- Canada

- /

- Metals and Mining

- /

- TSX:KNT

3 TSX Stocks Estimated To Be Up To 34.8% Below Intrinsic Value

Reviewed by Simply Wall St

The Canadian stock market has been enjoying a period of steady gains and low volatility, buoyed by trade optimism and solid corporate earnings. As the TSX continues to climb amid easing uncertainties, investors are increasingly focused on identifying undervalued stocks that may offer potential upside in this environment.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| West Fraser Timber (TSX:WFG) | CA$96.24 | CA$166.05 | 42% |

| TerraVest Industries (TSX:TVK) | CA$170.33 | CA$316.92 | 46.3% |

| OceanaGold (TSX:OGC) | CA$18.70 | CA$33.22 | 43.7% |

| Magellan Aerospace (TSX:MAL) | CA$16.95 | CA$26.85 | 36.9% |

| K92 Mining (TSX:KNT) | CA$14.32 | CA$21.97 | 34.8% |

| Ivanhoe Mines (TSX:IVN) | CA$11.02 | CA$18.69 | 41.1% |

| goeasy (TSX:GSY) | CA$185.23 | CA$367.35 | 49.6% |

| Foraco International (TSX:FAR) | CA$1.63 | CA$3.24 | 49.8% |

| Exchange Income (TSX:EIF) | CA$66.20 | CA$100.82 | 34.3% |

| Blackline Safety (TSX:BLN) | CA$6.36 | CA$9.89 | 35.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis Group Inc. is a company that, along with its subsidiaries, offers professional services, project management, and capital investment services across the United Kingdom, Canada, the United States, Saudi Arabia, and other international markets; it has a market cap of CA$16.25 billion.

Operations: The revenue segments for AtkinsRéalis Group Inc. include Engineering Services - UKI at CA$2.53 billion, Engineering Services - USLA at CA$1.72 billion, Engineering Services - Canada at CA$1.42 billion, Nuclear at CA$1.73 billion, Engineering Services - AMEA at CA$1.31 billion, Linxon at CA$900.71 million, Capital at CA$133.33 million, and LSTK Projects at CA$200.97 million.

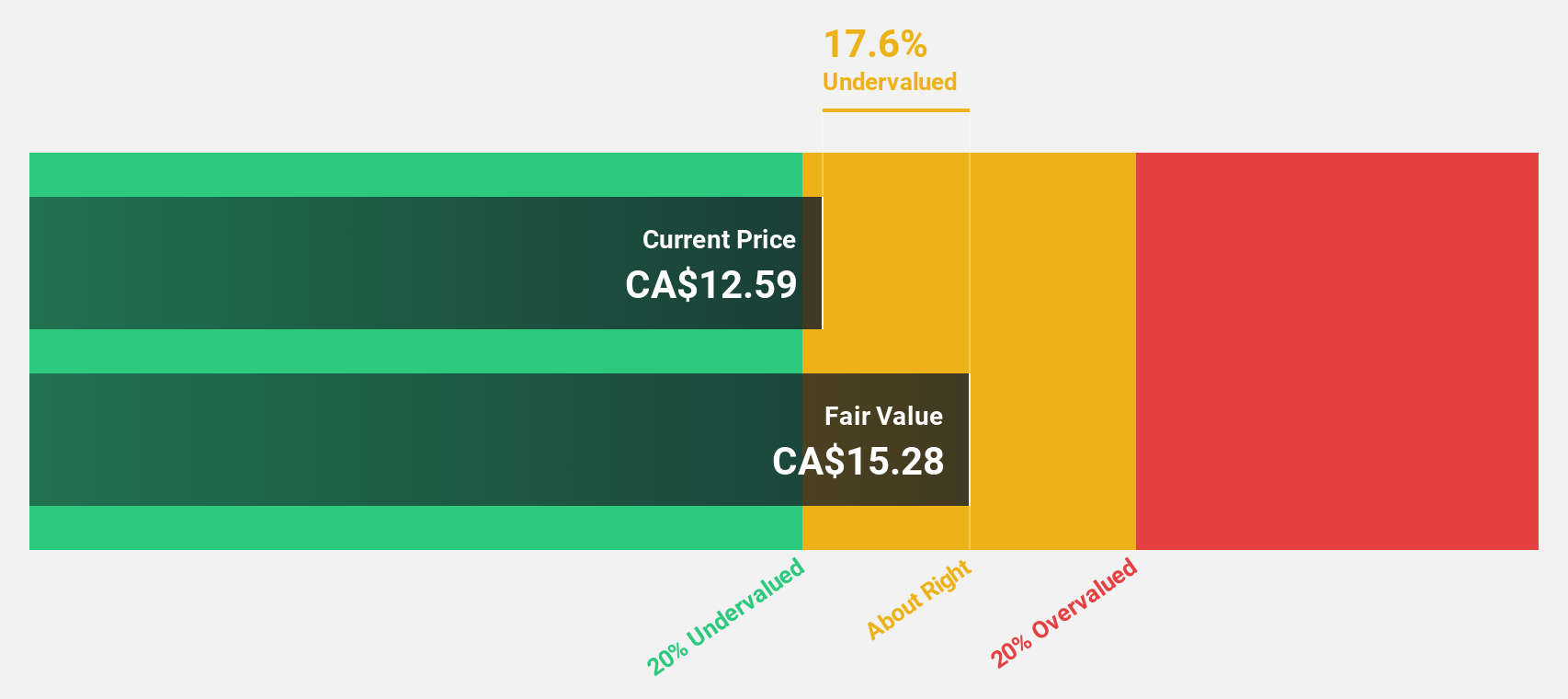

Estimated Discount To Fair Value: 19%

AtkinsRéalis Group is trading at CA$98, below its estimated fair value of CA$121, indicating potential undervaluation based on cash flows. Recent strategic alliances, such as the consultancy agreement for the Hong Kong-Shenzhen Western Rail Link and environmental services in the UK, highlight its growth initiatives. Despite a modest revenue growth forecast of 7.1% per year, earnings are expected to grow significantly by 22.9% annually, outpacing the Canadian market's average earnings growth rate.

- Our growth report here indicates AtkinsRéalis Group may be poised for an improving outlook.

- Navigate through the intricacies of AtkinsRéalis Group with our comprehensive financial health report here.

Aya Gold & Silver (TSX:AYA)

Overview: Aya Gold & Silver Inc. is involved in the exploration, evaluation, and development of precious metals projects in Morocco and has a market capitalization of CA$1.81 billion.

Operations: The company's revenue is primarily generated from the production at the Zgounder Silver Mine in Morocco, amounting to $67.87 million.

Estimated Discount To Fair Value: 28.1%

Aya Gold & Silver is trading at CA$12.12, below its fair value estimate of CA$16.85, suggesting it may be undervalued based on cash flows. Recent high-grade drill results from Boumadine and Zgounder in Morocco support significant resource growth potential. With revenue expected to grow 30.8% annually—faster than the Canadian market—and a forecasted earnings growth of 57.85% per year, Aya's financial outlook appears robust despite low return on equity projections (8.3%).

- Our expertly prepared growth report on Aya Gold & Silver implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Aya Gold & Silver with our detailed financial health report.

K92 Mining (TSX:KNT)

Overview: K92 Mining Inc. is involved in the exploration and development of mineral deposits in Papua New Guinea, with a market cap of CA$3.59 billion.

Operations: The company's revenue is primarily generated from the Kainantu Project, which amounts to $435.43 million.

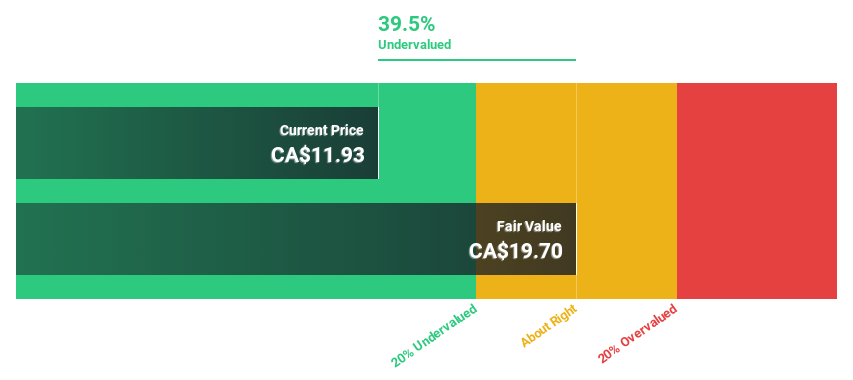

Estimated Discount To Fair Value: 34.8%

K92 Mining, trading at CA$14.32, is undervalued with a fair value estimate of CA$21.97 based on cash flows. The company reported strong production results and reiterated its 2025 guidance of 160,000 to 185,000 oz AuEq. Despite slower forecasted revenue growth (18.4% annually) compared to peers, earnings are expected to grow faster than the Canadian market at 13.5% annually. Recent high-grade drilling results bolster expansion potential at the Kainantu Gold Mine in Papua New Guinea.

- Our comprehensive growth report raises the possibility that K92 Mining is poised for substantial financial growth.

- Take a closer look at K92 Mining's balance sheet health here in our report.

Seize The Opportunity

- Reveal the 22 hidden gems among our Undervalued TSX Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K92 Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KNT

K92 Mining

Engages in the exploration and development of mineral deposits in Papua New Guinea.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives