- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Has Ivanhoe Mines Rallied Too Far After Copper Output Forecast and 20% Share Surge?

Reviewed by Bailey Pemberton

If you are looking at Ivanhoe Mines and wondering what to do next, you are not alone. The stock has delivered a roller coaster of performance over the past year, and investors are crunching the numbers to decide if now is the right time to make a move. After a strong bounce in the last month, with a gain of 19.7%, and a robust 6.4% rise over the past week, Ivanhoe is showing signs of renewed momentum. Yet, stepping back a bit, the year-to-date return is still in the red at -12.8%, with a steeper loss of -26.8% over the past twelve months. Long-term holders, however, have enjoyed a remarkable run, as the stock soared 68.3% over three years and an impressive 215.8% over five.

Markets have clearly been re-evaluating Ivanhoe’s prospects. Part of this stems from upbeat sentiment related to large copper discoveries and ongoing construction progress at their key mining sites. Global shifts in commodity demand, especially with copper’s role in the energy transition, have also played a part in changing risk perceptions around Ivanhoe’s future.

But what about valuation? According to our analysis, Ivanhoe Mines checks just 1 of 6 undervaluation criteria on our proprietary value score. That suggests the stock might not be as much of a bargain as some of the recent excitement could have you believe. In the next section, I will walk you through each of the main valuation methods and later in the article, reveal a smarter way to interpret what valuation really means for Ivanhoe Mines investors.

Ivanhoe Mines scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ivanhoe Mines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and discounting them back to today’s value. This approach gives an estimate of the business’s intrinsic worth. It helps investors bypass short-term market noise and focus on a company’s fundamental ability to generate future cash.

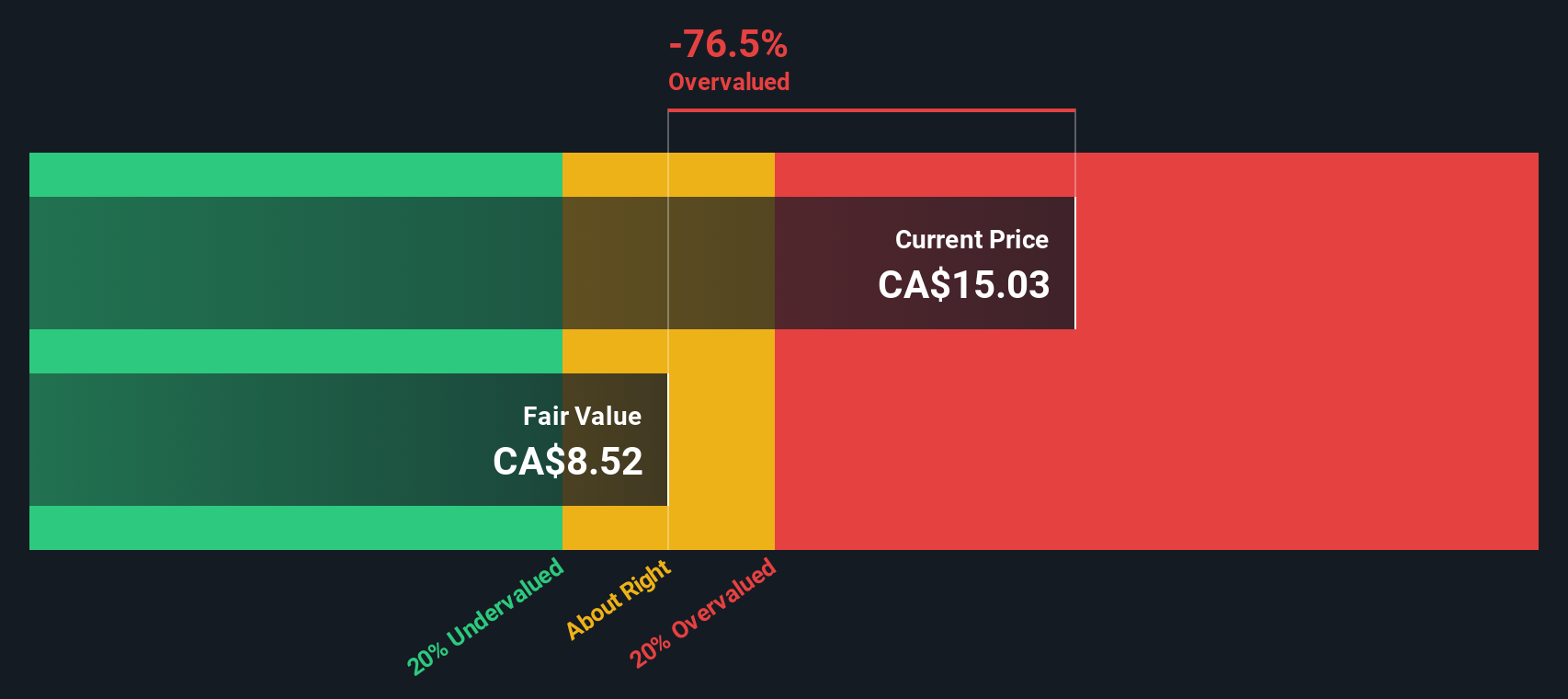

Ivanhoe Mines’ most recent twelve-month free cash flow stands at -$1.42 billion, reflecting the heavy investments and construction costs required for its major mining projects. Analyst estimates predict negative cash flow will persist for the next few years, with the company expected to turn positive in 2028 with $719 million and reach $449 million in 2035, based on both analyst forecasts and extended projections. All values are reported in USD ($).

Based on these forecasts and discounting them to present value using a two-stage DCF approach, Ivanhoe Mines’ estimated intrinsic value per share is $8.51. With the current share price at $14.99 (CA$), this means the stock is trading at a 76.5% premium to its intrinsic DCF valuation and is significantly overvalued as of today’s analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ivanhoe Mines may be overvalued by 76.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ivanhoe Mines Price vs Earnings

For profitable companies, the price-to-earnings (PE) ratio is one of the most widely used metrics to quickly compare valuation. It tells investors how much they are paying for each dollar of profit, which makes it especially relevant when a company like Ivanhoe Mines starts generating consistent earnings.

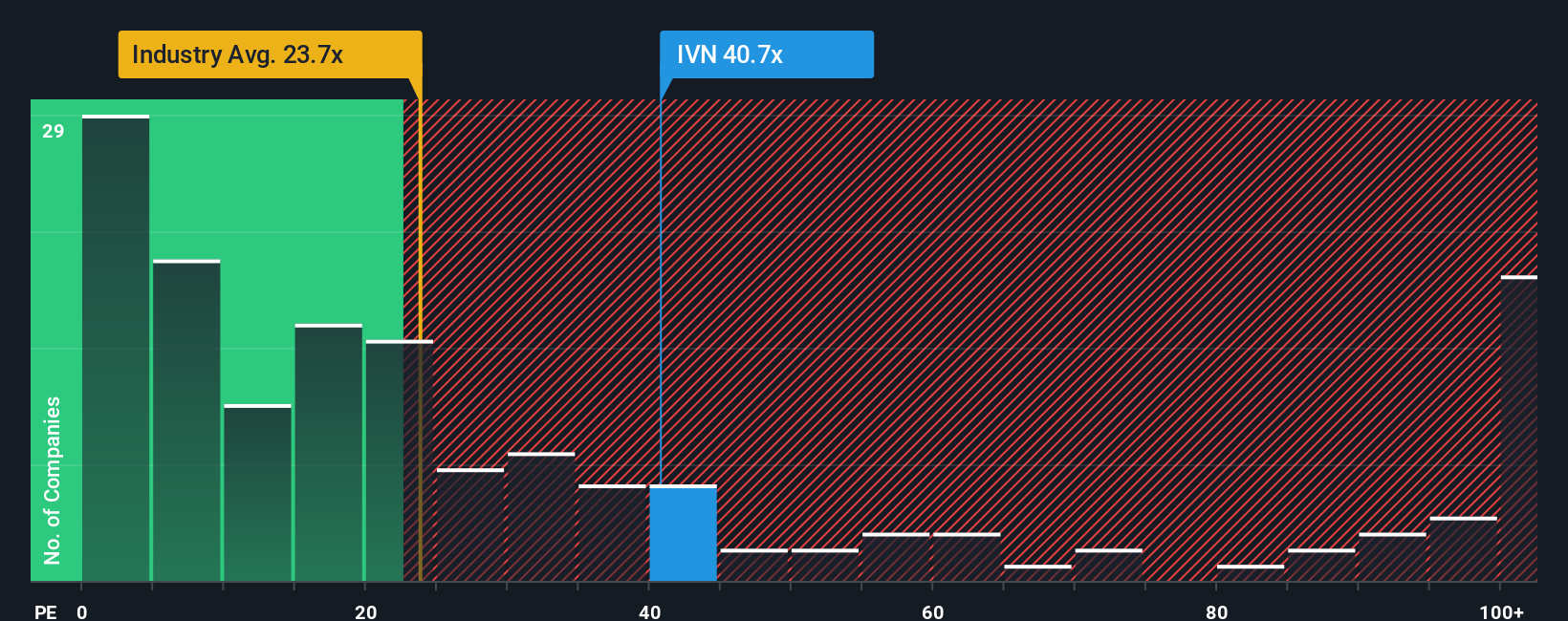

It is important to remember that what counts as a “fair” PE ratio can vary a lot. Higher growth expectations or perceived business quality usually justify a higher PE, while above-average risks can drag it down. Market trends and investor appetite for the sector also play a role in determining reasonable multiples.

Currently, Ivanhoe Mines trades at a PE ratio of 37.29x. This is well above the broader Metals and Mining industry average of 24.03x, but actually lower than its peer group, which is at a lofty 80.20x. To sharpen the picture, we turn to the proprietary Fair Ratio from Simply Wall St, which for Ivanhoe Mines is calculated at 34.88x. This metric stands out because it factors in the company’s actual growth prospects, profit margins, risk profile, and competitive environment, rather than just relying on blunt averages or peer numbers. The Fair Ratio can therefore provide a more customized and realistic benchmark for a stock’s value today.

Since Ivanhoe’s actual PE ratio (37.29x) is just slightly above its Fair Ratio (34.88x), the stock appears only modestly overvalued, if at all, by this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ivanhoe Mines Narrative

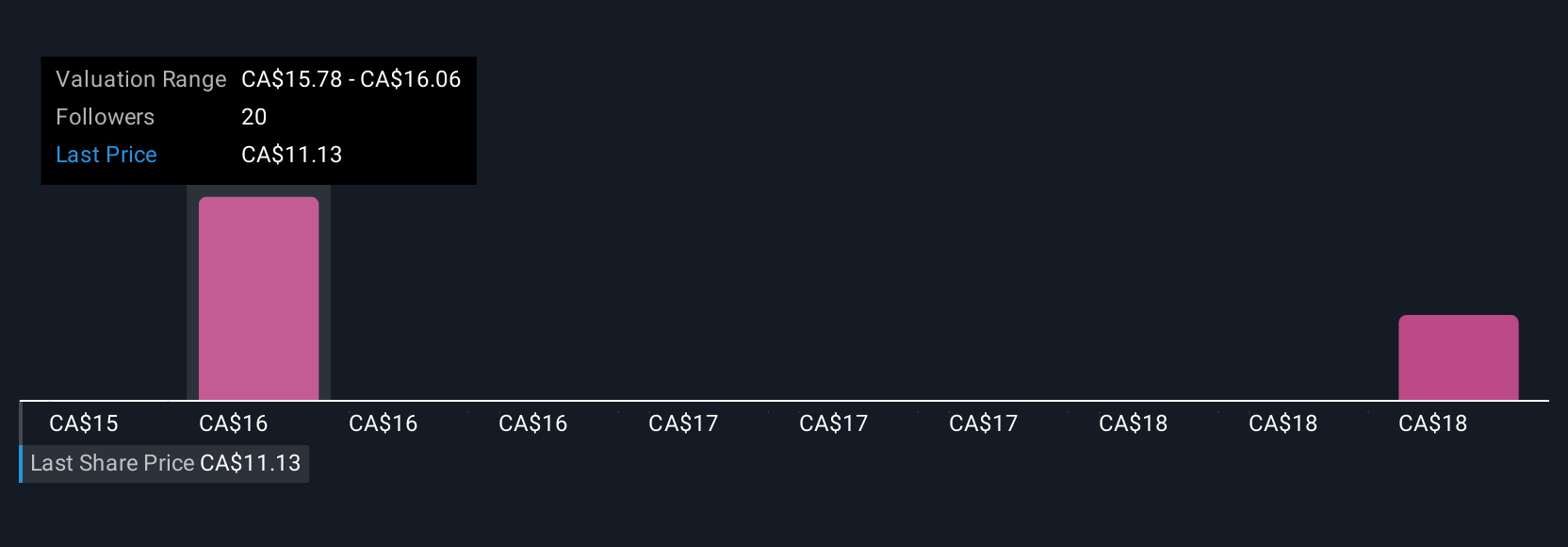

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple framework that lets you turn your view of a company, the story you believe, including your expectations for revenue, earnings, and margins, into a tailored financial forecast and a fair value estimate.

Rather than relying solely on numbers or ratios, Narratives bridge the gap between a company’s story and your investment decisions, making the "why" behind the numbers front and center. Narratives are uniquely available directly on Simply Wall St's platform in the Community page, making them highly accessible for any investor to use and update.

Narratives empower you to see how your fair value compares to the current price, helping you decide whether to buy or sell, while automatically adjusting as new information, such as news or earnings, is released. For Ivanhoe Mines, for instance, one investor’s Narrative might highlight major production gains and efficiency improvements from new projects, leading to an optimistic valuation, while another might focus on operational risks and volatility in the copper market, arriving at a more cautious fair value. Narratives ensure your analysis evolves along with the facts, giving you a smarter and more dynamic edge in your investment journey.

Do you think there's more to the story for Ivanhoe Mines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives