- Canada

- /

- Metals and Mining

- /

- TSX:LGO

Largo (TSX:LGO): Assessing Value After Debt Restructuring Unlocks Financial Flexibility

Reviewed by Kshitija Bhandaru

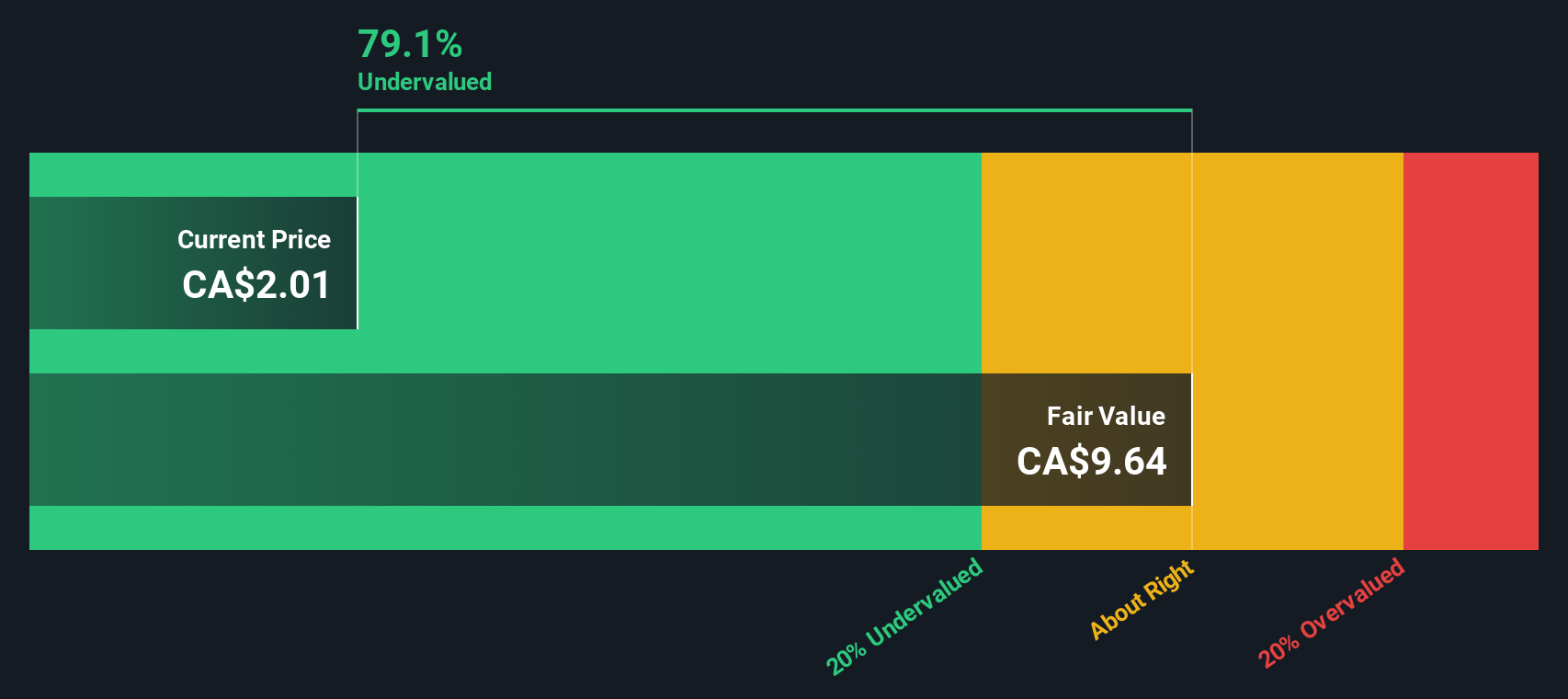

Largo (TSX:LGO) has reached an agreement with five Brazilian lenders to defer $84 million in principal debt repayments until at least March 2026. This arrangement is contingent on raising at least CAD 30 million in new capital by November 2025. Investors are watching how this deal could affect Largo’s financial flexibility and future growth options.

See our latest analysis for Largo.

Largo’s latest debt deal has added fresh momentum, with a 1-day share price return of over 25% and a remarkable 86% gain over the past quarter. While the company is still digging out from a multi-year total shareholder return of -56% over three years, investors appear more optimistic in the short term as new financial breathing room opens up possibilities for turning the corner.

If you’re curious what else is gaining traction lately, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares surging and the company enjoying new financial leeway, investors must weigh whether Largo remains undervalued at current levels or if the market is already factoring in future growth, which could leave little room for upside.

Price-to-Sales of 1.5x: Is it justified?

Largo is trading at a price-to-sales ratio of 1.5x, which positions the stock well below both peer and industry averages. With the last close at CA$3.52, this valuation could signal a compelling entry for value-focused investors, especially when compared to the broader market.

The price-to-sales (P/S) ratio indicates how much investors are willing to pay for each dollar of the company’s revenue. For a metals and mining company like Largo, this metric matters because industry earnings can be volatile. Revenue-based multiples can therefore provide a more stable comparison.

Largo’s P/S of 1.5x stands out sharply against the peer average of 19.5x and the Canadian metals and mining industry average of 5.8x. This discount hints that the market may be underestimating Largo’s revenue growth potential given the improved financial flexibility. However, it is worth noting that analyst and narrative earnings estimates are limited due to current unprofitability. Compared to an estimated fair price-to-sales ratio of 0.7x, Largo is still considered expensive, suggesting there could be further downside if the market resets expectations.

Explore the SWS fair ratio for Largo

Result: Price-to-Sales of 1.5x (UNDERVALUED compared to industry and peers, EXPENSIVE relative to fair ratio)

However, lingering unprofitability and the possibility of slower revenue growth remain key risks. These factors could dampen optimism around Largo’s recent financial momentum.

Find out about the key risks to this Largo narrative.

Another View: Our DCF Model Breaks Down Largo’s Value

Looking at Largo from another angle, our DCF model suggests the shares are trading at a significant discount, about 62% below the estimated fair value of CA$9.20. This signals potential upside that could challenge what traditional revenue multiples imply. Are investors missing a deeper value story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Largo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Largo Narrative

If you’re seeing things differently or want to dive into the numbers yourself, it’s easy to build your own perspective in just a few minutes, and Do it your way.

A great starting point for your Largo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one stock when you could spot tomorrow’s winners now? Stay a step ahead by tapping into these targeted investment screens:

- Maximize long-term returns by uncovering undervalued gems with strong fundamentals through these 881 undervalued stocks based on cash flows.

- Catch technology’s next big leap by focusing on innovation leaders with real potential using these 26 quantum computing stocks.

- Secure steady passive income and build wealth by checking out these 18 dividend stocks with yields > 3% with high-yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LGO

Largo

Engages in the development and sale of vanadium-based energy storage systems in Canada.

Undervalued with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion