TSX Value Picks: Constellation Software And 2 Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

The Canadian market has seen a positive trend, with a 1.1% increase over the last week and a 21% rise over the past year, alongside anticipated annual earnings growth of 15%. In this favorable environment, identifying undervalued stocks like Constellation Software can provide investors with opportunities to capitalize on potential market gains.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.41 | CA$22.07 | 48.3% |

| Savaria (TSX:SIS) | CA$21.51 | CA$40.99 | 47.5% |

| Kinaxis (TSX:KXS) | CA$156.29 | CA$279.18 | 44% |

| Calian Group (TSX:CGY) | CA$46.78 | CA$73.15 | 36% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$33.80 | CA$62.12 | 45.6% |

| Blackline Safety (TSX:BLN) | CA$5.70 | CA$11.03 | 48.3% |

| NFI Group (TSX:NFI) | CA$18.71 | CA$37.19 | 49.7% |

| Boyd Group Services (TSX:BYD) | CA$204.00 | CA$336.26 | 39.3% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Underneath we present a selection of stocks filtered out by our screen.

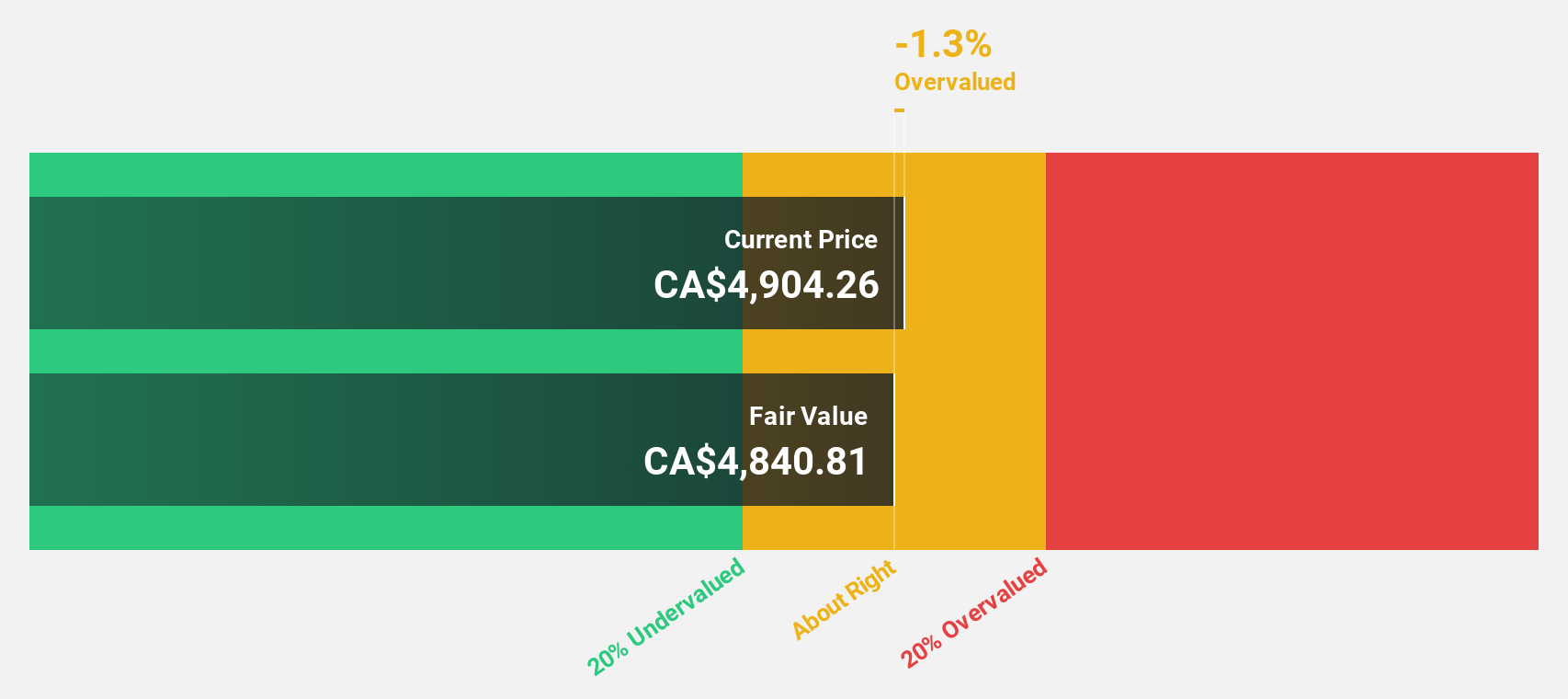

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc., with a market cap of CA$93.46 billion, acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

Operations: Constellation Software generates revenue primarily from its Software & Programming segment, amounting to $9.27 billion.

