- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN): Assessing Valuation After Record Zinc Output and Upbeat Production Guidance

Reviewed by Kshitija Bhandaru

Ivanhoe Mines (TSX:IVN) has released third quarter operating results, highlighting record zinc output at the Kipushi concentrator following the completion of its debottlenecking program. The company also reaffirmed its copper and zinc production targets for 2025.

See our latest analysis for Ivanhoe Mines.

Ivanhoe Mines’ strong operational update and record zinc output from Kipushi have helped the share price build momentum, with a 22.7% gain over the past month and an impressive 42.5% share price return in the last 90 days. However, total shareholder return is still down 17.5% over the past year. This reminds investors that even with recent progress, there is ground to regain. Over the longer term, Ivanhoe continues to stand out with a 78% total return over three years and 200% over five years. This signals potential for those with patience and highlights how quickly sentiment can shift as operational challenges turn into opportunities.

If Ivanhoe’s turnaround has you considering what else is out there, this is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With the stock up sharply in recent months and fresh records from Kipushi, the question now is whether Ivanhoe Mines is still trading at an attractive value or if expectations for future growth are already priced in.

Most Popular Narrative: 6.9% Undervalued

Ivanhoe Mines closed at CA$15.58, while the most popular narrative suggests a fair value of CA$16.73. This perspective provides a modest upside based on revenue growth, margin projections, and the latest operational catalysts.

Completion and ramp-up of the Kamoa-Kakula smelter (targeted for September) and the associated drop in logistics costs are expected to meaningfully reduce unit costs, directly boosting future operating margins and cash flow. Ongoing capacity expansions at Kamoa-Kakula (Phases 1 to 3) and de-bottlenecking at Kipushi, alongside operational recovery from the recent seismic event, are projected to drive substantial increases in copper and zinc output. These developments are expected to support strong top-line revenue growth in the next 12 to 24 months as production returns to full scale.

The logic behind this valuation hinges on bold production ramp-ups, aggressive cost-cutting, and some notable forecasts for future earnings power. Want to peek under the hood and see what future growth rates and profit margins are reflected in these projections? The full narrative reveals exactly why the fair value stands above the current share price.

Result: Fair Value of $16.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing risks from seismic events and reliance on lower-grade ore could disrupt Ivanhoe Mines' recovery, affecting production and margins in the near term.

Find out about the key risks to this Ivanhoe Mines narrative.

Another View: Valuation Based on Earnings Multiples

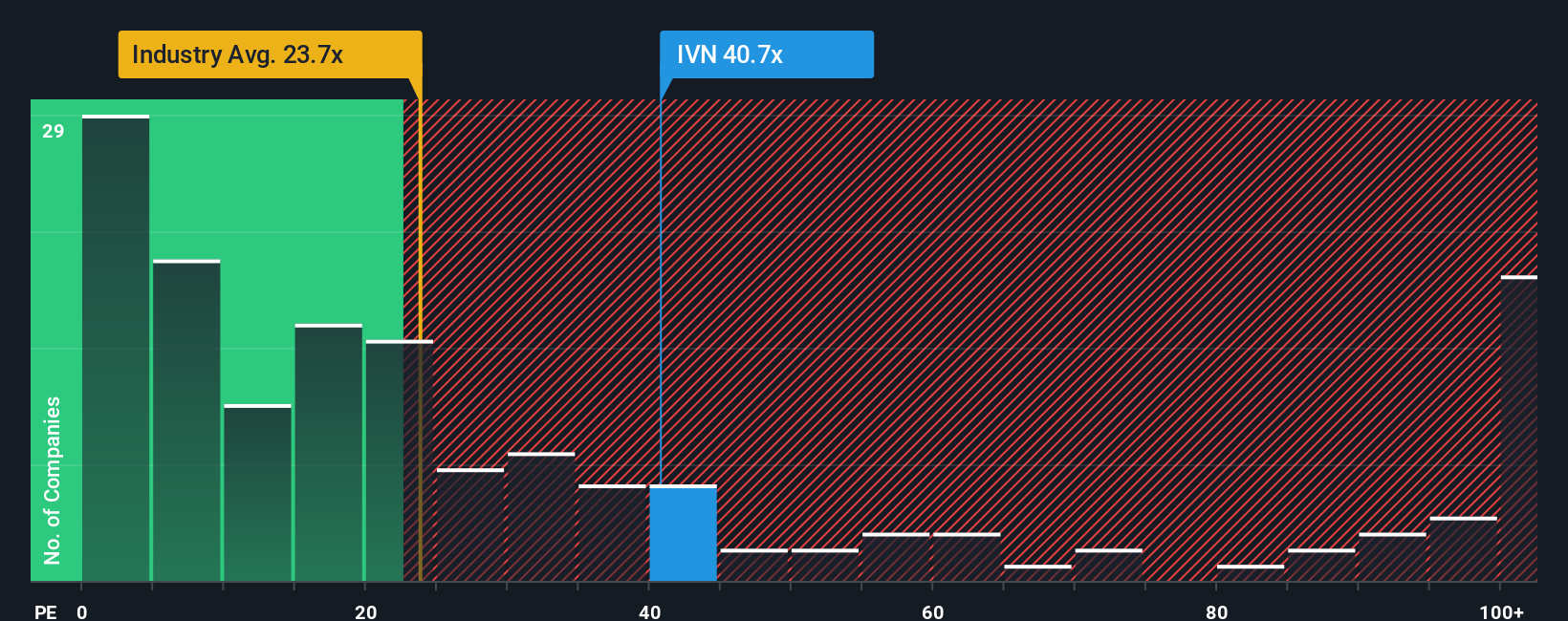

Looking from a different angle, Ivanhoe Mines currently trades at a price-to-earnings ratio of 40, which is well above both the Canadian Metals and Mining industry average of 24 and the fair ratio of 35.5. This premium means the market is expecting substantial future growth, but also highlights the risk if those expectations do not materialize. Will investor optimism continue to drive the share price higher, or could these lofty multiples bring valuation back to earth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

If you want to take a hands-on approach or think your own research might reveal a different story, you can build a personalised narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ivanhoe Mines.

Looking for more investment ideas?

Expand your investing game and set yourself up for tomorrow’s winners with these standout themes. Don’t miss the chance to spot opportunities your peers might overlook!

- Tap into the surge of artificial intelligence by scanning these 25 AI penny stocks driving transformation across multiple industries with innovative machine learning and automation breakthroughs.

- Fuel your portfolio with reliable income: check out these 18 dividend stocks with yields > 3% that consistently pay attractive yields above 3% and provide stability even in volatile markets.

- Catch the upside in undervalued opportunities by reviewing these 881 undervalued stocks based on cash flows that are priced below their fair value estimates, setting you up for potential gains as markets adjust.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives