- Canada

- /

- Metals and Mining

- /

- TSX:GGD

Shareholders in GoGold Resources (TSE:GGD) have lost 66%, as stock drops 11% this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term GoGold Resources Inc. (TSE:GGD) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 66% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 21% lower in that time. The falls have accelerated recently, with the share price down 27% in the last three months.

If the past week is anything to go by, investor sentiment for GoGold Resources isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for GoGold Resources

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that GoGold Resources has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

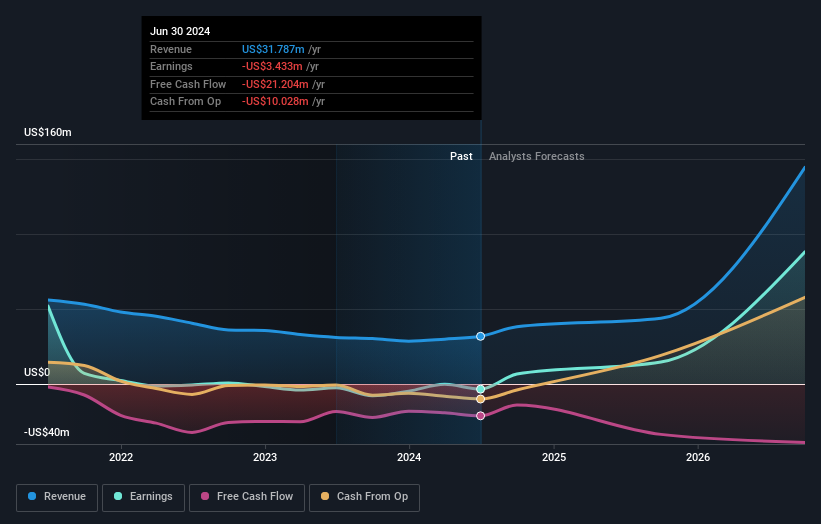

We think that the revenue decline over three years, at a rate of 23% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on GoGold Resources

A Different Perspective

Investors in GoGold Resources had a tough year, with a total loss of 21%, against a market gain of about 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

GoGold Resources is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GGD

GoGold Resources

Engages in the exploration, development, and production of silver, gold, and copper primarily in Mexico.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives