- Canada

- /

- Metals and Mining

- /

- TSX:OGC

Will OceanaGold's (TSX:OGC) US$8 Million Brewer Copper-Gold Earn-In Shift Its Exploration Narrative?

Reviewed by Sasha Jovanovic

- Carolina Rush Corporation announced that its Earn-In Option Agreement with OceanaGold became active on 26 November 2025, triggering a joint Technical Committee–approved Stage 1 exploration program with about 3,000 meters of drilling at the Brewer copper-gold project starting January 2026 and a minimum US$1.5 million spend by OceanaGold.

- The agreement requires OceanaGold to spend up to US$8.00 million by the end of 2027 to earn a 50% interest in Brewer, putting meaningful capital behind testing whether a deeper Cu-Au porphyry system underlies the historically mined epithermal mineralization.

- We’ll examine how OceanaGold’s commitment to fund up to US$8.00 million at Brewer could reshape its exploration-led growth investment narrative.

Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

OceanaGold Investment Narrative Recap

To own OceanaGold, you need to believe the company can translate its producing assets and pipeline into sustainable cash generation while managing cost and operational pressures. The Brewer earn in with Carolina Rush is directionally positive for exploration led growth, but it does not materially change the near term focus on execution at Haile, Didipio and Macraes, where operating performance and cost control still look like the key catalyst and main operational risk in the months ahead.

The recent confirmation of OceanaGold’s 2025 production guidance, alongside strong year to date earnings, feels most relevant when viewing the Brewer news in context. Management is committing up to US$8.0 million to a high impact copper gold target while also returning cash via dividends and buybacks, so investors may watch how exploration spending at Brewer fits alongside the company’s broader capital allocation and its ability to maintain margins in the face of ongoing cost and inflation pressures.

Yet, while exploration spend at Brewer may be capped, investors should still be aware that...

Read the full narrative on OceanaGold (it's free!)

OceanaGold's narrative projects $2.2 billion revenue and $764.2 million earnings by 2028. This requires 12.7% yearly revenue growth and about a $388 million earnings increase from $375.8 million today.

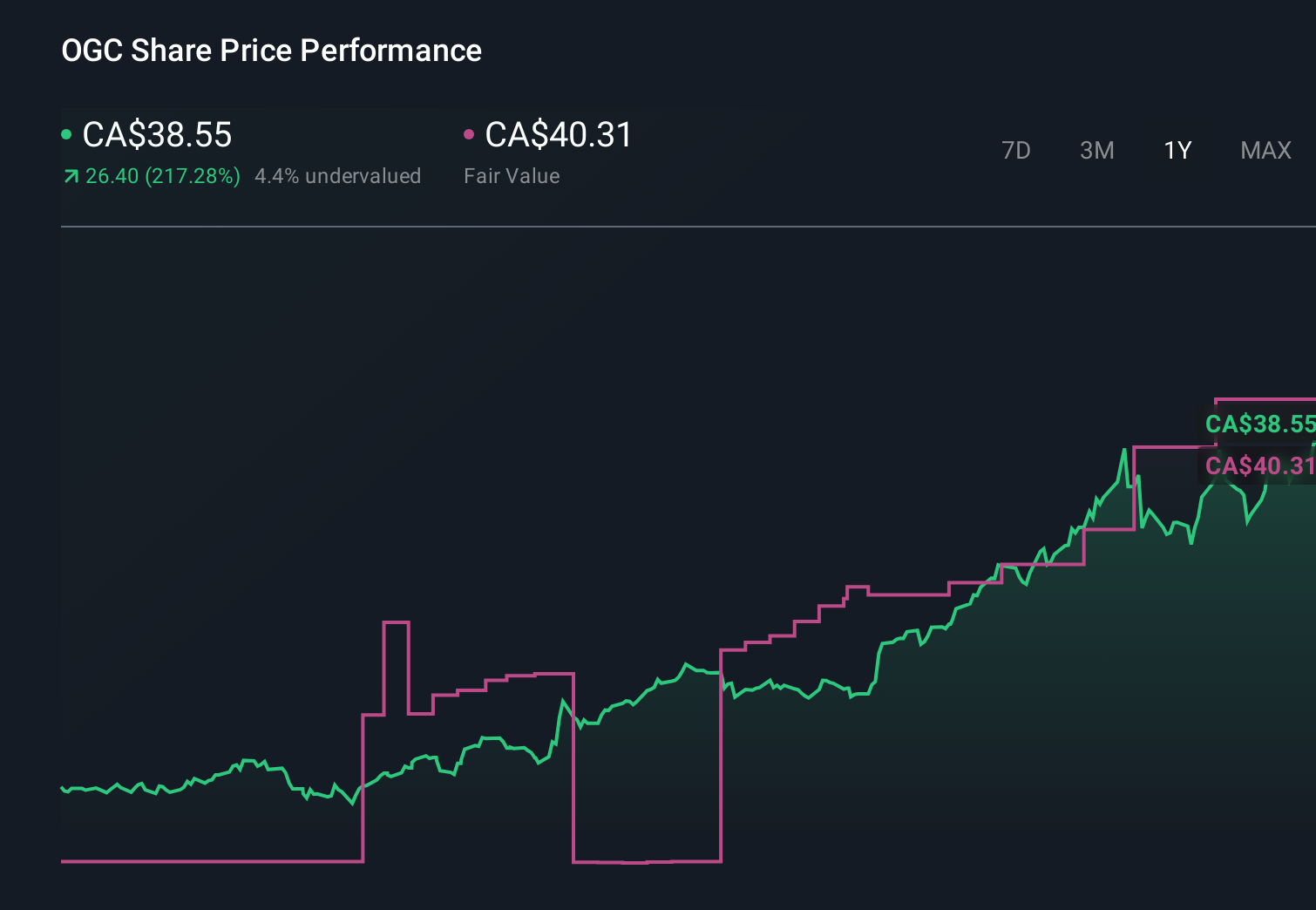

Uncover how OceanaGold's forecasts yield a CA$40.31 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$5.87 to US$155.57, showing how far apart individual views can be. Set against this spread, the key near term question many will weigh is how harder than expected ore and weather related challenges at core mines could affect the operational performance underpinning any of those valuations.

Explore 8 other fair value estimates on OceanaGold - why the stock might be worth less than half the current price!

Build Your Own OceanaGold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanaGold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free OceanaGold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanaGold's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OGC

OceanaGold

A gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)