3 TSX Companies That May Be Trading Below Their Intrinsic Value Estimates

Reviewed by Simply Wall St

In the last week, the Canadian market has been flat, but it is up 19% over the past year with earnings forecast to grow by 15% annually. In this context, identifying stocks that may be trading below their intrinsic value can offer investors potential opportunities for growth and stability.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.42 | CA$22.12 | 48.4% |

| goeasy (TSX:GSY) | CA$181.08 | CA$360.15 | 49.7% |

| Savaria (TSX:SIS) | CA$21.71 | CA$41.19 | 47.3% |

| Kinaxis (TSX:KXS) | CA$159.57 | CA$280.44 | 43.1% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$33.35 | CA$55.65 | 40.1% |

| Blackline Safety (TSX:BLN) | CA$5.85 | CA$11.03 | 47% |

| NFI Group (TSX:NFI) | CA$18.81 | CA$37.37 | 49.7% |

| Boyd Group Services (TSX:BYD) | CA$204.87 | CA$336.65 | 39.1% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Let's dive into some prime choices out of the screener.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$25.42 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

Estimated Discount To Fair Value: 21%

Ivanhoe Mines (CA$18.75) is trading 21% below its estimated fair value (CA$23.74), suggesting it may be undervalued based on cash flows. Revenue growth is forecasted at 83.5% per year, significantly outpacing the Canadian market average of 6.9%. Recent developments include a memorandum of understanding with Zambia's Ministry of Mines and record copper production at the Kamoa-Kakula Copper Complex, enhancing its long-term growth prospects and operational stability.

- Our earnings growth report unveils the potential for significant increases in Ivanhoe Mines' future results.

- Take a closer look at Ivanhoe Mines' balance sheet health here in our report.

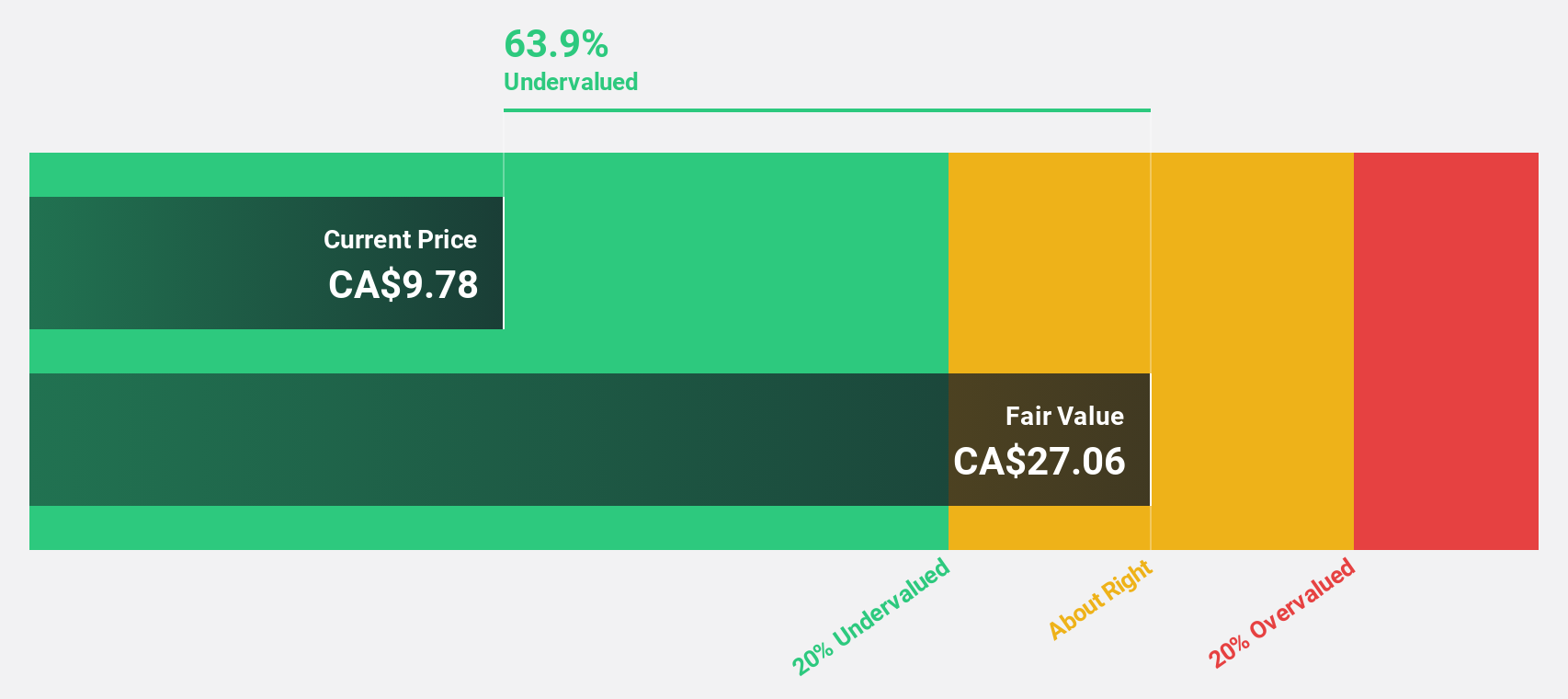

Paramount Resources (TSX:POU)

Overview: Paramount Resources Ltd. is a Canadian company that explores and develops conventional and unconventional petroleum and natural gas reserves, with a market cap of CA$3.77 billion.

Operations: Paramount Resources Ltd. generates revenue primarily from the exploration and development of conventional and unconventional petroleum and natural gas reserves in Canada.

Estimated Discount To Fair Value: 10.7%

Paramount Resources (CA$25.75) is trading at a discount to its estimated fair value (CA$28.83), indicating potential undervaluation based on cash flows. Despite a dividend yield of 6.99%, it is not well covered by free cash flows, raising sustainability concerns. The company reported strong Q2 earnings with revenue of CA$497.9 million and net income of CA$84.5 million, but profit margins have declined year-over-year from 35.2% to 19.7%.

- Our expertly prepared growth report on Paramount Resources implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Paramount Resources stock in this financial health report.

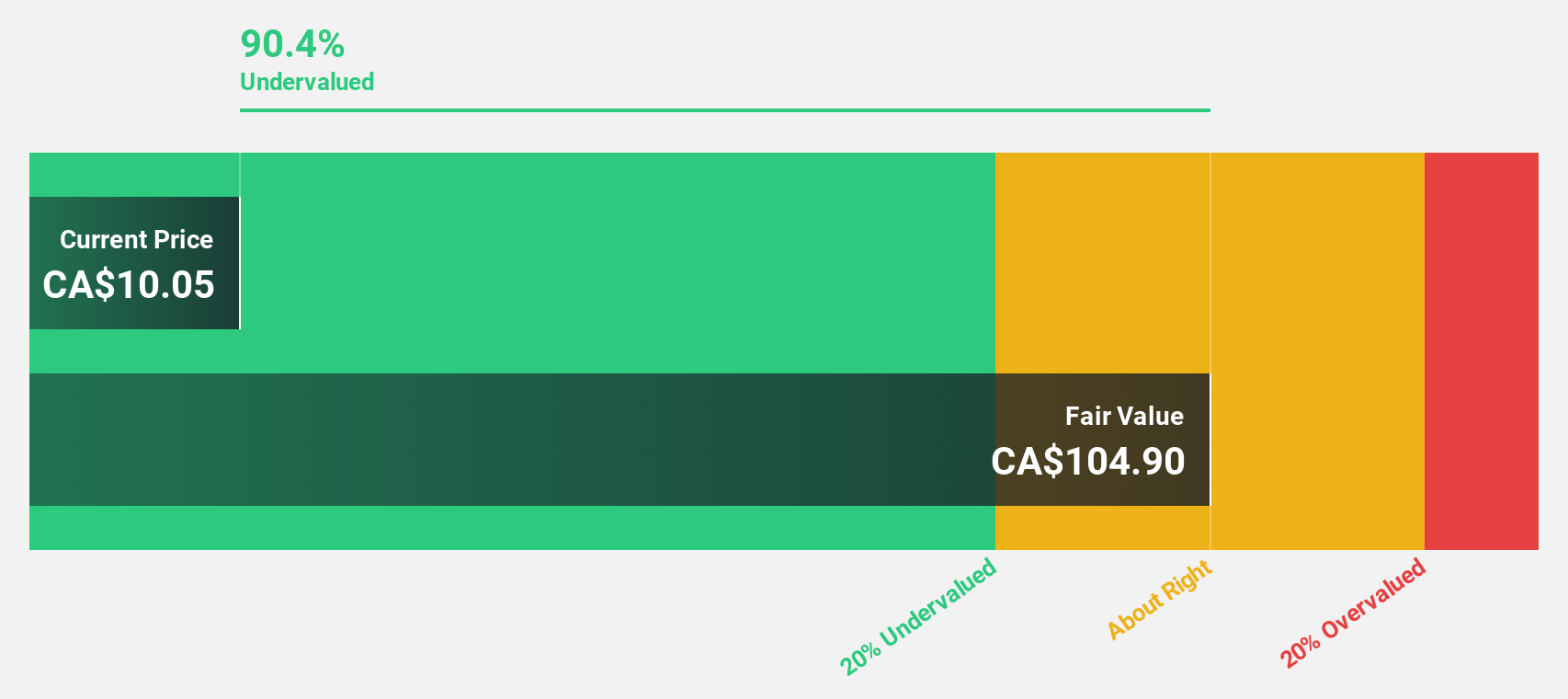

5N Plus (TSX:VNP)

Overview: 5N Plus Inc. produces and sells specialty metals and chemicals across North America, Europe, and Asia, with a market cap of CA$614.42 million.

Operations: The company's revenue segments include Performance Materials generating $82.69 million and Specialty Semiconductors contributing $184.92 million.

Estimated Discount To Fair Value: 14.8%

5N Plus (CA$6.83) is trading below its estimated fair value (CA$8.02), indicating potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 36.37% per year, outpacing the Canadian market's 14.9%. Recent Q2 results showed sales of US$74.58 million, up from US$59.08 million a year ago, though net income dropped to US$4.79 million from US$10.14 million due to large one-off items impacting financial results and significant insider selling over the past three months remains a concern.

- Our growth report here indicates 5N Plus may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of 5N Plus.

Key Takeaways

- Unlock our comprehensive list of 28 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty semiconductors and performance materials in the Americas, Europe, Asia, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives