- Canada

- /

- Metals and Mining

- /

- TSX:IMG

Here's Why We Think IAMGOLD (TSE:IMG) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like IAMGOLD (TSE:IMG), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for IAMGOLD

How Fast Is IAMGOLD Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for IAMGOLD to have grown EPS from US$0.19 to US$1.27 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

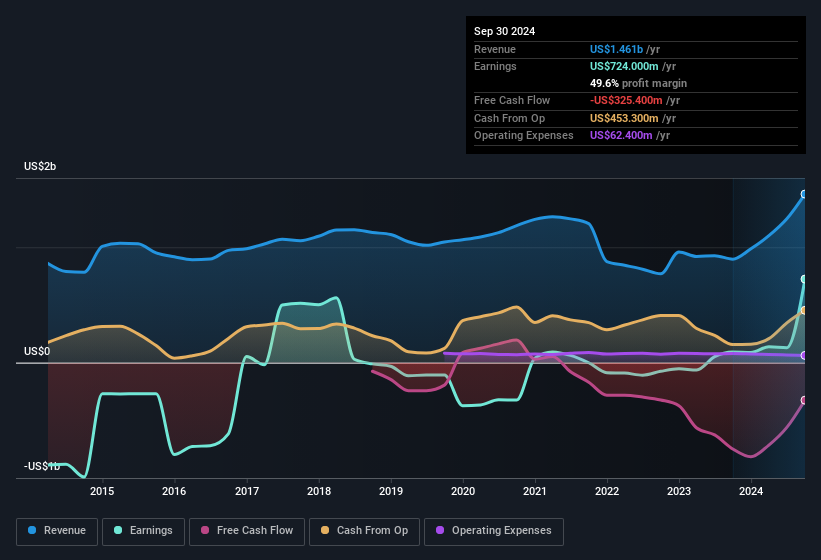

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that IAMGOLD is growing revenues, and EBIT margins improved by 26.6 percentage points to 24%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for IAMGOLD?

Are IAMGOLD Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Despite US$277k worth of sales, IAMGOLD insiders have overwhelmingly been buying the stock, spending US$665k on purchases in the last twelve months. An optimistic sign for those with IAMGOLD in their watchlist. We also note that it was the CEO, President & Director, Renaud Adams, who made the biggest single acquisition, paying CA$251k for shares at about CA$5.71 each.

Should You Add IAMGOLD To Your Watchlist?

IAMGOLD's earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of IAMGOLD to your watchlist won't go amiss. What about risks? Every company has them, and we've spotted 3 warning signs for IAMGOLD (of which 2 shouldn't be ignored!) you should know about.

The good news is that IAMGOLD is not the only stock with insider buying. Here's a list of small cap, undervalued companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026