- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Undervalued Equity Opportunities For December 2024

Reviewed by Simply Wall St

As global markets grapple with cautious Fed commentary and political uncertainties, recent rate cuts and economic data have added layers of complexity to investor sentiment. Amidst this backdrop, identifying undervalued stocks can present unique opportunities for investors seeking potential value plays in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Bank (SHSE:601187) | CN¥5.69 | CN¥11.34 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| T'Way Air (KOSE:A091810) | ₩2505.00 | ₩4994.20 | 49.8% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409580.73 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥13.24 | CN¥26.38 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

Let's explore several standout options from the results in the screener.

Aris Mining (TSX:ARIS)

Overview: Aris Mining Corporation, with a market cap of CA$871.59 million, focuses on acquiring, exploring, developing, and operating gold properties in Canada, Colombia, and Guyana.

Operations: The company generates revenue from its Marmato Project, contributing $52.68 million, and Segovia Operations, which bring in $431.83 million.

Estimated Discount To Fair Value: 45.4%

Aris Mining is trading at CA$5.1, significantly below its estimated fair value of CA$9.34, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution and a net loss of US$2.07 million in Q3 2024, the company's revenue is projected to grow by 25.5% annually, outpacing the Canadian market's growth rate. Aris has also completed a US$450 million debt offering to refinance existing notes and support operations, indicating strategic financial management amidst profitability forecasts over three years.

- In light of our recent growth report, it seems possible that Aris Mining's financial performance will exceed current levels.

- Click here to discover the nuances of Aris Mining with our detailed financial health report.

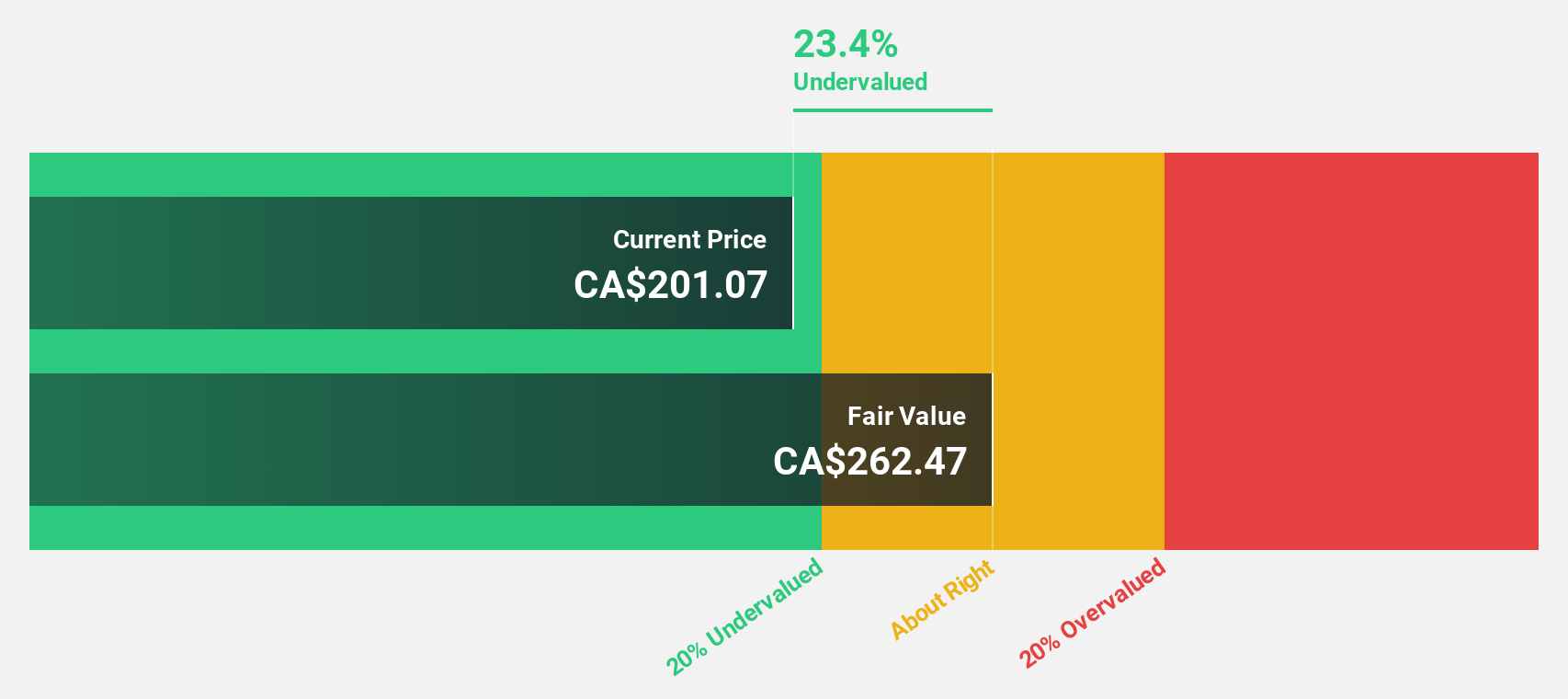

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$5.02 billion.

Operations: The company's revenue is primarily derived from its software and programming segment, totaling $471.17 million.

Estimated Discount To Fair Value: 38.7%

Kinaxis, trading at CA$178.61, is valued below its estimated fair value of CA$291.19, highlighting potential undervaluation based on cash flows. Despite recent insider selling, the company's earnings are projected to grow significantly faster than the Canadian market over the next three years. Recent partnerships with NTT DATA Japan and Octapharma reflect Kinaxis's expanding influence in supply chain management across diverse industries, potentially enhancing its revenue growth prospects beyond current forecasts of 12.9% annually.

- Insights from our recent growth report point to a promising forecast for Kinaxis' business outlook.

- Get an in-depth perspective on Kinaxis' balance sheet by reading our health report here.

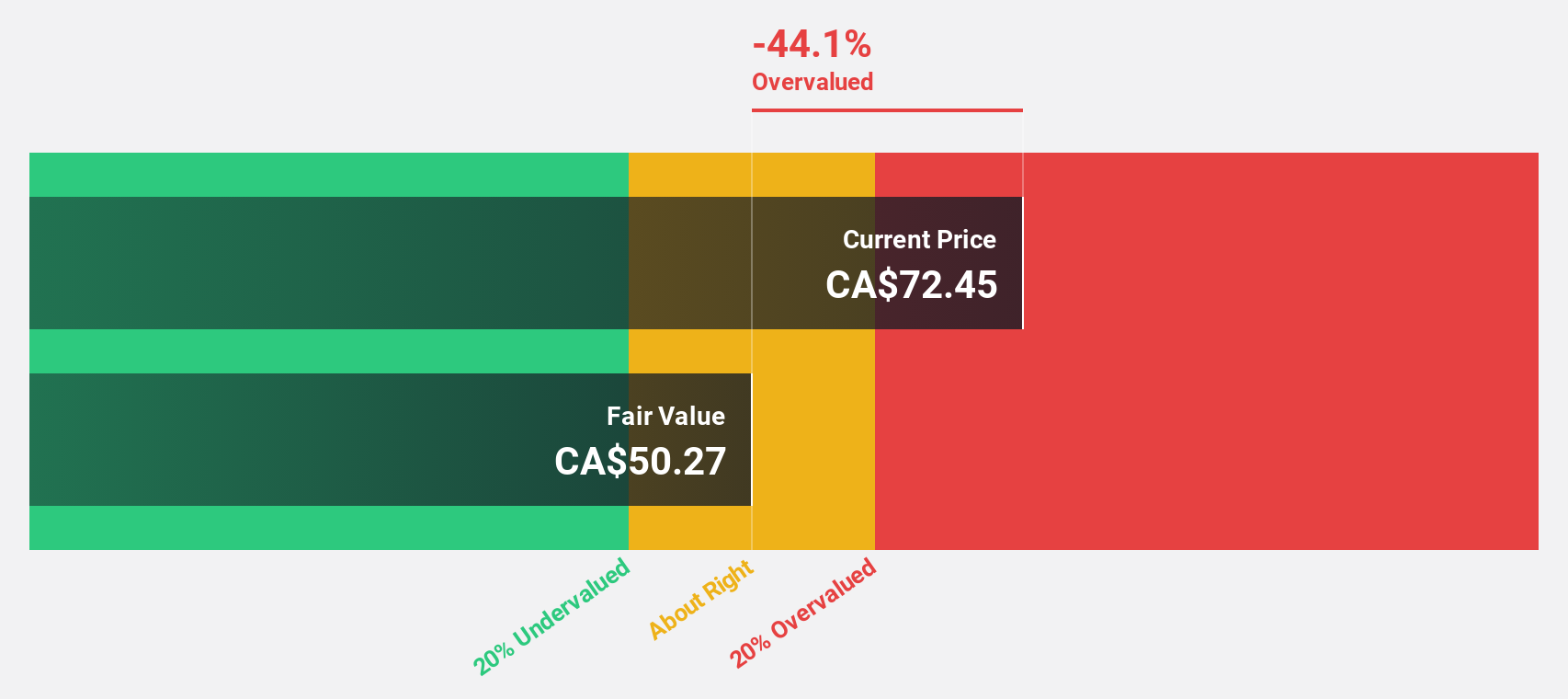

Lundin Gold (TSX:LUG)

Overview: Lundin Gold Inc. is a Canadian mining company with a market cap of CA$7.47 billion, focusing on gold production and exploration activities.

Operations: The company's revenue is primarily derived from its Fruta Del Norte mining operations, amounting to $1.04 billion.

Estimated Discount To Fair Value: 45.8%

Lundin Gold, trading at CA$31.12, is significantly undervalued compared to its estimated fair value of CA$57.38, suggesting potential based on cash flows. The company's earnings have grown substantially over the past year and are forecasted to continue growing at a high rate annually. Recent drilling results from Fruta del Norte indicate promising expansion potential, which could further enhance future production and revenue streams, supporting the case for its undervaluation.

- Our growth report here indicates Lundin Gold may be poised for an improving outlook.

- Dive into the specifics of Lundin Gold here with our thorough financial health report.

Next Steps

- Gain an insight into the universe of 868 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives