank (NEOE:SUNN) | 16% | 52.1% |

| First National Financial (TSX:FN) | 38.4% | 22.1% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| Discovery Silver (TSX:DSV) | 13.6% | 57.8% |

| CEMATRIX (TSX:CEMX) | 10.5% | 76.6% |

| Aritzia (TSX:ATZ) | 17.2% | 29.6% |

| Allied Gold (TSX:AAUC) | 16% | 86.5% |

We're going to check out a few of the best picks from our screener tool.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orla Mining Ltd. is involved in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$4.27 billion.

Operations: Orla Mining Ltd. generates its revenue through the acquisition, exploration, development, and exploitation of mineral properties.

Insider Ownership: 11.2%

Earnings Growth Forecast: 76.7% p.a.

Orla Mining, a growth-focused company with substantial insider ownership, is set for significant expansion. Its revenue is projected to grow 23% annually, outpacing the Canadian market. Despite no substantial recent insider buying, insiders have been net buyers over the past three months. Orla's South Railroad Project in Nevada marks a key milestone in its organic growth strategy aiming for 500,000 ounces of annual gold production. The stock trades below fair value estimates and analysts expect price appreciation.

- Click here to discover the nuances of Orla Mining with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Orla Mining is trading beyond its estimated value.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

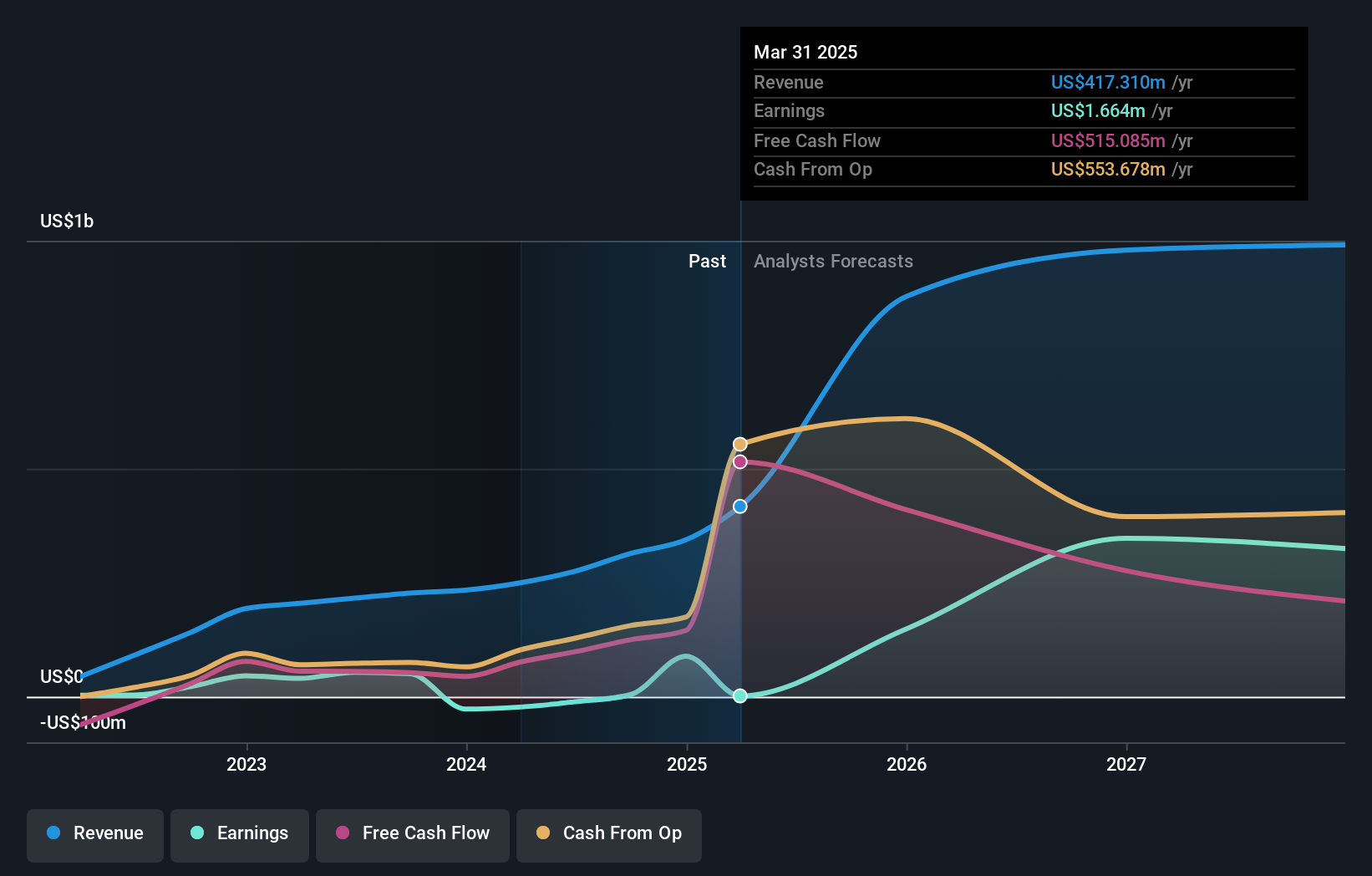

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$792.54 million.

Operations: The company generates revenue primarily from its Healthcare Software segment, which accounts for CA$82.63 million.

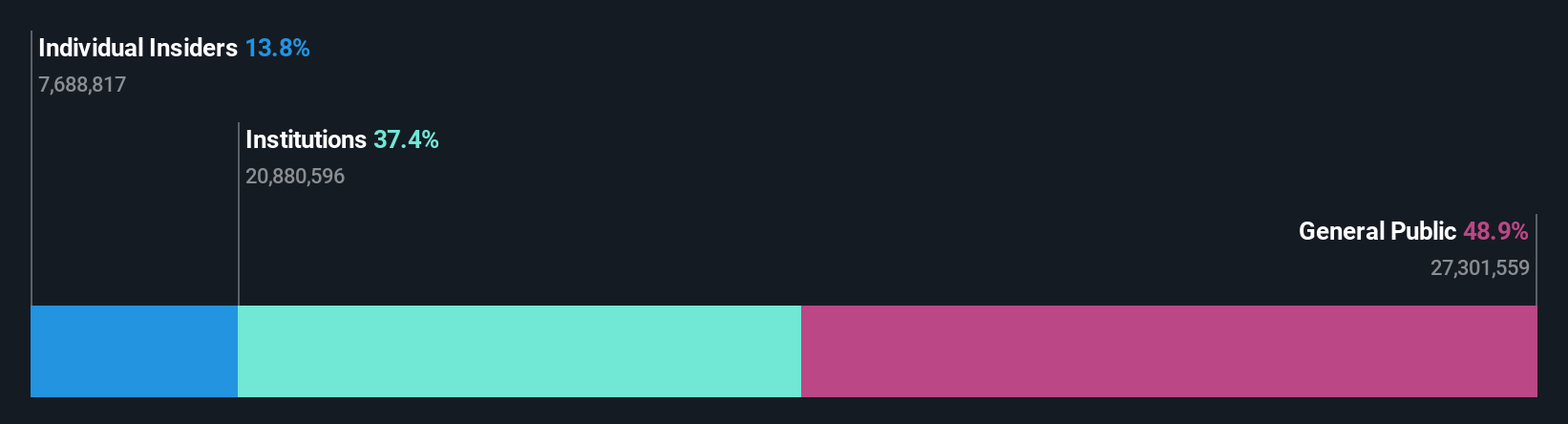

Insider Ownership: 12.4%

Earnings Growth Forecast: 54.9% p.a.

Vitalhub demonstrates strong growth potential with earnings forecasted to grow significantly at 54.9% annually, outpacing the Canadian market. Recent financial results show improved profitability, with Q2 net income of C$1.77 million compared to a loss last year. The company completed a follow-on equity offering of C$65 million, which may dilute shareholders but supports expansion efforts. Trading below estimated fair value, analysts anticipate price appreciation despite no recent insider trading activity noted in the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Vitalhub.

- Our valuation report unveils the possibility Vitalhub's shares may be trading at a discount.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

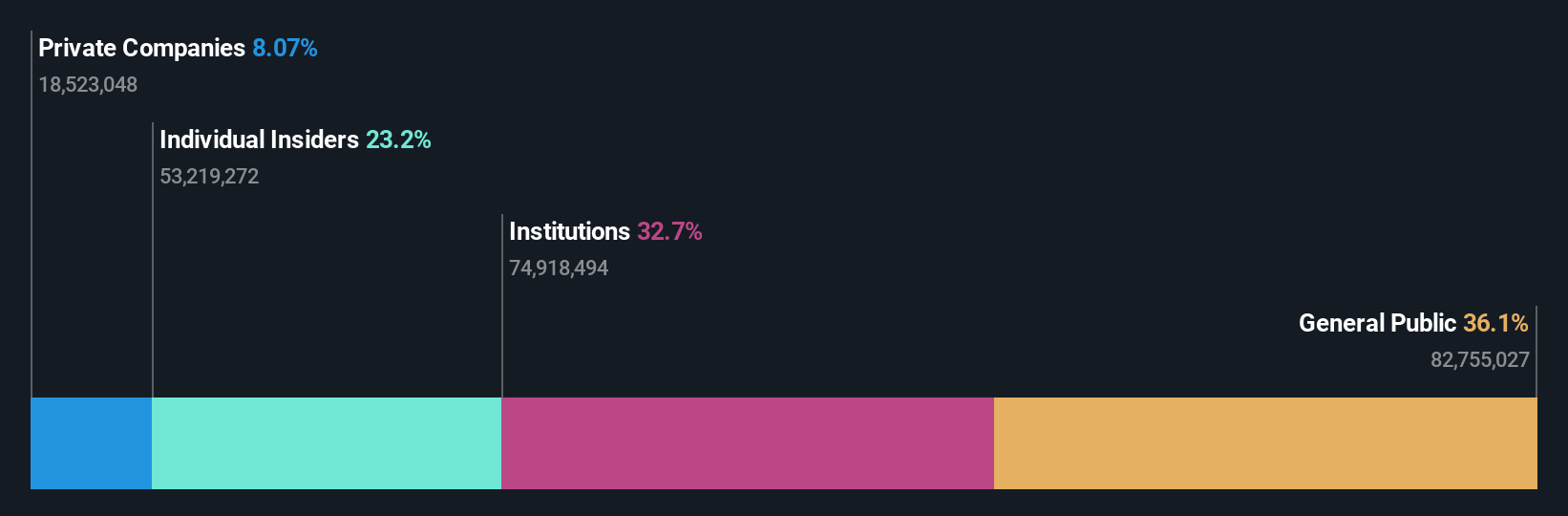

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$768.54 million.

Operations: The company's revenue segment is derived from its gold mining operations at the Nampala site, generating CA$189.36 million.

Insider Ownership: 23.2%

Earnings Growth Forecast: 99.4% p.a.

Robex Resources is forecasted to achieve substantial revenue growth of 62.1% annually, outpacing the Canadian market significantly. Despite recent losses, including a net loss of C$37.45 million in Q2 2025, the company's strategic focus on its Kiniero Gold Project shows promise with first gold production expected by late 2025. Insider activity has been stable with more shares bought than sold recently, and no significant insider selling over the past three months noted.

- Click to explore a detailed breakdown of our findings in Robex Resources' earnings growth report.

- According our valuation report, there's an indication that Robex Resources' share price might be on the cheaper side.

Where To Now?

- Click here to access our complete index of 43 Fast Growing TSX Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)