- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals Inc. (TSE:HBM) Stocks Shoot Up 27% But Its P/E Still Looks Reasonable

Hudbay Minerals Inc. (TSE:HBM) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 74% in the last year.

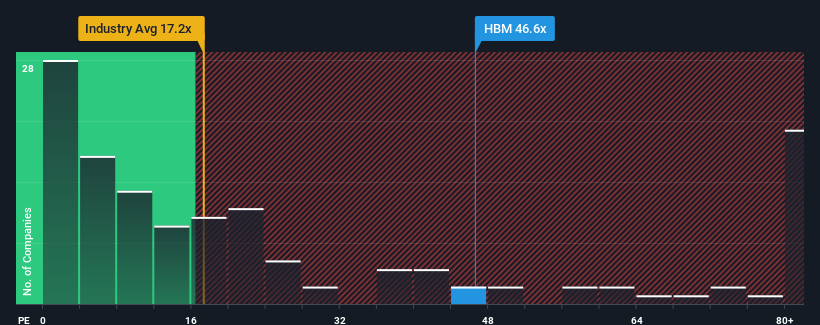

Since its price has surged higher, given close to half the companies in Canada have price-to-earnings ratios (or "P/E's") below 13x, you may consider Hudbay Minerals as a stock to avoid entirely with its 46.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Hudbay Minerals as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Hudbay Minerals

Is There Enough Growth For Hudbay Minerals?

Hudbay Minerals' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 94% over the next year. That's shaping up to be materially higher than the 18% growth forecast for the broader market.

With this information, we can see why Hudbay Minerals is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Hudbay Minerals' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hudbay Minerals' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hudbay Minerals, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Solid track record with excellent balance sheet.