3 Stocks Including Bonesupport Holding That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the current global market landscape, characterized by cautious Federal Reserve commentary and political uncertainties, investors are navigating through a period of volatility. Despite these challenges, opportunities may arise in stocks that appear to be trading below their estimated value. Identifying such undervalued stocks requires a careful analysis of fundamentals and market sentiment, especially during times when broader indices experience fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥62.17 | CN¥124.03 | 49.9% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.43 | CN¥30.85 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1133.35 | ₹2252.97 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409953.04 | 49.9% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.15 | 49.9% |

| Informa (LSE:INF) | £7.992 | £15.92 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.46 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

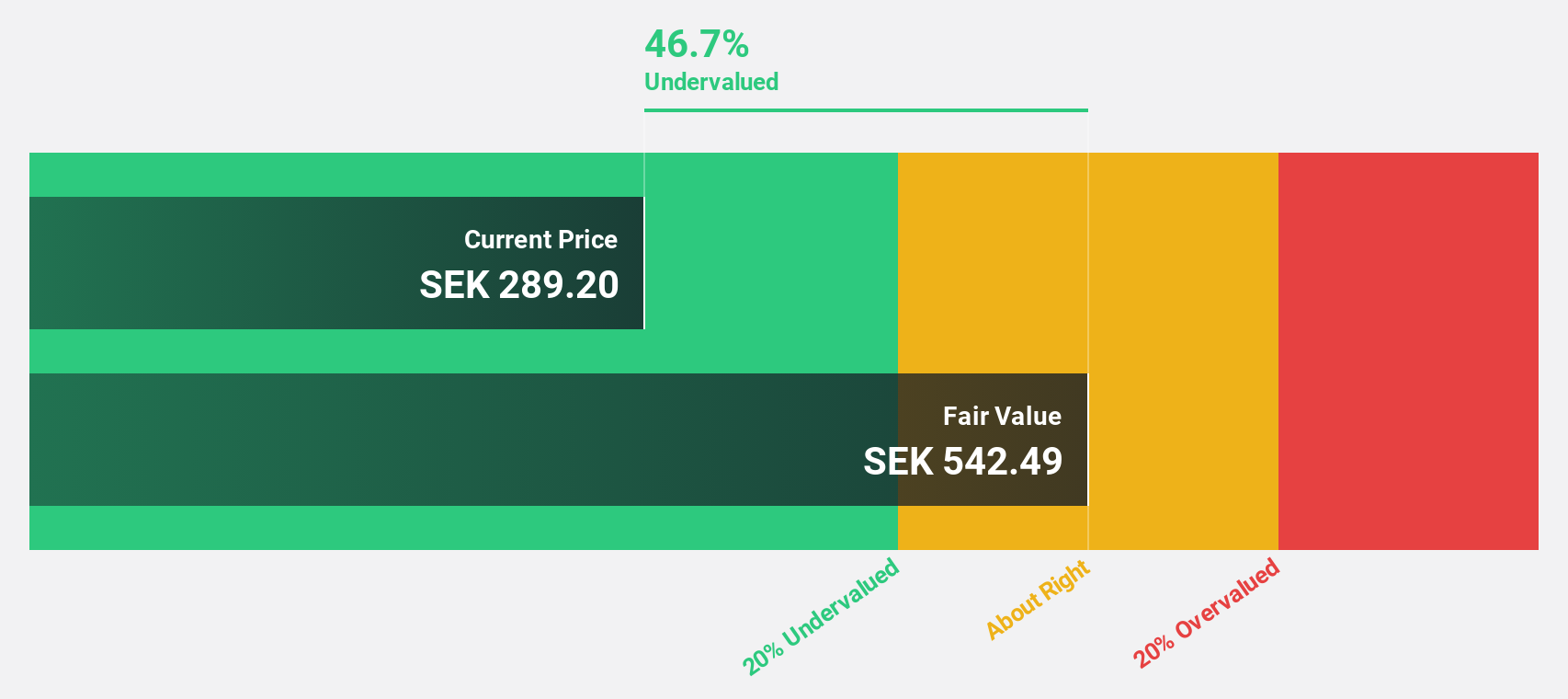

Bonesupport Holding (OM:BONEX)

Overview: Bonesupport Holding AB is an orthobiologics company that develops and commercializes injectable bio-ceramic bone graft substitutes globally, with a market cap of SEK25.47 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to SEK814.46 million.

Estimated Discount To Fair Value: 20.9%

Bonesupport Holding is trading at SEK 387, significantly below its estimated fair value of SEK 489.52, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from last year, the company shows promising growth prospects with expected annual earnings and revenue growth rates of 72.2% and 33.5%, respectively, outpacing the Swedish market averages. Recent changes in the Nomination Committee reflect strategic ownership shifts that could influence future governance dynamics.

- Our earnings growth report unveils the potential for significant increases in Bonesupport Holding's future results.

- Dive into the specifics of Bonesupport Holding here with our thorough financial health report.

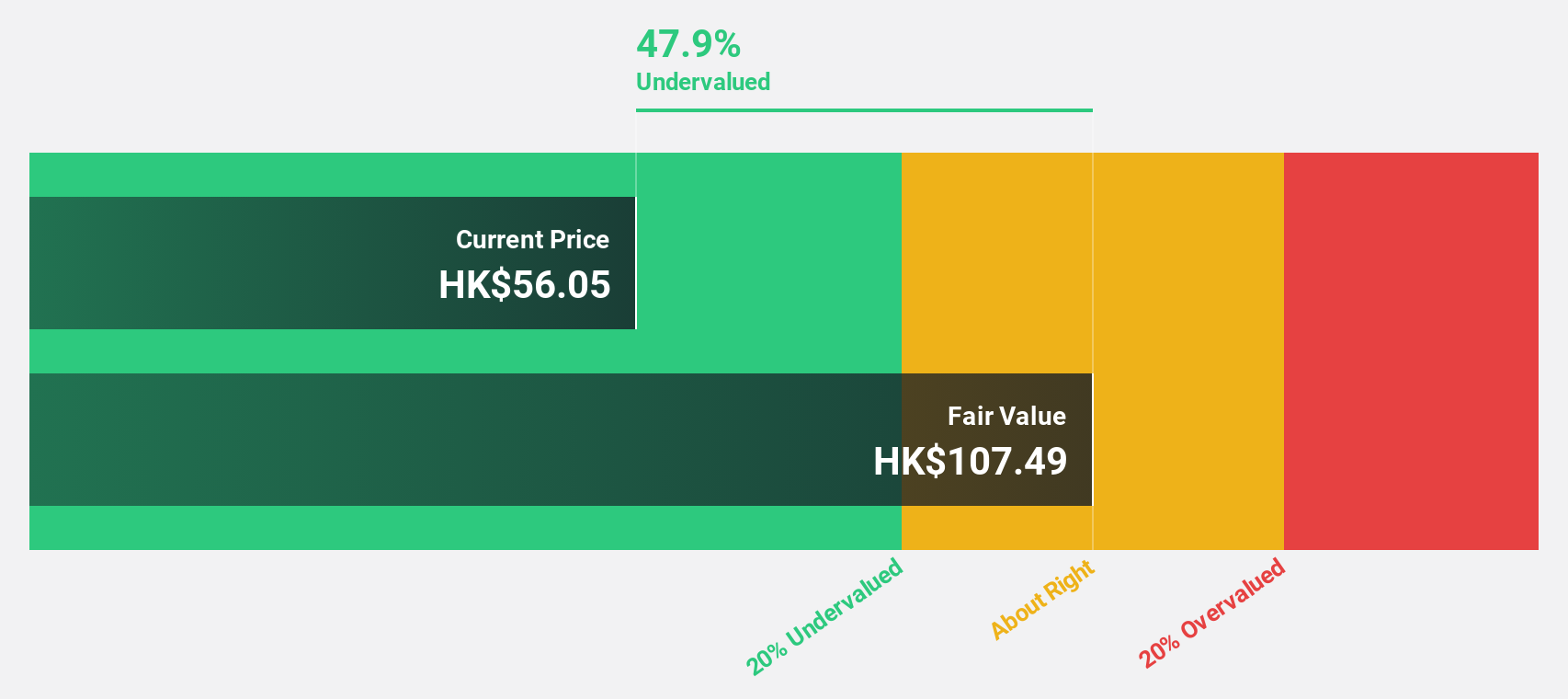

Shenzhou International Group Holdings (SEHK:2313)

Overview: Shenzhou International Group Holdings Limited is an investment holding company involved in the manufacture, printing, and sale of knitwear products across Mainland China, the European Union, the United States, Japan, and other international markets with a market cap of approximately HK$90.49 billion.

Operations: The company generates revenue of CN¥26.38 billion from its operations in the manufacture and sale of knitwear products across various international markets.

Estimated Discount To Fair Value: 33.9%

Shenzhou International Group Holdings is trading at HK$60.6, significantly below its estimated fair value of HK$91.66, highlighting potential undervaluation based on cash flows. The company’s earnings are expected to grow 12.9% annually, outpacing the Hong Kong market's 11.5%. Despite an unstable dividend track record, revenue growth forecasts of 10.8% per year exceed the market average of 7.8%. Analysts anticipate a stock price rise by 49.5%, indicating positive sentiment.

- Our comprehensive growth report raises the possibility that Shenzhou International Group Holdings is poised for substantial financial growth.

- Click here to discover the nuances of Shenzhou International Group Holdings with our detailed financial health report.

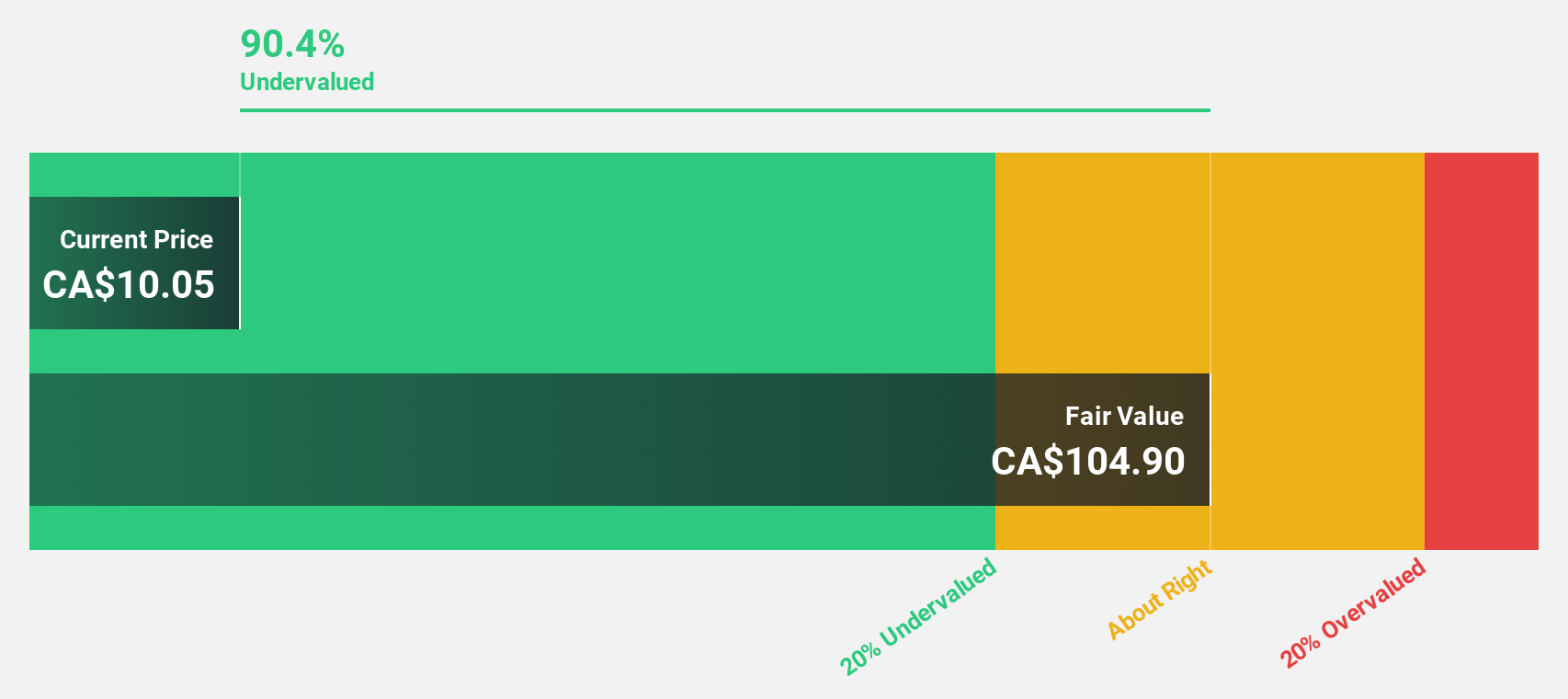

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$23.73 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

Estimated Discount To Fair Value: 19.1%

Ivanhoe Mines is trading at CA$17.77, below its estimated fair value of CA$21.96, suggesting potential undervaluation based on cash flows. The Kamoa-Kakula Copper Complex's record production enhances future cash flow prospects, with earnings forecasted to grow 42.4% annually, surpassing the Canadian market average of 15.5%. Despite past shareholder dilution and low revenue figures, analysts expect a 42.1% stock price increase due to robust growth projections and operational achievements in the DRC.

- Our expertly prepared growth report on Ivanhoe Mines implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Ivanhoe Mines with our comprehensive financial health report here.

Key Takeaways

- Navigate through the entire inventory of 871 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2313

Shenzhou International Group Holdings

An investment holding company, engages in the manufacture, printing, and sale of knitwear products in Mainland China, European Union, the United States, Japan, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.