Estimated Discount To Fair Value: 20.5%

Constellation Software is trading at CA$4372, which is 20.5% below its estimated fair value of CA$5502.06, indicating it may be undervalued based on cash flows. Despite a high level of debt and significant insider selling over the past three months, earnings grew by 33.5% last year and are forecast to grow 23.55% annually, outpacing the Canadian market's expected growth rate of 14.8%. Recent Q2 earnings show strong revenue growth from US$2.04 billion to US$2.47 billion year-over-year with net income rising from US$103 million to US$177 million.

- Our earnings growth report unveils the potential for significant increases in Constellation Software's future results.

- Take a closer look at Constellation Software's balance sheet health here in our report.

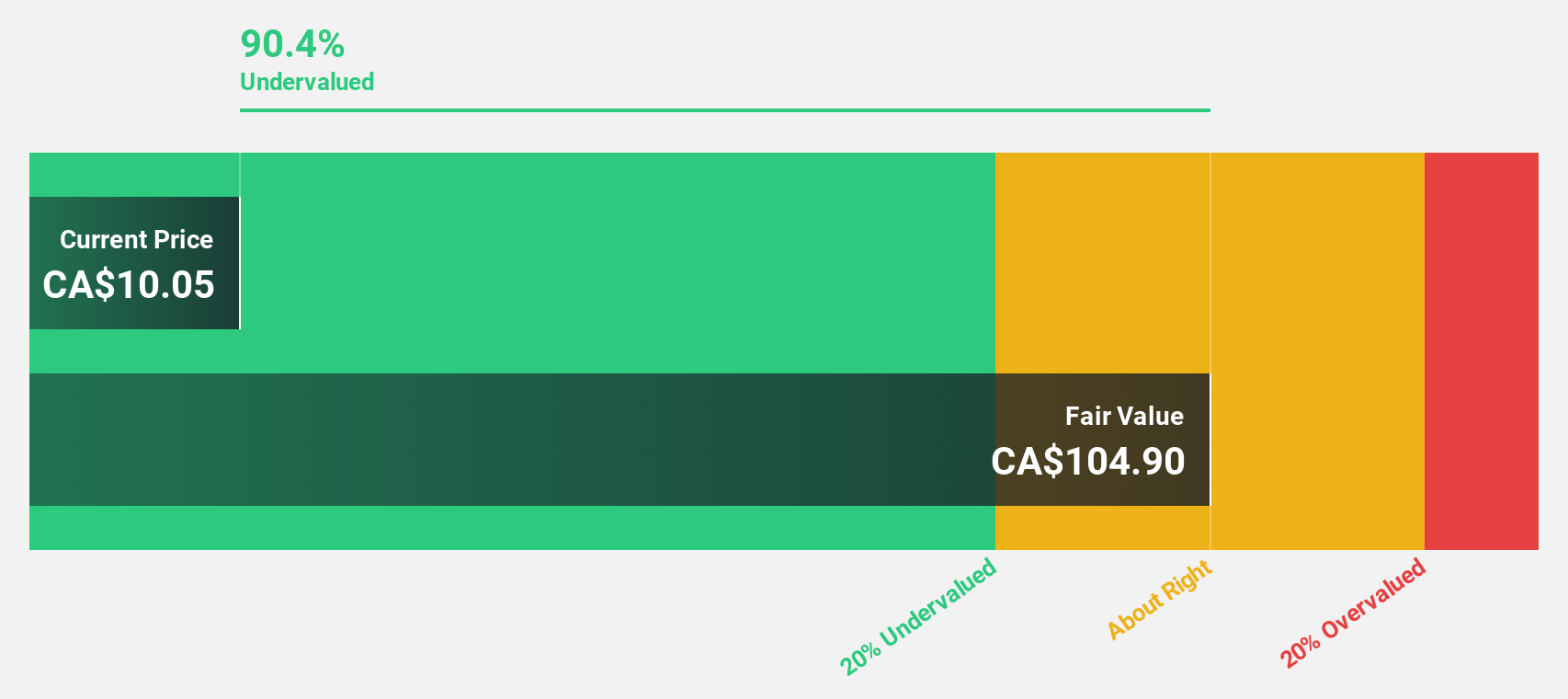

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals mainly in Africa, with a market cap of CA$26.30 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

Estimated Discount To Fair Value: 18.3%

Ivanhoe Mines, trading at CA$19.21, is 18.3% below its estimated fair value of CA$23.53, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 71.5% annually over the next three years, outpacing the Canadian market's growth rate of 14.8%. Recent developments include a memorandum with Zambia's Ministry of Mines for exploration activities and record production levels at the Kamoa-Kakula Copper Complex in August 2024.

- In light of our recent growth report, it seems possible that Ivanhoe Mines' financial performance will exceed current levels.

- Click here to discover the nuances of Ivanhoe Mines with our detailed financial health report.

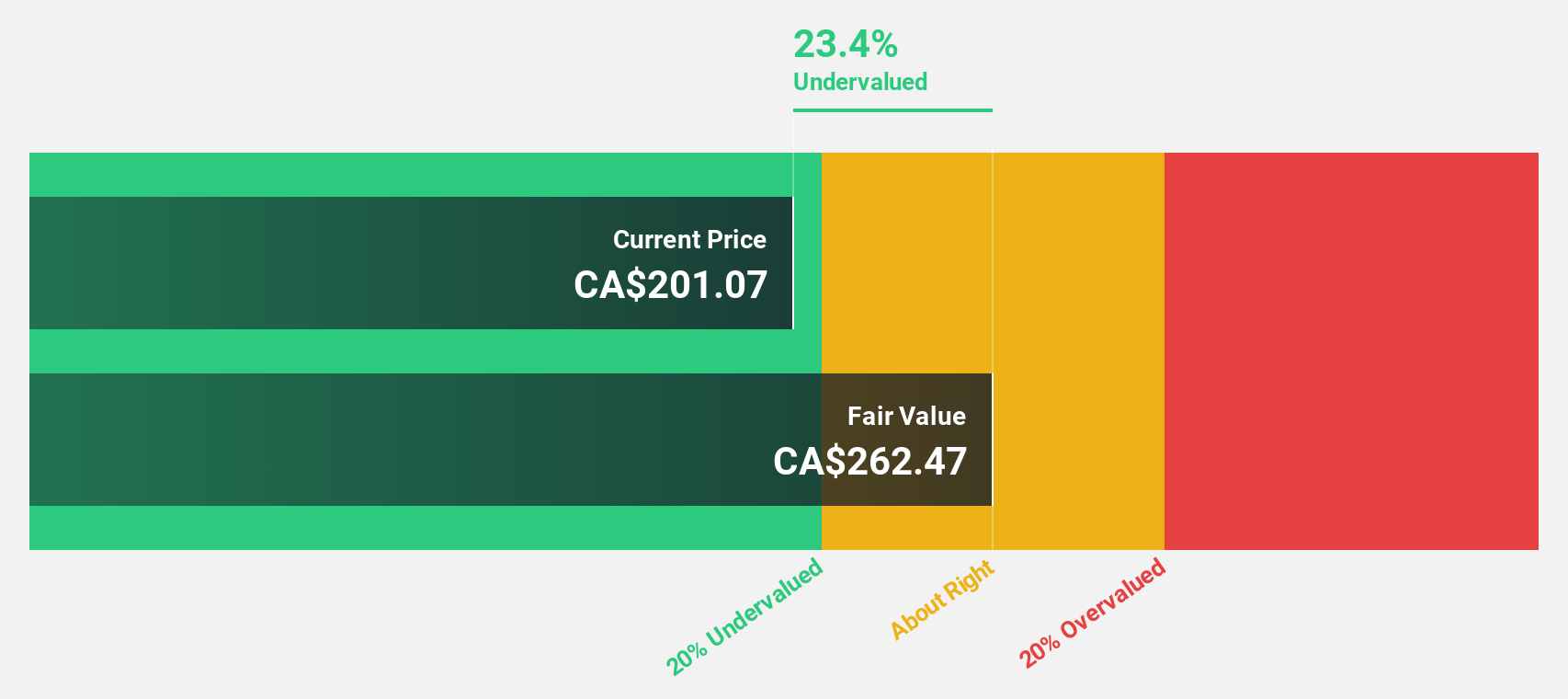

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.35 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $457.72 million.

Estimated Discount To Fair Value: 44%

Kinaxis, trading at CA$156.29, is significantly undervalued with an estimated fair value of CA$279.18. Earnings are forecast to grow 48.88% annually, outpacing the Canadian market's 14.8%. Recent investor activism has urged strategic reviews and potential sales due to leadership changes and execution issues, but the board remains focused on its strategic plan to maximize shareholder value. Kinaxis continues to expand its market presence in supply chain management software with notable client acquisitions like Brother and Syensqo.

- Insights from our recent growth report point to a promising forecast for Kinaxis' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Kinaxis.

Seize The Opportunity

- Gain an insight into the universe of 27 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

High growth potential with questionable track record.