- Canada

- /

- Metals and Mining

- /

- TSX:GEO

TSX Penny Stocks With Market Caps Under CA$200M To Consider

Reviewed by Simply Wall St

Canadian equities have recently reached new record highs, buoyed by dovish signals from the Bank of Canada and similar sentiments from the U.S. Federal Reserve, which have tempered market expectations for immediate interest rate hikes. In this context, investors are increasingly looking for opportunities that might not be immediately apparent in larger cap stocks. Penny stocks, though often considered a relic of past trading days, can still offer growth potential when backed by strong financials. In this article, we examine three penny stocks that could provide compelling investment opportunities with their balance sheet strength and potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.40 | CA$257.26M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.25 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.47 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.05 | CA$154.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.03 | CA$30.34M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.01 | CA$190.2M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DIRTT Environmental Solutions Ltd. is a Canadian interior construction company with a market cap of CA$176.56 million.

Operations: The company generates revenue from its Building Products segment, totaling $166.82 million.

Market Cap: CA$176.56M

DIRTT Environmental Solutions, with a market cap of CA$176.56 million, is navigating its financial challenges while maintaining strategic growth initiatives. Despite being unprofitable, the company has a positive cash flow and sufficient runway exceeding three years. Recent debt financing from BDC aims to refinance convertible debentures due soon, reflecting prudent financial management amid an increased debt-to-equity ratio over five years. DIRTT's revenue for the third quarter was US$37.72 million; however, it reported a net loss of US$3.48 million compared to last year's net income. Strategic leadership changes aim to accelerate transformation efforts in this volatile penny stock space.

- Click here and access our complete financial health analysis report to understand the dynamics of DIRTT Environmental Solutions.

- Explore DIRTT Environmental Solutions' analyst forecasts in our growth report.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, with a market cap of CA$185.82 million, offers mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru.

Operations: Geodrill generates revenue primarily from its Business Services segment, which accounted for $171.19 million.

Market Cap: CA$185.82M

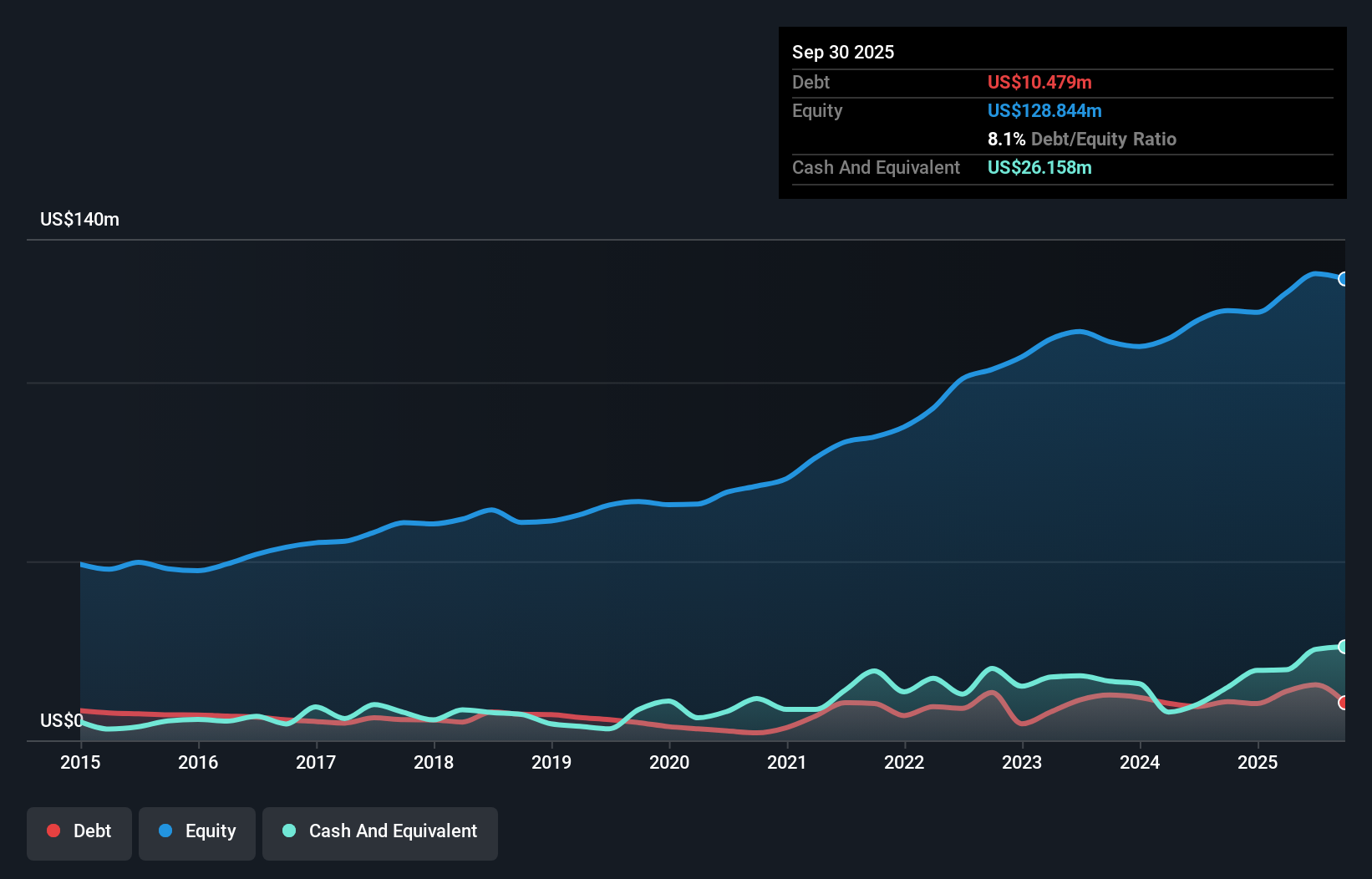

Geodrill Limited, with a market cap of CA$185.82 million, demonstrates financial resilience despite recent challenges. The company reported third-quarter sales of US$38.97 million, an increase from the previous year, though it faced a net loss of US$1.36 million compared to prior net income. Geodrill's earnings growth over the past year outpaced its five-year average decline but lagged behind industry standards. Strong cash reserves exceed total debt and short-term liabilities are well covered by assets, indicating sound fiscal management in this penny stock sector despite low return on equity and increased debt-to-equity ratio over five years.

- Get an in-depth perspective on Geodrill's performance by reading our balance sheet health report here.

- Learn about Geodrill's future growth trajectory here.

Wilton Resources (TSXV:WIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wilton Resources Inc. is a Canadian company focused on oil and gas exploration and development, with a market cap of CA$21.61 million.

Operations: The company generates revenue from its oil and gas exploration and development segment, amounting to CA$0.009922 million.

Market Cap: CA$21.61M

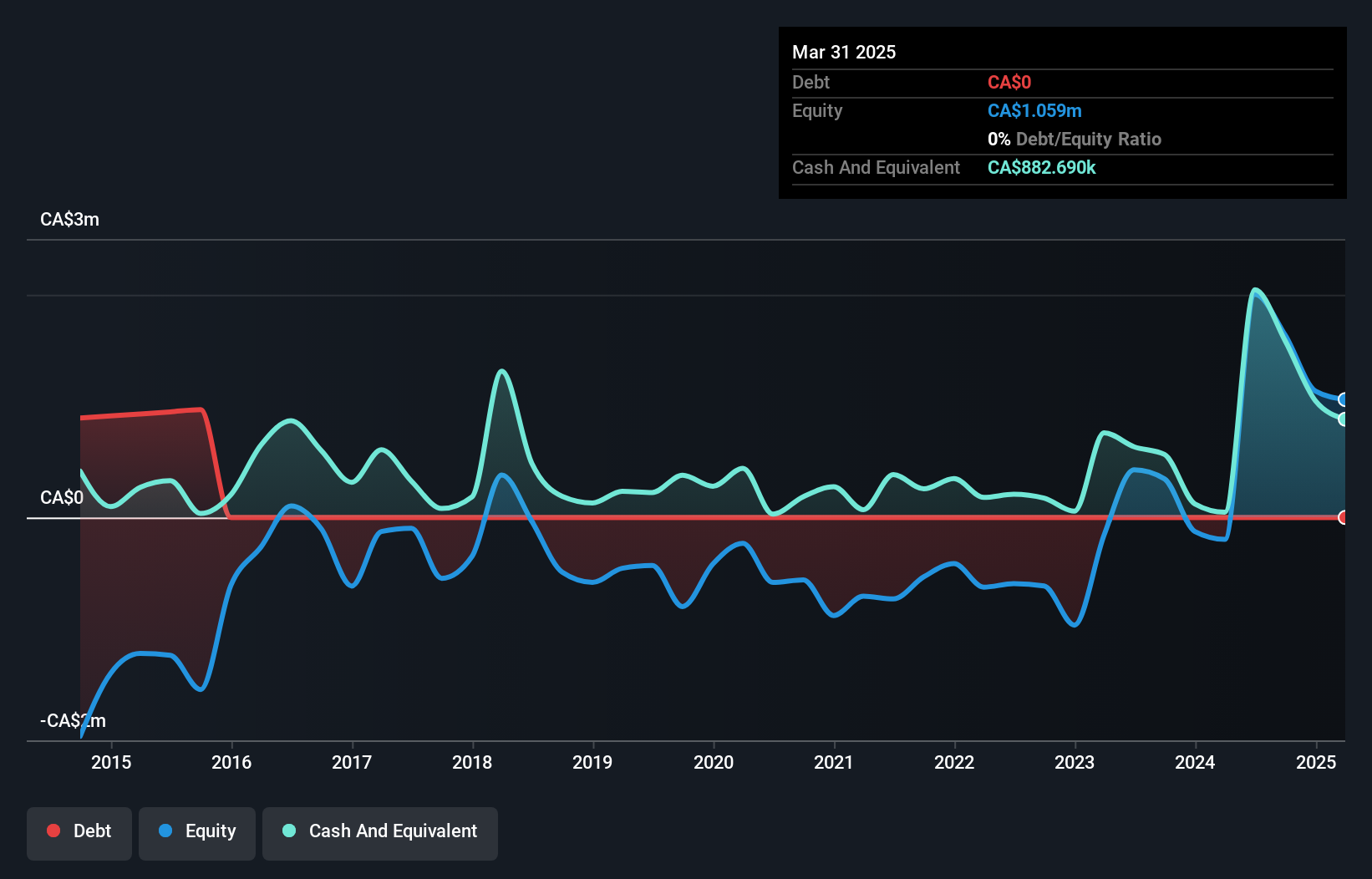

Wilton Resources Inc., with a market cap of CA$21.61 million, operates in the oil and gas exploration sector but remains pre-revenue, generating minimal income. The company has experienced increased losses over the past five years, with earnings declining by 10.5% annually. Despite its unprofitability and high volatility compared to most Canadian stocks, Wilton's short-term assets cover long-term liabilities but fall short against short-term obligations. Recent private placements aim to raise CA$1 million through issuing shares and warrants, reflecting ongoing capital-raising efforts amid limited cash runway projections and no debt burden on its balance sheet.

- Click here to discover the nuances of Wilton Resources with our detailed analytical financial health report.

- Learn about Wilton Resources' historical performance here.

Make It Happen

- Take a closer look at our TSX Penny Stocks list of 391 companies by clicking here.

- Ready For A Different Approach? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GEO

Geodrill

Provides mineral exploration drilling services to the mining companies in West Africa, Egypt, Chile, and Peru.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)